Housing advocates: FHFA won’t reduce principal, offers discounted NPLs

Two liberal advocacy groups have published a provocative study accusing the Department of Housing & Urban Development and the Federal Housing Finance Agencyof...

Two liberal advocacy groups have published a provocative study accusing the Department of Housing & Urban Development and the Federal Housing Finance Agencyof helping Wall Street at the expense of low-income communities by selling non-performing loans to investors.

The Center for Popular Democracy and the ACCE Institute’s report “Do Hedge Funds Make Good Neighbors?: How Fannie Mae, Freddie Mac and HUD are Selling Off Our Neighborhoods to Wall Street” is lengthy and accusatory.

The study looks at how HUD has since 2012 auctioned off, at a discount, some 120,000 Non-Performing Loans that they want to get off their books.

They also take into account similar actions by the FHFA through Fannie Mae and Freddie Mac, which have sold over 10,000 mortgages already this year.

The study, which can be read here, notes that nearly all of the roughly 130,000 mortgages have been sold to Wall Street hedge funds and private equities firms, leading to what they call the rise of a new phenomenon in this country – Wall Street as major landlord and neighbor in communities across the country.

“An initial examination into four of the largest purchasers of HUD and FHFA loans has unearthed an array of disturbing business practices, ranging from those that clearly run counter to the goals of homeownership preservation and neighborhood stability to those that break laws, deceive homeowners, and harm taxpayers more generally,” the study claims.

The authors argue that HUD and FHFA should sell these troubled mortgages to entities working to preserve homeownership and create affordable housing, not to Wall Street speculators with a history of defrauding taxpayers and harming homeowners, tenants and neighborhoods.

“Nearly eight years after the start of the global financial crisis, hedge funds and private equity firms have found yet another way to make big profits: distressed housing assets. Often, the very same corporate actors that precipitated the housing crash in the first place are buying and selling off delinquent mortgages and vacant houses that are a product of the crash,” the study says. “Together, these Wall Street entities have raised over $20 billion to buy the notes for as many as 200,000 homes in the United States. The newly consolidated single-family rental market is a lucrative business. A 2014 study estimated that the four largest holders of these assets have seen as much as a 23% rate of return on the properties they purchased in the last three years.”

However, HUD has been making changes to how it deals with distressed assets and NPL sales.

Just two months ago, HUD announced significant changes to its Distressed Asset Stabilization Program. HUD also announced additional improvements to the Neighborhood Stabilization Outcome sales portion of DASP which are aimed at increasing non-profit participation.

Updates include giving non-profits a first look at vacant properties, allowing purchasers to re-sell notes to non-profits, and offering a non-profit only pool.

Previously, loan servicers could foreclose 6 months after they received the loan and were encouraged, though not required to assess a borrower’s qualifications for loss mitigation programs. Purchasers of the geographically targeted neighborhood stabilization pools have always been required to ensure that at least 50% of the loans in a pool achieve outcomes that help areas hardest hit by foreclosure avoid the neighborhood decline associated with numerous vacant properties.

“These changes reflect our desire to make improvements that encourage investors to work with delinquent borrowers to find the right solutions for dealing with the potential loss of their home and encourage greater non-profit participation in our sales,” said Genger Charles, Acting General Deputy Assistant Secretary, Office of Housing, when it was announced. “The improvements not only strengthen the program but help to ensure it continues to serve its intended purposes of supporting the MMI Fund and offering borrowers a second chance at avoiding foreclosure.”

The groups are calling on HUD and FHFA to “establish much higher standards and criteria for the kind of companies that are eligible to purchase delinquent mortgages” and to “prioritize companies that have a clearly defined program to offer permanent modifications with principal reduction and to create affordable housing with vacant properties.” ?

They also want FHFA to “immediately begin to offer principal reduction in their own modification process.”

“Two distinct paths forward are available: the abuses of the biggest purchasers to date of the HUD and FHFA non-performing loans; or, the approach of community development financial institutions with both the ability and the commitment to create affordable housing to better local communities. The status quo benefits the very actors that hastened the financial crisis and actively created the conditions that sucked over half the wealth from millions of American families. These companies profit from new predatory practices and speculative business models that once again take advantage of ordinary people,” the study concludes.

Source: HousingWire

Working full time, but living in poverty

Metro - February 13, 2013, by Alison Brown -

They are working full time, but they are living in poverty.

One day after President Barack Obama said America...

Metro - February 13, 2013, by Alison Brown -

They are working full time, but they are living in poverty.

One day after President Barack Obama said America should not be a place where people working 4o-hour weeks are still in poverty, New York workers said that reality exists all too often.

During his State of the Union address Tuesday night, Obama said a family with two kids earning minimum wage lives below the poverty line.

“That’s wrong,” he said. “In the wealthiest nation on earth, no one who works full-time should have to live in poverty.”

Obama suggested raising the federal minimum wage to $9 an hour.

New Yorkers want even more – raising the minimum wage to $10 an hour would give full-time workers an annual salary of $20,000, according to a report released today.

Right now, about 1.7 million New Yorkers are trying to live on about $18,530 for a family of three, according to the report. Meanwhile, unemployment increased from 5.3 percent in 2007 to 9.7 percent now, the report noted.

And more than 110,000 full-time workers live in poverty, according to the report, authored by groups The Center for Popular Democracy and UnitedNY.

Many of these are in the low-wage industry, like car wash workers, who often work more than 60 hours a week but make less than $400 per week.

And some are tasked with important services, like airport screening. The report said a survey of 300 airline employees found them paid barely more than $8 per hour.

Last year, many rallied outside their workplaces, with retail workers standing outside the Fifth Avenue Abercrombie & Fitch to demand higher wages. JFK workers also threatened to strike before the 2012 holiday season. And fast-food employees went on strike in November to demand nearly doubling their salary to $15 an hour.

“You can’t even afford to get sick, “ McDonald’s worker Linda Archer told Metro while striking.

The report referenced the struggle to pay New York City prices on a retail or car-wash paycheck.

“After working as a cashier at Abercrombie & Fitch for over a year, I ended up with an average of just 10 hours per week,” one worker said. “That’s not enough to live on and go to school.”

A car wash worker in the report added, “I came to this ‘land of opportunity’ with so many hopes, but I have become disillusioned about being able to help my family.”

Source

Jackson Hole Journal: Rate Rise Friends, Foes Encircle Fed Event

Also getting under way at the lodge is a protest conference organized by the Center for Popular Democracy, a liberal group that has been cajoling the Fed to hold off on raising interest rates....

Also getting under way at the lodge is a protest conference organized by the Center for Popular Democracy, a liberal group that has been cajoling the Fed to hold off on raising interest rates. Their headline speaker will be Joseph Stiglitz, a Nobel Prize-winning economist and once a mentor to Fed Chair Janet Yellen, who is not attending the Fed event.

Policy makers such as Fed Vice Chairman Stanley Fischer won’t be able to avoid seeing their activists, roaming around the lodge in green t-shirts, reading “Whose recovery?” and “Let our wages grow.”

The group, which this year includes representatives from the Black Lives Matter movement, have reserved conference space directly below the room where the Kansas City Fed’s sessions take place.

Left out is the American Principles Project, a conservative organization that has heavily criticized the Fed’s monetary policy as excessively accommodative. They believe interest rates should have been lifted long ago.

The group tried to reserve space at the Jackson Lake Lodge but were refused, according to Steve Lonegan, their director of monetary affairs. So they’ll get their alternative conference started this evening in Teton Village, a more than 30-mile (48-kilometer) drive away. Scheduled speakers include Representative Scott Garrett, a New Jersey Republican who has sponsored legislation to make the Fed more accountable to Congress.

Better Access

Standing at an information table covered with gold-coin chocolates on Wednesday in Jackson Hole Airport, Lonegan complained that his group was refused space at the lodge while the other protesters enjoyed much closer access to the Fed attendees, including the media.

Kansas City Fed Spokesman Bill Medley said the bank had “no say over who else books space here.”

Elizabeth Biebl, a spokeswoman for lodge operator Vail Resorts Hospitality and Real Estate, said in an e-mail there are space limitations and the Center for Popular Democracy was accommodated at the Jackson Lake Lodge because it requested smaller numbers than American Principles Project.

“Groups interested in booking with us are not subject to the approval of other groups who already have bookings,” she wrote.

Source: Bloomberg

Are Superstar Firms and Amazon Effects Reshaping the Economy?

Are Superstar Firms and Amazon Effects Reshaping the Economy?

“Wage stagnation is not a puzzle,” said Marshall Steinbaum, a fellow at the Roosevelt Institute, who spoke on a panel organized by the activist group Fed Up outside the lodge where the Fed...

“Wage stagnation is not a puzzle,” said Marshall Steinbaum, a fellow at the Roosevelt Institute, who spoke on a panel organized by the activist group Fed Up outside the lodge where the Fed symposium later took place. “Cutting-edge research tells us exactly what’s going on, and yet the Fed seems to be considering this for the first time.”

Read the full article here.

The John Gore Organization & Scarlett Johansson's Our Town Benefit Raises $500,000 for Hurricane Maria Community Relief Fund

The event played to a full house and a very enthusiastic crowd. With more than 3,500 tickets sold, it was one of the largest audiences the play has ever been presented to in one night. Johansson...

The event played to a full house and a very enthusiastic crowd. With more than 3,500 tickets sold, it was one of the largest audiences the play has ever been presented to in one night. Johansson was joined on stage for opening remarks by director Leon and Xiomara Caro, Director of New Organizing Projects for the Center of Popular Democracy and coordinator for The Maria Fund, sharing an inspiring message about the purpose of the event and the relief effort. They brought the crowd to their feet when they revealed that the evening’s efforts resulted in half of a million dollars raised to help Puerto Rico in their hour of need.

Read the full article here.

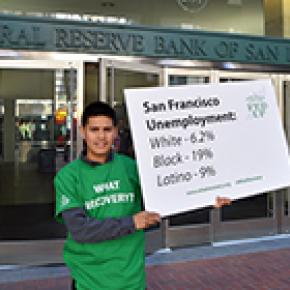

Report: Black Unemployment in Bay Area More Than Three Times the Average

SF Examiner - March 6, 2014, by Chris Roberts - After 200 unanswered job applications, Ebony Eisler finally landed a $15 an hour position as a medical assistant in Mission Bay. But since she's a...

SF Examiner - March 6, 2014, by Chris Roberts - After 200 unanswered job applications, Ebony Eisler finally landed a $15 an hour position as a medical assistant in Mission Bay. But since she's a temp worker, she earns less than her co-workers, who make $20 to $25 per hour for the same work.

Still, as a black woman in San Francisco, she is fortunate. The unemployment rate for black people in the Bay Area is 19 percent, according to 2013 U.S. Census Bureau data crunched by the Economic Policy Institute.

Blacks are unemployed at more than three times the rate of workers of other races, according to this data. The Bay Area finished 2013 with a 6 percent total unemployment rate, according to the Bureau of Labor Statistics.

In San Francisco, unemployment has dropped rapidly since Mayor Ed Lee took office in January 2011, when the jobless rate was 9.5 percent. The most recent figures from the state Employment Development Department — which does not publish jobless rates by race — pegged The City's unemployment rate at 3.8 percent, by far the rosiest employment figures since the first dot-com boom at the turn of the millennium.

The wide gulf in the jobless rate between ethnic groups living in the same city belies the idea that The City and state have fully recovered from the Great Recession, according to advocates with the leftist Center for Popular Democracy.

The group released the unemployment figures by ethnicity Thursday as part of a national campaign to convince the Federal Reserve Bank to keep interest rates low in order for the economic recovery to trickle down to all workers.

So far, "the recovery is based on white America alone," said Eisler, 36, a Bayview resident who holds an associates degree and a certified nursing assistant license. Her current job, the best she could find, does not cover her $1,800 a month rent, she said.

Statewide, the jobless rate for black people is 14 percent, according to the Economic Policy Institute, compared to 6.1 percent for whites, 8.5 percent for Latinos and 5.9 percent for Asians.

Source

Two weeks before hurricane season, Puerto Rico is not ready, groups warn

Two weeks before hurricane season, Puerto Rico is not ready, groups warn

“One thing is evident at the core of the response,” said Ana Maria Archila, co-executive director at the Center for Popular Democracy and a part of the Power 4 Puerto Rico coalition. “There is a...

“One thing is evident at the core of the response,” said Ana Maria Archila, co-executive director at the Center for Popular Democracy and a part of the Power 4 Puerto Rico coalition. “There is a crisis of democracy. The federal government is acting as if the people of Puerto Rico are not constituents.”

Read the full article here.

Community activists and others file legal opposition to NYPD body cam policy

Community activists and others file legal opposition to NYPD body cam policy

The New York Police Department’s body camera program launched this week, but not without a fight from activists.

Last week, Communities United for Police Reform and other community groups...

The New York Police Department’s body camera program launched this week, but not without a fight from activists.

Last week, Communities United for Police Reform and other community groups filed a legal opposition to the NYPD’s then-proposed policy. Submitted to Judge Analisa Torres, they wanted to halt the program’s rollout. The community groups, along with entities like The Center for Constitutional Rights, believe the language of the program renders the concept of body cameras for cops meaningless.

Read the full article here.

We’d Be Picking Workers Up Off The Street

Salon - October 29, 2013, by Josh Eidelson -

If the potential president does business's bidding on a new scaffolding bill, workers will die, an advocate warns.

...

Salon - October 29, 2013, by Josh Eidelson -

If the potential president does business's bidding on a new scaffolding bill, workers will die, an advocate warns.

Industry groups hope New York Gov. Andrew Cuomo – a presumed presidential aspirant who’s frequently defied liberals on economics – will back their push to “reform” the country’s toughest law holding contractors responsible when workplace falls end in injury or death.

“I think we’d be picking workers up off the street,” if the state’s “scaffold law” is gutted, said Joel Shufro, who directs the New York Committee for Occupational Safety and Health. “Because I think employers would cut corners in ways that would result in workers being injured or killed.” Cuomo’s office did not respond to inquiries.

In an Oct. 16 letter, dozens of business groups and the New York Conference of Mayors urged Cuomo to reform the stat’s “scaffold law,” a move they said would “help alleviate fiscal stress by saving taxpayer dollars, creating jobs, and increasing revenue to the state and localities.” Signatories included the Lawsuit Reform Alliance of New York, whose director Tom Stebbins told Salon that the group has made the issue a priority because “insurance rates put people of business, they take jobs away, and as we’re finding out more and more, it’s costing us more and more in our public projects.”

The 128-year-old “scaffold law” allows contractors to be held liable for “gravity-related” injuries suffered by their employees when management failed to comply with a safety rule, even (with certain exceptions) if the employee was also at fault. Stebbins contended there was “no data that supports” the claim that it improves safety, and argued that what he called the law’s “absolute liability” standard means “you’re assigned fault without negligence,” and actually “makes job sites less safe.”

“If you absolve employees from responsibility for their actions, they’re less responsible,” said Stebbins. “And if employers are guilty under almost any circumstances, they’re not as incentivized.”

NYCOSH’s Shufro countered that the law holds employers liable “if they violate OSHA regulations or other city, state ordinances, do not provide appropriate training, do not provide appropriate personal protective equipment … But if they are in compliance … they are not liable, they will not be found at fault.”

Stebbins acknowledged that “if you were the only cause of your injury, then that absolute liability doesn’t apply,” but he told Salon that “even the responsible contractor can’t stop every situation.” Stebbins cited the case of a worker who he said intentionally “jumped off the building in order to make a scaffold law claim.” Under current law, he said, a contractor “could be a fraction of a percent responsible and be held liable for 100 percent of the judgment,” rather than having “liability apportioned by fault.” He argued that the law also hurt workers because cash devoted to insurance costs is “money that’s not being spent on jobs, not being spent on union labor.”

Labor groups rejected such claims. “Opponents claim that the Scaffold Law drives up costs and is a job killer; the reality is that it helps prevent a job from being a worker killer,” New York AFL-CIO president Mario Cilento told Salon in an email. Cilento credited the law with “placing responsibility for providing adequate safety equipment and measures squarely in the hands of contractors and owners, ensuring that there is absolutely no ambiguity in who is responsible for maintaining a safe workplace in a very dangerous occupation.” He added that “insurers and contractors try to gut the Scaffold Law and in turn workplace safety” over and over, but “they’ve been rebuffed because the Legislature has recognized that there is no price tag on the lives and well-being of New Yorkers.” Cilento’s Illinois counterpart, state AFL president Michael Carrigan, emailed that the labor federation “regrets the repeal” of the similar Illinois Scaffolding Act, prior to which “Illinois had been the second safest state in construction deaths and accidents.” (The business groups’ letter to Cuomo credited the repeal of Illinois’ law for a subsequent 53 percent decline in construction injuries and said it gave the state “the 10th lowest injury rate in the country”; NYCOSH attributed the decline in injuries to overall national trends.)

“All this law says is that the employers shall be liable if they do not follow rules and regulations that govern safety on these jobs,” said NYCOSH’s Shufro. “So it seems to me that the best way of reducing their costs is to require employers to follow the law.” An NYCOSH analysis of OSHA data on New York state construction found that “At least one OSHA fall prevention standard was violated in nearly 80 percent of accidents in which a worker fell and was killed.”

A study released Thursday by progressive Center for Popular Democracy argued that the industry’s death and injury toll is disproportionately borne by immigrant workers and Latinos. CPD found that Latino and/or immigrant workers made up 60 percent of “fall from elevation fatalities” investigated by OSHA in New York State, and reported that “In 2011 focus groups, Latino construction workers reported fearing retaliation as a key deterrent to raising concerns about safety.”

While business groups have long sought changes in the scaffold law, both sides said this year’s showdown on the issue could be particularly acute. “More and more we’re seeing the cost to the public,” said Stebbins, including insurers “leaving because they can’t sustain an absolute liability and it’s impossible for them to gauge risk.” Shufro countered that insurers “have refused” when asked by legislators to “open the books” and document their losses; NYCOSH also notes that New York experienced only a 9.1 percent drop in construction employment from 2006 to 2011, while the national decline was 28.4 percent.

Cuomo has previously clashed with labor on issues ranging from public workers’ pensions to an expiring (ultimately partially extended) millionaire’s tax. Salon’s Blake Zeff argued in a January BuzzFeed essay that Cuomo’s “approach to balancing two competing interests – piling up points to advance in a Democratic primary for president, while steering to the center in key areas (and carefully avoiding antagonizing monied interests who fund campaigns and influence elite opinion) – has consisted of aggressive advocacy of ‘cultural’ or ‘social’ progressive causes, while downplaying economic ones.” Cuomo this month appointed GOP former Gov. George Pataki to co-chair a commission on reducing tax rates, a move that Michael Kink, who directs the labor-backed coalition A Strong Economy for All, compared in a Capital New York interview to “bringing in Godzilla to oversee the rebuilding from a Godzilla attack.”

Shufro said the scaffold question would “be one of the major political battles that will go on and dominate Albany for the next session,” and so Cuomo was “going to have to make a certain decision about which side he’s going to come out on … I know that this is an important issue to labor, just as it seems to be an important issue to the business community.” Shufro predicted Cuomo’s approach to the scaffold law would be “one of the major issues that will help unions make decisions about how they see him going forward.” He added, “It’s not an easy place to be in.”

Source:

Americans Don’t Miss Manufacturing — They Miss Unions

Filed under In Real Terms

This is In Real Terms, a column analyzing the week in economic news. Comments? Criticisms? Ideas for future columns? Email me or drop a...

Filed under In Real Terms

This is In Real Terms, a column analyzing the week in economic news. Comments? Criticisms? Ideas for future columns? Email me or drop a note in the comments.

U.S. manufacturing jobs, I argued a few weeks ago, are never coming back. But that doesn’t stop politicians from talking about them. Donald Trump scored his knockout blow in Indiana in part by railing against the decision by Carrier, a local air-conditioning manufacturer, to shift production to Mexico. Bernie Sanders and Hillary Clinton have sparred throughout their race over who would best protect manufacturing jobs. And the man they are all trying to replace, President Obama, pledged during his reelection campaign to create a million manufacturing jobs during his second term; he’s still about 700,000 jobs short of that goal.

Candidates talk about manufacturing because of what it represents in the popular imagination: a source of stable, well-paying jobs, especially for people without a college degree. But that image is rooted more in nostalgia than in reality. Manufacturing no longer plays its former role in the economy, and not only because there are far fewer factory jobs than in the past. The jobs being created today often pay less than those of the past — sometimes far less.

A new report this week from the Labor Center at the University of California, Berkeley, found that a third of production workers — non-managers working on factory floors and in related occupations — earn so little that their families receive some form of public assistance such as food stamps or the Earned Income Tax Credit. Many of those workers are temps, who account for a growing share of factory employment. The median wage for a manufacturing production worker, according to separate data from the Bureau of Labor Statistics, was $16.14 an hour in 2015, below the $17.40 an hour for all workers.

On average, manufacturing jobs still pay better than most jobs available to people without a college degree. The median manufacturing worker without a bachelor’s degree earned $15 an hour in 2015, a dollar more than similarly educated workers in other industries.1 But those averages obscure a great deal of variation beneath the surface. Average manufacturing wages are inflated by high-earning veterans; newly created jobs tend to pay less. And there are substantial regional variations. The average manufacturing production worker in Michigan earns $20.80 an hour, vs.$18.86 in South Carolina, according to data from the Bureau of Labor Statistics.

Why do factory workers make more in Michigan? In a word: unions. The Midwest was, at least until recently, a bastion of union strength. Southern states, by contrast, are mostly “right-to-work” states where unions never gained a strong foothold. Private-sector unions have been shrinking across the country for decades, but they are stronger in the Midwest than in most other parts of the country. In Michigan, 23 percent of manufacturing production workers were union members in 2015; in South Carolina, less than 2 percent were.2

Unions also help explain why the middle class is healthier in the Midwest than in the Southeast, where manufacturing jobs have been growing rapidly in recent decades. A new analysis from the Pew Research Center this week explored the state of the middle class in different parts of the country by looking at the share of households making between two-thirds and double the national median income, after controlling for the local cost of living. In many Midwestern cities, 60 percent or more of households are considered “middle-income” by this definition; in some Southern cities, even those with large manufacturing bases, middle-income households are now in the minority.

Even in the Midwest, however, unions are weakening and the middle class is shrinking. In the Indianapolis metro area, where the Carrier plant Trump talks about is located, the share of households in the middle tier of earners has shrunk to 54.8 percent in 2014 from 58.9 percent in 2000. And unlike in some parts of the country, the decline in the middle class there has been primarily driven by people falling into the lower tier of earners, not moving up. The Carrier plant, where workers make more than $20 an hour, is unionized.

Cause and effect here is complicated. