A National Solution

New York Times - June 25, 2014, by Peter Markowitz - For too many years our nation’s discourse around immigration has been distorted by anti-immigrant activists who have advanced bold but...

New York Times - June 25, 2014, by Peter Markowitz - For too many years our nation’s discourse around immigration has been distorted by anti-immigrant activists who have advanced bold but regressive state immigration policies. State laws in Arizona and elsewhere have powerfully, but inaccurately, framed the immigration issue through the lenses of criminality and terrorism. While these laws have not generally fared well in court, their impact on our national perception of immigration has impeded federal immigration reform. Meanwhile, states like New York continue to suffer the consequences of our broken immigration laws. Our families continue to be fractured by a torrent of deportations. Our economic growth continues to be impeded by the barriers our immigrant labor force faces. And our democracy continues to be undermined by the exclusion of a broad class of New York residents.

The New York Is Home Act, recently introduced by New York State Senator Gustavo Rivera and Assembly Member Karim Camara, with support from the Center for Popular Democracy and Make the Road New York, charts a path forward on immigration — a path that like-minded states and ultimately the federal government could follow. The legislation would grant state citizenship to noncitizens who can prove three years of residency and tax payment and who demonstrate a commitment to abiding by state laws and the state constitution.

The bill is an ambitious but sensible assertion of a state’s well-established power to define the bounds of its own political community. Unlike the Arizona law, this legislation is carefully crafted to respect the unique province of the federal government. As misguided and brutal as the federal immigration regime is, New York cannot alter federal deportation policy. However, it is absolutely within New York’s power to facilitate the full inclusion of immigrants in our state. By granting state citizenship, we would extend the full bundle of rights a state can deliver — the right to vote in state elections, to drive, to access higher education, among others — and we would define the full range of responsibilities that come along with citizenship, including tax payment, jury service and respect for state law. By reorienting our national conversation on immigration around the more accurate and productive themes of family, economic vitality and political inclusion, this legislation will move us toward a real solution to our nation’s immigration quagmire.

Source

Senate's Kavanaugh Vote Ends in Chaos After GOP Sen. Flake Asks for FBI Sex-Assault Probe

Senate's Kavanaugh Vote Ends in Chaos After GOP Sen. Flake Asks for FBI Sex-Assault Probe

One day after Brett Kavanaugh and Christine Blasey Ford testified about her sexual assault allegations against the Supreme Court nominee, the Senate Judiciary Committee on Friday voted to send...

One day after Brett Kavanaugh and Christine Blasey Ford testified about her sexual assault allegations against the Supreme Court nominee, the Senate Judiciary Committee on Friday voted to send Kavanaugh’s confirmation to the full Senate — but it wasn’t without drama.

Read the full article here.

For immigrants fighting deportation, a push for government-funded lawyers

For immigrants fighting deportation, a push for government-funded lawyers

Nearly 4,000 immigrants in the Washington region face deportation every year without a lawyer, according to a report that calls on area governments to follow the lead of New...

Nearly 4,000 immigrants in the Washington region face deportation every year without a lawyer, according to a report that calls on area governments to follow the lead of New York and Los Angeles and provide funding for legal aid to immigrants.

The Center for Popular Democracy, a national nonprofit organization, analyzed thousands of deportation cases at immigration courts in Baltimore and Arlington and found that immigrants were far more likely to prevail if they had a lawyer...

Read full article here.

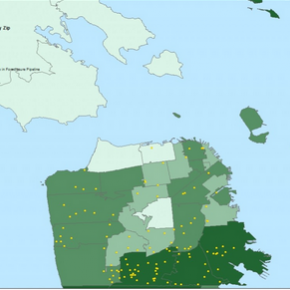

Does Your Bay Area Neighborhood Have a High Wells Fargo Foreclosure Rate?

KQED - March 12, 2013 - California is still struggling to get back on its feet after a devastating housing crisis. And Wells Fargo is partly to blame for the sluggish recovery because it is...

KQED - March 12, 2013 - California is still struggling to get back on its feet after a devastating housing crisis. And Wells Fargo is partly to blame for the sluggish recovery because it is refusing to modify home loans, according to a coalition of homeowners groups.

By foreclosing on homeowners who can't make their payments, the San Francisco-based bank will suck billions of dollars out of the state's economy, according to the Alliance of Californians for Community Empowerment, the Center for Popular Democracy and the Home Defenders League.

In a new report, the coalition charges that Wells Fargo has been less inclined to reduce the principle of home loans than have other banks, such as Bank of America.

Wells Fargo responded that it has a low foreclosure rate compared to the industry in general.

