A Right to Attorney: NYC Looks at a Possible Fix for the Immigration Court Crisis

The Huffington Post - November 18, 2013, by Nick Malinowski - Everyone in the United States has the right to an attorney in criminal court. The same is not true in immigration deportation...

The Huffington Post - November 18, 2013, by Nick Malinowski - Everyone in the United States has the right to an attorney in criminal court. The same is not true in immigration deportation proceedings -- which are administrative in nature, rather than criminal. This strange gap in the law leaves hundreds of thousands of people on their own to defend against removal by the Department of Homeland Security, a complex and confusing legal procedure frequently conducted in a language the respondents do not understand.

Noncitizens convicted of crimes often face consequences more severe than those demanded by the criminal penalties associated with their charge. A misdemeanor conviction for shoplifting, though unlikely to prompt incarceration, can nevertheless trigger mandatory deportation: dividing families, disrupting communities and preventing people otherwise eligible from seeking asylum. This result is especially troubling in cases where the person may be persecuted or killed for religious or political reasons in their country of origin. Like undocumented immigrants, legal permanent residents are similarly at risk of deportation through this process.

The Vera Institute recently analyzed the 71,767 cases lodged in New York State Immigration Courts between October 2005 and July 2010. They found that 60 percent of detained immigrants did not have an attorney by the time their case was completed. Among the barriers to finding representation are prohibitive costs, high bail rates -- often around $10,000 even for minor offenses -- and the transfer of detainees to far-away locales such as Texas, Louisiana and Pennsylvania. Within the studied cases, positive outcomes -- relief or termination -- were reached just 3 percent of the time for detainees without representation.

Unfortunately, those able to retain an attorney are not always better off. A survey of 31 of the 33 judges who preside over deportation hearings in New York, described a poor track record by the immigrant defense bar. Immigrants received "inadequate" legal assistance in 33 percent of the cases studied and "grossly inadequate" assistance in 14 percent of the cases. The vast majority of representation in immigration proceedings in New York (91 percent) is provided by private attorneys. While some obviously provide excellent services, as a class, these attorneys offered the worst representation in this forum when compared to non-profit organizations, pro bono attorneys and even law students.

The immigration representation crisis has gained traction and visibility during the past decade as increasingly harsh immigration laws, along with more intense enforcement, have resulted in a stunning increase in the number of people detained and deported for minor crimes. In 2012 alone, DHS deported 410,000 immigrants.

It is a common misconception that people deported via the criminal justice system are dangerous. When it was launched, Secure Communities -- the federal program linking local law enforcement records to ICE databases -- was advertised as prioritizing the removal of "the most dangerous and violent offenders." Yet nearly 75 percent of people deported under "S-Comm" have not been accused of major crimes. Twenty-six percent actually had no criminal charges at all.

Overall, Secure Communities has led to more harm than safety, according to Families for Freedom, part of the statewide coalition New York State Working Group Against Deportation. The program destroys police-community relationships, perverts notions of due process and justice through disparate treatment of immigrants during legal proceedings, and encourages racial and ethnic profiling, the group says.

Meanwhile the well-documented racial disproportionalities of the criminal legal system are apparent in these cases as well. Spanish speaking residents represent 74 percent of immigrants facing deportation hearings in New York City, despite this group making up closer to 40 percent of the entire undocumented population in the city.

All of this comes at an astonishing cost for taxpayers. The so-called "bed mandate" -- an eleventh-hour add-on to the 2009 Homeland Security spending bill that requires Immigration and Customs Enforcement to keep a minimum of 34,000 undocumented immigrants locked-up at all times, regardless of the crimes alleged to have been committed, costs $2 billion a year. Clearly, private prison companies, which house almost two-thirds of ICE's detainees, are benefiting, with just two -- Corrections Corp. and Geo Group -- collecting nearly $500 million in ICE contracts alone during 2012. Who else benefits from these practices?

As a 2008 New York Times editorial described: "A nation of immigrants is holding another nation of immigrants in bondage, exploiting its labor while ignoring its suffering, condemning its lawlessness while sealing off a path to living lawfully."

The New York City Council has approved a $500,000 grant for local public defender agencies -- Brooklyn Defender Services and The Bronx Defenders -- to begin providing representation to indigent people in immigration proceedings, the first program of its kind in the country. This is perhaps a first step toward creating a system within the immigration courts that is fair and just -- an impossible description for the current state characterized most dominantly by poor legal representation, when attorneys are available at all.

However, the project will assist just 190 people during the first year, and there is no guarantee the funding will be continued past 2014. While the program will likely help these represented immigrants, it seeks to provide attorneys to only a small number of those who might otherwise qualify for assistance. It would cost $7 million a year to provide legal counsel for every indigent deportation case, a small amount considering the annual Department of Corrections budget of $1.08 billion.

Source:

Fed Up Condemns Trump Nomination to Federal Reserve

07.10.17

NEW YORK – In...

07.10.17

NEW YORK – In response to the White House’s nomination of Randal Quarles to the Federal Reserve as Vice Chair for Supervision, Jordan Haedtler, Campaign Manager for the Fed Up coalition, released the following statement:

“Throughout his career, self-described ‘Wall Street lawyer' Randal Quarles has looked out for his banker clients at the expense of America’s hard-working families.

After the financial crisis took a devastating toll on our country, Daniel Tarullo and the Federal Reserve Board of Governors implemented regulations to protect consumers from Wall Street excesses and facilitated job recovery by keeping interest rates low. Quarles stood against crucial decisions like these that helped working families, and he was proven wrong.

Quarles is on record opposing the Volcker Rule, which is meant to prevent banks from gambling with depositors’ money. During the Bush administration, Quarles negotiated trade agreements that blocked countries from regulating derivatives and other instruments that caused the crash. And after returning to the private sector, Quarles held private equity up as a solution to avoid government bailouts. He then took advantage of relaxed restrictions on private equity ownership to purchase a failing bank, and had the FDIC pay 80% of that bank’s losses.

We are also very concerned about Quarles’ monetary policy views. He enthusiastically supports the adoption of a Taylor Rule by the Fed, which would deprioritize full employment and put monetary policy decisions on autopilot. If Quarles had his way and the Fed strictly followed a Taylor Rule over the past five years, economists estimate that 2.5 million fewer jobs would have been created.

Trump claims that his highest priority is jobs, but Quarles’ regulatory and monetary record show that he would destroy jobs, not create them.We urge the Senate to press Quarles on all of these troubling positions, and to oppose his confirmation.”

### www.thepeoplesfed.org

Fed Up is a coalition of community organizations, labor unions, and policy experts across the country calling on the Federal Reserve to reform its governance and adopt policies that build a strong economy for the American public. By keeping interest rates low and prioritizing genuine full employment, the Fed gives the economy a fair chance to recover and allows wages to grow across all communities.

Contact: Shawn Sebastian, Fed Up co-director, ssebastian@populardemocracy.org, 515.451.8773

Fed chairman defends interest rate hikes as Trump’s attacks show no sign of working

Fed chairman defends interest rate hikes as Trump’s attacks show no sign of working

Several protesters from the progressive group Fed Up stood outside the conference room where Powell delivered the speech. Much like Trump, they say raising rates again will harm working people’s...

Several protesters from the progressive group Fed Up stood outside the conference room where Powell delivered the speech. Much like Trump, they say raising rates again will harm working people’s chances of getting jobs and better pay. The protesters wore green T-shirts reading “The Fed wants more of us unemployed.

Read the full article here.

NYC Council Progressive Caucus Backs Keith Ellison for DNC Chair

NYC Council Progressive Caucus Backs Keith Ellison for DNC Chair

The City Council’s dominant Progressive Caucus—led by Speaker Melissa Mark-Viverito—announced their endorsement today of Minnesota Congressman Keith Ellison for chairman of the Democratic National...

The City Council’s dominant Progressive Caucus—led by Speaker Melissa Mark-Viverito—announced their endorsement today of Minnesota Congressman Keith Ellison for chairman of the Democratic National Committee.

As Democrats look to recover from a devastating Election Day, Ellison is vying to lead the party against former Vermont Gov. Howard Dean and South Carolina chairman Jaime Harrison. Ellison, the first Muslim-American ever elected to the House of Representatives, has attracted the support of Sen. Charles Schumer and Vermont Sen. Bernie Sanders, whom the congressman backed for the presidency in defiance of most party leaders.

Now the Progressive Caucus, whose 19 members mostly though not unanimously favored Hillary Clinton in the Democratic primary, has added its backing to the Midwestern lawmaker’s bid.

“The members of the Progressive Caucus Alliance are proud to add our voices to those in support of Keith Ellison for Chair of the Democratic National Committee,” the group said in a press release today. “Congressman Ellison has been a true progressive champion in Congress, and has demonstrated the grit and tenacity that we’ll need for the tough fights ahead.”

Dean, who headed the DNC from 2005 to 2009, has asserted that the organization needs a chair who can attend to party business full-time. The Democrats have suffered severe setbacks over the past eight years under chairs who held elected office, most recently the controversial Florida Congresswoman Debbie Wasserman-Schultz.

The former Green Mountain State governor and 2004 presidential candidate has highlighted the success of his “50-state strategy” in yielding the first Democratic majority in Congress in 22 years in 2006.

More important for the Council’s Progressive Caucus, however, are Ellison’s two turns as keynote speaker at “Local Progress” gatherings of low-level left-leaning officials. This, the caucus asserted, showed an emphasis on building a party bench at the most basic levels of government.

“As municipal legislators, we are especially enthusiastic about his emphasis on progressive politics at the local level,” their statement said. “Congressman Ellison recognizes that progressive politics matter at the most local of levels: to families seeking a job that pays the bills, to kids from low-income families hoping to go to college, and to parents worried about whether their kids of color will be treated fairly by the criminal justice system. He knows the difference it makes to unite action at the local, state and federal levels, and why it is important to build strength among City Council members and other local elected officials.”

Ellison’s bid also comes as many Democrats, including Schumer, have argued the party needs to increase outreach to blue collar white voters in depressed industrial areas. But the Progressive Caucus insisted the “incredibly divisive national atmosphere” President-elect Donald Trump’s incendiary anti-immigrant rhetoric has created demands party leadership that will stick up for minorities.

“We need a leader who will stand firm against hatred, bias, discrimination, anti-Semitism, Islamophobia,” the Council members’ release said. “The members of the Progressive Caucus Alliance know that Congressman Ellison will be that type of leader, and we enthusiastically support his bid for Chair of the DNC.”

“We are enthusiastic that he will be [the] first Muslim-American DNC Chair,” it added.

Disclosure: Donald Trump is the father-in-law of Jared Kushner, the publisher of Observer Media.

By Will Bredderman

Source

After Volkswagen scandal, can consumers trust anything companies say? (+video)

After Volkswagen scandal, can consumers trust anything companies say? (+video)

Adam Galatioto’s loyalty to diesel Volkswagens predates his ability to drive.

The 29-year-old’s parents first bought a Jetta TDI in 1998, and he drove the little...

Adam Galatioto’s loyalty to diesel Volkswagens predates his ability to drive.

The 29-year-old’s parents first bought a Jetta TDI in 1998, and he drove the little sedan through high school, college, and a master’s program before selling it in 2013. Mr. Galatioto and his girlfriend now share a 2011 Jetta TDI SportWagen, which he helped encourage her to buy.

“They get really good mileage,” he says. “Mine got 50 m.p.g. on the highway. By proxy that means you are being environmentally friendly.”

He’s not alone. Volkswagen has long enjoyed a reputation for reliable engineering, cheerful affordability, and, largely thanks to its efforts in clean diesel, sustainability. In Consumer Reports’ 2014 survey on how people perceive leading car brands, the German automaker was singled out (alongside Tesla) for its fuel efficiency.

That made recent revelations that VW had duped environmental regulators for years, installing software on 11 million diesel vehicles worldwide allowing them to run cleaner during emissions tests than they did on the road, all the more unnerving.

“I don’t generally trust corporations on what they say, and this was so intentionally devious it just lumps them in with any other car company for me,” Galatioto says.

This is a worst-nightmare scenario for companies trying to attract customers that increasingly want to make not just quality or affordable purchases, but ethical ones. It’s an impulse nearly every consumer industry is racing to capitalize on, from restaurant chains shifting to cage-free eggs and fair-trade coffee to retailers pledging to raise wages and give workers more predictable scheduling.

But with such promises being made left and right, and especially in the wake of Volkswagen’s fall, conscientious consumers may be wondering: Can any of them really be trusted?

Not always, clearly, but there is some comfort to be had on that front. Brands that fail to deliver risk even greater financial and reputational fallout than ever before (Volkswagen lost a third of its stock value when the scandal broke, and it faces billions in future losses from EPA fines, repairs, and lost sales). Combined with effective third-party oversight, it’s a powerful motivator for companies on the whole to behave better, experts say.

Consumers, particularly younger ones, are armed with easier access to information about what they buy than previous generations, and it’s affecting their choices. Millennials (adults ages 21 to 34) are more than twice as likely as their Gen-X and baby boomer counterparts to be willing to pay extra for products and services billed as environmentally and socially sustainable, according to a 2014 Nielsen survey. They are equally more prone to check product labels for signs of sustainable and ethical production.

“There’s an increased attention to more intangible characteristics of a product,” says Dutch Leonard, a professor who teaches corporate responsibility and risk management at Harvard Business School. “When I buy a shirt, it has a particular color, it’s soft, or wrinkle-free. But now people are also paying attention to where it was made, if the workers are being exploited, and if the company is environmentally conscious or not.”

This makes responsible changes effective marketing tools, which can create domino effects as companies try to keep up with and outdo standards in their particular industries. When Wal-Mart, the biggest retailer in the world, raised its minimum pay rate at the beginning of this year, competitors such as Target and Kohl’s quickly followed suit. The success of Chipotle, which has a carefully detailed food-sourcing policy, has been followed by major supply chain overhauls for McDonald’s, General Mills, and other giants of the corporate food world.

“Customers want 'food with integrity,' ” Warren Solochek, a restaurant-industry analyst with NPD Group, a market-research firm, told the Monitor in May. “[Companies] that choose locally sourced, fresh ingredients can put that on their website and know that people are looking at it.”

But especially for major corporations, “when you say you are doing things, you will attract attention from outside business groups," Professor Leonard says. "You can bet some NGO [nongovernmental organization] is going to try and figure out if that’s true or not.”

Indeed, Volkswagen isn’t the first brand to have its positive positioning face pushback, especially as global companies work to strike an operational balance between ethics and profitability. Wal-Mart’s wage hikes were followed by cutbacks in worker hours when the retailer’s earnings suffered, a move that led labor advocacy groups to call the earlier wage hikes “a publicity stunt.” Earlier this week, the Center for Popular Democracyreleased a report showing that Starbucks has so far failed to live up to a much-publicized vow from a year ago to give workers more consistent schedules.

While Volkswagen eluded the Environmental Protection Agency, it was eventually found out by the International Council on Clean Transportation, an independent nonprofit aided by researchers at West Virginia University.

In addition to catching such discrepancies, watchdog groups can be helpful in weeding out credible claims of positive change from the less so. In the mid-2000s, the Unions of Concerned Scientists’ annual environmental consumer guide largely dispelled the idea that washable cloth diapers are significantly better for the environment than disposable ones.

Furthermore, some major corporations and industry groups have partnerships with independent, NGO-like organizations to set ethical industry standards and submit to outside monitoring. Unilever, for example, teamed up with the the World Wide Fund for Nature (WWF) in the 1990s to create the Marine Stewardship Council, a certification program for sustainable fisheries. In 2008, Starbucks embarked on a decade-long project with Conservation International to improve the sustainability of its coffee supply around the world. Home Depot sells lumber certified by an outside organization.

Such collaborations may not catch everything, Leonard says, but they are effective because they are “constructed in such a way that the [certification groups] are not beholden to an industry. We may not be able to get full agreement on the standards, but we might make real progress by creating safe harbors through development of standards that are negotiated in advance.”

Source: The Christian Science Monitor

Clinton Wants Bankers Off Regional Fed Boards

Democratic presidential candidate Hillary Clinton joined the fray Thursday in the debate over how the nation’s central bank operates, saying banking industry insiders need to be removed from the...

Democratic presidential candidate Hillary Clinton joined the fray Thursday in the debate over how the nation’s central bank operates, saying banking industry insiders need to be removed from the Federal Reserve System.

Mrs. Clinton’s campaign said, if elected, she would appoint officials who will carry out “unwavering oversight” of the financial sector and “defend” both sides of the central bank’s inflation and employment mandates. The campaign also said “commonsense reforms—like getting bankers off the boards of regional Federal Reserve banks—are long overdue.”

Mrs. Clinton’s comments on central bank changes appeared to be her first on the topic in a campaign season where the Fed has intermittently been an issue, albeit mostly on the Republican side. Mrs. Clinton’s views emerged on a day in which dozens of Democratic congressional members, led by Sen. Elizabeth Warren of Massachusetts and Rep. John Conyers Jr. of Michigan, criticized the central bank for a leadership largely made up of white males with business and finance backgrounds.

While the Fed is led by its first-ever woman chief, all of its governors are white and three of the five are men. Of the 12 regional bank presidents, none are black and 10 are men. The last African-American to serve in a key leadership role left in 2006.

The letter to Ms. Yellen, referencing a recent study by the left-leaning Center for Popular Democracy’s Fed Up Coalition, also flagged a lack of diversity among the boards of directors that oversee the regional Fed banks. The letter said a Fed that doesn’t look like the nation it works for will struggle to make policy that benefits an increasingly diverse nation. Regional Fed board members are drawn from the private sector to watch over institutions that are quasi-private. By law, the boards are supposed to represent their broader communities with three classes of directors reserved for differing interests, including the financial sector, in a process set out by a complicated set of rules. These boards oversee regional Fed bank operations, provide local economic insights and help select new bank presidents.

But the presence of bankers on the boards, representing firms regulated by the Fed, has been a sore spot for Fed critics. Over the years, the New York Fed faced notable controversies on this front.

Recent legal changes have removed financial-market participants from the process of selecting new bank presidents. Also, the Fed’s regulatory operations are managed in Washington even as they operate out of regional banks, and are insulated from the influence of the regional boards. Most regional Fed boards are spoken of in glowing terms by their respective bank presidents.

Financial-market professionals are well represented among Fed leaders. Most top central bankers are either economists by training or former bankers. The leaders of the New York, Minneapolis, Dallas and Philadelphia Fed banks all have worked in some capacity for investment bank Goldman Sachs. Current Fed Vice Chairman Stanley Fischer was vice chairman of Citigroup from 2002 to 2005.

Mrs. Clinton’s desire to remove financial-sector leaders from the regional Fed boards would mark a historic change for a central bank that was founded on the mission of promoting financial stability, and whose monetary policy actions work through private financial-market channels to affect the performance of the broader economy.

In response to the congressional letter, the Fed said in a statement that when it comes to the members of the regional boards, “by law, we consider the interests of agriculture, commerce, industry, services, labor, and consumers. We also are aiming to increase ethnic and gender diversity.“ It also said there has been a rise in both racial and gender diversity on the regional Fed boards, with 46% of all directors now meeting the label of “diverse.”

A recent overhaul proposal by former top Fed staffer Andrew Levin, now a professor at Dartmouth College, called for the regional Fed banks to be made fully public, ending their private ownership structure operating within the Fed board, which is explicitly part of the government. Mr. Levin also called for directors representing firms regulated by the central bank to be removed.

By MICHAEL S. DERBY

Source

The Week Ahead in New York Politics, May 21

On Monday at 11 a.m. at City Hall Park, “Representative Adriano Espaillat (NY-13), joined by New York State Assemblyman Marco Crespo and community leaders, will hold a press conference calling for...

On Monday at 11 a.m. at City Hall Park, “Representative Adriano Espaillat (NY-13), joined by New York State Assemblyman Marco Crespo and community leaders, will hold a press conference calling for secure housing for residents of Puerto Rico in support of the Housing Victims of Major Disasters Act, introduced by Rep. Espaillat earlier this Congress.” Other participants will include former City Council Speaker Melissa Mark Viverito, Frankie Miranda of Hispanic Federation, and Ana María Archila of Center for Popular Democracy, among others.

Read the full article here.

The financial reality facing America's 16 million retail workers

The financial reality facing America's 16 million retail workers

Shaheim Wright's house is falling apart. It's infested with bedbugs. The washing machine is broken. He needs a new sink. Oh, and there's the crack in the bathtub.

"It's leaking out, and...

Shaheim Wright's house is falling apart. It's infested with bedbugs. The washing machine is broken. He needs a new sink. Oh, and there's the crack in the bathtub.

"It's leaking out, and right near my door is a wet spot from water coming down," Wright said. "And it's like, well I can't pay for any of this."

Read the full article here.

Activists Counter Federal Reserve Gathering With Push Against Interest Rate Hikes

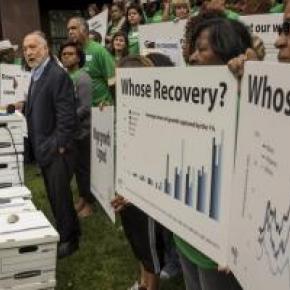

The two-day event, Whose...

The two-day event, Whose Recovery: A National Convening on Inequality, Race, and the Federal Reserve, is organized by the Fed Up campaign, a coalition of groups led by the nonprofit Center for Popular Democracy. It serves as a counter-conference to the annual Federal Reserve Bank of Kansas City symposium, where Fed officials come together to discuss monetary policy -- and which is currently taking place at the same resort as the Fed Up gathering.

Fed Up’s member organizations brought over 100 primarily low-income grassroots activists from across the country for the gathering. It's a dramatic increase from its inaugural visit to Jackson Hole last year, when the campaign brought a group of 10 activists.

The size of Fed Up’s delegation of activists and presence of prominent economists -- including Nobel laureate Joseph Stiglitz -- attests to the rapid growth of a once-unlikely campaign that began just a year ago. Fed Up has managed to turn the esoteric issue of central bank interest rates into a key element of the progressive agenda -- and a rallying cry for low-income workers.

Rod Adams, a recent college graduate from Minneapolis, said he was attending the convention because he was disappointed in the job market. Despite his college degree, he currently makes $10.10 an hour working at the Mall of America.

“I have seen Wall Street’s recovery and corporate America’s recovery -- where is ours?” Adams demanded, eliciting cheers at a spirited press conference outside the Jackson Lake Lodge on Thursday.

The activists oppose the Federal Reserve increasing interest rates before the economy creates enough jobs to generate substantial wage growth for all workers. They believe that a premature interest rate hike would be especially harmful to workers in communities of color, who continue to suffer higher rates of unemployment than the overall population. Activists say this is partly the result of discrimination in the job market. Fed Up released a report on Thursday that uses original data to show that if there was the same low unemployment rate in every community in America, African-Americans and American Indians would experience the largest income gains.

The delegation plans to present officials attending the exclusive Fed symposium with an online petition opposing an interest rate hike that bears 110,000 signatures. The petition effort was the result of Fed Up's collaboration earlier this month with online progressive heavyweights including CREDO Action, Daily Kos, the Working Families Organization and Demand Progress. Robert Reich, former secretary of labor and an economist at the University of California, Berkeley, gave the petition drive a high-profile boost with a popular video promoting the effort.

A similar petition that Fed Up brought last year had 10,000 signatures.

The Kansas City Federal Reserve Bank, which convenes the annual Jackson Hole symposium for Fed officials, declined to comment on this year's parallel protest conference.

Kansas City Fed President Esther George met with Fed Up activists during last year's symposium.

Janet Yellen, chair of the Federal Reserve Board of Governors, is not attending this year's symposium, precluding even the possibility of an impromptu encounter with protesters.

“Janet Yellen is missing a great opportunity to see what real people look like,” Adams said. “We are not data on a spreadsheet.”

Proponents of a Federal Reserve interest rate hike in the near future argue that the Fed should begin raising rates to prevent excessive price and asset inflation. The Fed has a dual mandate to maintain full employment and stable price inflation.

William Dudley, president of the Federal Reserve Bank of New York, signaled on Wednesday that they would postpone an interest rate hike that Fed officials had previously indicated would occur in September. Dudley said turmoil in China and other emerging market economies that sparked massive swings in the U.S. stock market earlier in the week made a September rate hike “less compelling.”

Josh Bivens, the progressive Economic Policy Institute’s research and policy director, applauded the Fed’s move away from an interest rate hike, but said the reason for the Fed’s decision confirmed the need for more grassroots activism.

“A week ago the case against raising rates for the labor market was clear as day, but all of a sudden when wealthy people lost money in the stock market the tide turned against a rate increase,” Bivens said at Thursday's press conference. “I’m happy rates are less likely to go up because of that, but it is a terrible reason.”

Source: Huffington Post

White Male Bankers Dominate New Crop of Federal Reserve Directors and Presidents

02/08/16

Today, the Fed Up campaign released...

02/08/16

Today, the Fed Up campaign released a report showing that the January 1 appointments to the 12 Federal Reserve boards across the country have exacerbated the system’s skewed leadership structure and resulted in economic policy choices that privilege the needs of the wealthy over the welfare of low-income communities of color. The report, “To Represent the Public”: The Federal Reserve’s Continued Failure to Represent the American People, is being released as Chair Janet Yellen begins two days of testimony before Congress and three weeks before the expiration of the five-year terms of all 12 regional Federal Reserve Bank presidents, who are all expected to be reappointed by the regional boards through a completely opaque process.

Among the 19 board members appointed at the beginning of 2016, 16 are white, three are black, and none are Latino or Asian. Twelve come from either banks or corporations, while three are from academia, one represents a labor union, and the remaining three come from the non-profit world. This year’s new appointees mirror society in terms of gender with 10 women and nine men, although the boards remain dominated by men.

The report is being released as approximately 80 community leaders and organizers from around the country converge on Washington DC today and tomorrow for Yellen’s “Humphrey-Hawkins” hearings in front of the House Financial Services and Senate Banking committees. For over a year, the Fed Up campaign have been warning the Fed not to intentionally slow down the economy while it remains fragile, with 0.7 percent growth in the fourth quarter of 2015 and a slack labor market with low wage growth. Nevertheless, Fed officials raised rates in December, sending international markets into a tailspin on fears of a global slowdown and even a new recession.“To Represent the Public” shows that its decision to slow down the economy – which reduces aggregate demand, slows job creation, undercuts workers’ bargaining power, and leads to lower wages – is the result of a leadership dominated by bank executives who profit from higher interest rates and corporate executives who profit from lower labor costs.

The report reveals that, despite the legal requirement that Federal Reserve Bank directors “represent the public” with “due consideration” to a wide array of constituencies across the economy, directorships at Fed Banks are occupied disproportionately by white men, almost entirely from the corporate and financial sectors. 83 percent of Federal Reserve board members are white and nearly 75 percent are men. By comparison, 63 percent of the country is white and 49 percent is male. Banking and commercial sectors dominate the board seats, with representatives from community and labor organizations representing less than five percent of all seats.

On top of the lack of diversity, the report casts a spotlight on the revolving door between the banking industry and the Federal Reserve. The majority of Federal Reserve Bank presidents spend their entire careers either in the federal government or in the banking sector before taking a job at the Fed. One fourth of current Fed presidents have strong ties to Goldman Sachs.

The report makes a set of recommendations, calling on the Fed to ensure that community, labor, academic, and alternative banking voices have a strong presence within the system’s governance.

Shawn Sebastian, the Fed Up campaign’s Field Director, released the following statement:

“When a policy-making body that looks like this evaluates whether lower unemployment and higher wages would be a good thing for America, whose perspectives are they taking into consideration? When no regional president is African-American, how do they weigh the importance of Black unemployment?

“When the vast majority who represent banking and financial interests debate with the few labor representatives over whether we have a strong labor market, who wins? The answers are obvious.

“The Federal Reserve intentionally slowed down the economy in December, ignoring the voices of working people around the country. The Fed needs to prioritize strong job and wage growth for everybody. But its leadership continues to represent America’s one percent and to advance policies that help the wealthiest, rather than the rest of us. That needs to change.”

# # #

www.whatrecovery.com

Fed Up is a coalition of community organizations and labor unions across the country calling on the Federal Reserve to reform its governance and adopt policies that build a strong economy for the American public. The Fed can keep interest rates low, give the economy a fair chance to recover, and prioritize genuine full employment and rising wages.

# # #

www.populardemocracy.org

The Center for Popular Democracy promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country. CPD builds the strength and capacity of democratic organizations to envision and advance a pro-worker, pro-immigrant, racial justice agenda.

Press Contact:

Anita Jain, ajain@populardemocracy.org, 347-636-9761

Sofie Tholl, stholl@populardemocracy.org, 646-509-5558

2 months ago

2 months ago