Wells Fargo's bias toward foreclosures is disproportionately affecting predominantly black and Latino neighborhoods, the report charges.

Right now, about 65,000 California homeowners have received notice of a pending foreclosure, and about 20 percent of these loans are serviced by Wells Fargo, the report says.

The report estimates that as of February 2013, Wells Fargo had 11,616 homes in its "foreclosure pipeline."

Foreclosing on the homes will have the following effects, according to the report:

Each home would lose approximately 22 percent of its value, for a total loss of approximately $1.07 billion,

Homes in the surrounding neighborhood would lose value as well, for an additional loss of about $2.2 billion, and

Government tax revenues would be cut by $20 million, as a result of that depreciation.

If the bank were to reduce the principle on the borrowers' loans, homeowners would have more money to spend. This would boost the state's economy, the coalition says.

Wells Fargo often bundles loans to sell to other entities, such as Fannie Mae, but acts as an agent for the new lender, collecting payments and handling foreclosures. In that capacity, Wells Fargo makes more money through foreclosures than loan modifications, the report says.

Wells Fargo has had an aggressive principal reduction program for loans that we own since 2009. Wells Fargo conducts all lending and servicing activities in a fair and responsible manner without regard to race or ethnicity. We are proud to be the nation’s leading lender.

Wells Fargo issued a written statement in response to the report:

Over the last four years, Wells Fargo has: • Helped more than 841,000 customers with loan modifications. • Provided $6.3 billion in principal forgiveness—most of which has gone to borrowers in California.

Wells Fargo consistently provides assistance to customers facing financial challenges. Wells Fargo’s delinquency and foreclosure rates continue to rate below the industry average. Here are the facts: • The combined national industry delinquency and foreclosure rates are roughly 11%. Wells Fargo’s is 7.04%. • The Wells Fargo foreclosure rate in California is 1.04%*, less than half of our national rate.

*As of Q4 2012

Source

Organize Florida activists protest Trump infrastructure plan

Progressive activists gathered on the shores of Lake Parker on Thursday to air their discontent with the Trump administration’s outline for a nationwide infrastructure improvement plan.

The...

Progressive activists gathered on the shores of Lake Parker on Thursday to air their discontent with the Trump administration’s outline for a nationwide infrastructure improvement plan.

The plan, outlined broadly in a six-page memo released last month, amounts to placing heavy burdens on the poor through flat user fees like tolls, subsidizing private companies and ignoring public transportation, school facilities and clean energy, said activists with Organize Florida, a project of the Center for Popular Democracy, a left-leaning political advocacy group.

Read the full article here.

The Federal Reserve Should Not Increase Interest Rates

Later this month, the world's top financial and economic policymakers will pow-wow at the Federal Reserve Bank annual meeting in Jackson Hole to determine whether it is time for the Fed to roll...

Later this month, the world's top financial and economic policymakers will pow-wow at the Federal Reserve Bank annual meeting in Jackson Hole to determine whether it is time for the Fed to roll back recession-era policies -- e.g. a near-zero benchmark interest rate -- put in place to support job growth and recovery.

This would be the wrong decision for the communities that are still struggling to recover and the wrong decision for America. Advocates for higher interest rates point to an improving job market as a sign that America has come back from the recession. But many activists, economists, and community groups know that raising interest rates now would stymie the many communities, particularly those of color, that continue to face persistent unemployment, underemployment, and stagnant wages. As the Fed Up campaign, headed by the Center for Popular Democracy, notes in areport released this week, tackling the crisis of employment in this country is a powerful and necessary step toward building an economic recovery that reaches all Americans -- and ultimately, toward building a stronger economy for everyone.

The report, "Full Employment for All: The Social and Economic Benefits of Race and Gender Equity in Employment," shares a new data analysis by PolicyLink and the Program for Environmental and Regional Equity (PERE) estimating the boost to the economy that full employment -- defined as an unemployment rate of 4 percent for all communities and demographics along with increases in labor force participation -- would provide. While overall unemployment is down to 5.3 percent, it is still 9.1 percent for blacks and 6.8 percent for Latinos. Underemployment and stagnant wages have further driven income inequality and hinder the success of local economies. By keeping interest rates low, the Fed can promote continued job creation that leads to tighter labor markets, higher wages, less discrimination, and better job opportunities -- especially within those communities still struggling post-recession.

Lowering unemployment to 4 percent for all gender and racial groups (the rate of overall unemployment in 2000 when the economy was last at full employment) and increasing labor force participation rates would mean that 14.3 million more Americans are employed, 9.3 million fewer would live in poverty, GDP would increase by $1.3 trillion, and the government would receive an additional $261 billion in tax revenue, according to the report.

Full employment would also have an enormous positive impact on racial inequities in income. Currently, only half of workers of color make at least a living wage ($15/hour), compared to 69 percent of white workers, and median household income within communities of color is significantly lower compared to white households. With full employment, black households would see their incomes rise 23 percent, Latino households would see a 14 percent increase, and Native American households would see a 32 percent increase.

Armed with this data, which was compiled as part of ongoing economic research by PolicyLink and PERE's National Equity Atlas team, Fed Up will host its own meeting in Jackson Hole, featuring presentations by this team, activists, economists, and community organizers. This meeting, concurrent with the Fed's, aims to put pressure on the Federal Reserve to acknowledge those communities of color still mired in the recession and take up policies that will bring full employment to all. While Federal Reserve policies are not the only solution to boosting employment among those communities so often left behind, they are a vital and necessary step towards building a stronger, more inclusive American economy.

Source: Huffington Post Politics

Are Scheduling Bills Like D.C.'s Helpful or Meddlesome?

The District of Columbia Council scheduled a hearing for Jan. 13 on a bill that would require stores and restaurants to tell employees what their work schedules will be several weeks in advance...

The District of Columbia Council scheduled a hearing for Jan. 13 on a bill that would require stores and restaurants to tell employees what their work schedules will be several weeks in advance and require employers to compensate employees for last-minute schedule changes.

“This movement is under way across this country,” lead sponsor Vincent Orange Jr. (D-At Large) said when he introduced the measure Dec. 5. “San Francisco recently passed regulations to address this issue and bills have been introduced in seven states.”

The Hours and Scheduling Stability Act of 2015 wouldn't apply to all stores and restaurants, but it would have a big impact, Orange told Bloomberg BNA Dec. 17. If passed, the measure “will assist tremendously with providing [the district's] workforce and their families with certainty,” the councilmember said.

The bill would require employers to tell workers what their schedules will be at least three weeks in advance. A change in schedule less than three weeks out would require the employer to pay an extra hour of wages. Less than 24 hours' notice would require four hours of wages.

Orange's bill would cover any D.C. franchisee of a restaurant chain with at least 20 locations nationwide or a retail store chain with at least five.

Unpredicatability Affects Planning, Benefits Eligibility

It's hard enough for families to balance work and personal life, Orange said when he introduced the bill. “Having a schedule you can count on leads to a better work environment and better harmony in scheduling family obligations.”

Liz Ben-Ishai, senior policy analyst at the Center for Law and Social Policy, which supports legislation requiring employers to provide workers with advance notice of schedules, told California lawmakers in March of 2015 that volatile schedules affect workers’ ability to arrange child care. Such volatility also interferes with their ability to hold second jobs and pursue education or training, she said.

There's another problem with unpredictable schedules, Ben-Ishai told Bloomberg BNA Dec. 22. Many public assistance programs ask participants to estimate their income or number of hours they will work, she said. “Because they have these erratic schedules or insufficient hours they can't predict how much they'll make,” she said.

Utah is “an example of a good approach,” she told Bloomberg BNA. State eligibility assessors use “professional judgment” to draw on multiple sources of information, including paychecks and conversations with employers regarding anticipated hours and overtime, to determine an applicant's’ eligibility, Ben-Ishai wrote in a policy brief. Utah encourages workers to follow up on information applicants provide that may not reflect their current eligibility, such as out-of-date wage information

Ben-Ishai also suggested a different time frame for evaluating applicants’ incomes and work hours. She pointed to the Child Care and Development Block Grant, which “requires a longer authorization period” and “accounts for fluctuation in people's hours.” This federally funded program allows states to determine eligibility “over a period of 12 months to provide a more realistic picture,” she said.

Bills Introduced Around the Country

The Washington, D.C., bill is one of several under consideration in state and local legislatures, as well as on the federal level. Within the past two years, there have been similar proposals in 13 other cities and states, plus one on the federal level.

San Francisco has been the first and, so far, only jurisdiction to pass a predictable scheduling law. It passed Nov. 25, 2014, by a 10-0 vote of the 11-member Board of Supervisors and became law without the signature of Mayor Ed Lee (D). Lee said he was “concerned about large numbers of impacted merchants who said there was little meaningful discussion” in the drafting of the law (243 DLR C-1, 12/18/14).

Lizzy Simmons, the National Retail Federation's senior director, government relations, told Bloomberg BNA Dec. 30 that the San Francisco law has a “carve-out that allows unions and their collective bargaining agreements to waive out” of its requirements. She said she's concerned that allowing employees to contractually waive the law's requirements grants outsize influence to labor organizations “since a lot of the unions have been behind” efforts to pass predictable scheduling laws.

The San Francisco law actually “takes away and impedes on employee flexibility,” Simmons said. Retail managers and employees should work together to come up with schedules that can accommodate individual needs, she said. “A one-size-fits-all government mandate” makes that harder to accomplish, she said.

Part of the problem with scheduling bills is that there's little guidance on how to implement them, said Robin Winchell Roberts, the federation's senior director, media relations. For example, the San Francisco law exempts employee-requested changes from triggering schedule change compensation, which Roberts calls “penalty pay.” The key factor in determining when an employer must pay schedule change compensation is who requests the change, Roberts said. It isn't clear whether it is due when a retailer requires an employee who can't work a scheduled shift to find a co-worker to work the shift in her place, Roberts said.

The compensation might also be triggered if business is better than expected, Simmons said. For example, a store might want to extend a sale that's going well. If the store wants to staff up to respond to the additional customer demand, it might incur unexpected expenses on account of employees who weren't scheduled, she told Bloomberg BNA. “I don't think you can just say after the fact sales made up for that,” she said when asked whether the unexpected increase in revenue would offset the unexpected increase in expenses.

Flexibility Essential, Industry Group Says

“Flexibility is a trademark of the restaurant industry,” Christin Fernandez, director of media relations and public affairs at the National Restaurant Association, told Bloomberg BNA by e-mail Dec. 23. Businesses operate around the clock “with business models unique to each restaurant,” she said.

Starbucks is an example of a business that pursued its own scheduling model. The company announced in August 2014 that it would voluntarily change its scheduling practices. It said it would provide employees with schedules a week in advance. It also said it would prohibit scheduling employees to close a store one night and return a few hours later to open the next morning (157 DLR A-6, 8/14/14).

But 11 months later, a report by the Center for Popular Democracy, an organization that describes itself as advocating for a “pro-worker” agenda, concluded that the company hasn’t kept its promises. The report, “The Grind: Striving for Scheduling Fairness at Starbucks,” drew on comments from a survey of employees who say back-to-back closing and opening shifts continue. Reached for comment Dec. 22, Brent Gow, global director for payroll at Starbucks, told Bloomberg BNA he couldn’t speak on the record because the company is still working on the issue.

Reporting Time Pay Laws Exist in Some States

Predictable scheduling laws don't take into account that “some of the people that go into these jobs to begin with do it for exactly the flexibility that's being challenged here,” said Diane Saunders, a shareholder in the Boston office of Ogletree, Deakins, Nash, Smoak & Stewart P.C. who advises employers as co-chair of the firm's Retail Practice Group.

Saunders advises her clients to ensure that they comply with reporting time laws that are already on the books. In Washington, D.C., and eight states, employees are guaranteed a minimum number of hours of pay if they report to work but are sent home because business is unexpectedly slow, she wrote in a Novemberblog post.

New York Attorney General Eric Schneiderman's labor bureau chief, Terri Gerstein, wrote to 13 retailers in April 2015 as part of a review of on-call scheduling. In the letters, Gerstein reminded the companies that New York state law requires that an employee who reports for work must be paid four hours, or the number of hours of a regularly scheduled shift if that is less than four hours.

Gerstein told the retailers the attorney general's office had received reports that an increasing number of employers require their employees to call in “just a few hours in advance, or the night before.” Threatening enforcement action over this practice goes beyond what New York law says, said Jim Evans, a partner in Alston & Bird LLP's labor and employment practice who represents employers.

Whether the proposals become law, employers should focus on “the human aspect” of predictability in scheduling, he said. Employers that voluntarily change their practices and lawmakers who draft predictable scheduling laws should consider the “harsh economic consequences” of last-minute shift cancellations, he said.

New Application for Existing Laws

The New York attorney general's letters were sent to companies with household names such as Gap Inc., J. Crew and Burlington Coat Factory. One recipient was Abercrombie & Fitch Co., which is facing a class action in California over its use of on-call scheduling.

In the absence of laws requiring pay for on-call shifts, one team of lawyers is attempting to use wage and hour laws that are already on the books to help their clients. Hallie Von Rock and Carey James, of Aiman-Smith & Marcy, filed a lawsuit in December against Abercrombie & Fitch on behalf of C’endan Claiborne and a class they estimate includes between 15,000 and 65,000 members in three states.

In the lawsuit, Von Rock and James allege that the company's practice of requiring California employees to call in one hour before their scheduled start time in order to find out whether they're required to work the shift should be considered reporting to work. When an employee calls and is told to stay home, the employee is entitled to a few hours of pay, Von Rock and James told Bloomberg BNA.

Under wage and hour laws already on the books, Abercrombie should pay its employees for the time they spend calling in, Rock and James said. The calls last between two and 20 minutes, which adds up to several hours of unpaid wages per month, they said.

Von Rock and James contend that employees—who aren't paid for the time they spend on these phone calls—are reporting for work when they make these calls. “Even though they're not physically showing up” at the store, the phone call is the beginning of a work shift, Von Rock said. Abercrombie, which is represented by Morgan Lewis & Bockius LLP and Vorys Sater Seymour and Pease LLP, denies the lawsuit’s allegations.

James said the law “is undeveloped in California” as to what qualifies as reporting for work under the reporting time law. “To me, report is a straightforward word and it could just as easily mean call,” he said.

Von Rock expressed concern about a power imbalance between employers and employees. Predictable scheduling laws attempt to level the unequal bargaining power, she said.

Simmons, with the National Retail Federation, views it differently. These laws insert friction into the employer-employee relationship, she told Bloomberg BNA. “These bills punish job creators,” the federation says in its restrictive scheduling toolkit. A better approach would be to continue to allow the market to strike a balance, Simmons said.

Common Ground

One thing on which supporters and opponents of predictable scheduling laws agree is that it's too soon to tell what kind of impact San Francisco's law is having. Ben-Ishai, the policy analyst, and Simmons, of the National Retail Federation, told Bloomberg BNA it is too early to have meaningful research.

Evans, the employer-side attorney, offered advice on balancing employers' need for flexibility with workers' need for predictability. “Focus on the human aspect of it,” he said. “I represent large corporations, many of which are very focused on the human aspect of it. I think that the human aspect of the legislation and the impact of the practices can't be overemphasized.”

“It's just not fair to subject people to that last minute change and kind of harsh economic consequences,” he added. “When you measure who has the ability to absorb the impact of a last minute change in schedule, the answer's kind of obvious.”

Source: Clasp

Metro Phoenix Woman Fights For Toys R Us Workers' Severance Pay

Auerbach got mad and got moving. With the help of two groups, Rise Up Retail and Center for Popular Democracy, she joined other former employees to lobby politicians in Washington, D.C., and to...

Auerbach got mad and got moving. With the help of two groups, Rise Up Retail and Center for Popular Democracy, she joined other former employees to lobby politicians in Washington, D.C., and to march into the lobbies of companies they hold responsible.

Read the full article here.

Rising New York Fed President Is An Experienced Cipher

Rising New York Fed President Is An Experienced Cipher

Jordan Haedtler, campaign manager for the Center for Popular Democracy, points out that Williams was Fed president in San Francisco when Wells Fargo was signing customers up for fake accounts,...

Jordan Haedtler, campaign manager for the Center for Popular Democracy, points out that Williams was Fed president in San Francisco when Wells Fargo was signing customers up for fake accounts, noting “his supervising left something to be desired.”

Read the full article here.

Progressive Group Sues Fed, Seeking Information on Presidential Selection

Progressive Group Sues Fed, Seeking Information on Presidential Selection

The left-leaning Center for Popular Democracy on Wednesday filed a lawsuit in federal court against the Federal Reserve, seeking to shine light on the central bank’s president selection process....

The left-leaning Center for Popular Democracy on Wednesday filed a lawsuit in federal court against the Federal Reserve, seeking to shine light on the central bank’s president selection process.

The lawsuit, filed under the Freedom of Information Act, is a product of the “Fed Up” campaign to strip private bankers’ influence from the Fed’s top rungs and increase transparency in its leadership selection. The suit was filed after the Fed ignored a FOIA request filed in August seeking information on president selections in 2015 and 2016, the group said.

“The leaders of the twelve Reserve Banks are among the most powerful and influential actors in shaping the nation’s monetary policies, yet the process by which they are chosen is completely non-transparent,” the group wrote in the complaint, filed in the U.S. District Court for the Eastern District of New York.

The lawsuit comes as Dennis Lockhart, president of the Federal Reserve Bank of Atlanta, prepares to leave the bank in February.

“The public has a right to obtain records about how the Federal Reserve’s leaders are selected, and there is no justification for the Fed’s withholding of basic information about its governance,” said Connie Chan, an attorney representing Fed Up, in a statement. “The fact that Fed Up has to bring this FOIA lawsuit is itself further evidence of the Fed’s lack of transparency.”

By Tara Jeffries

Source

2 months ago

2 months ago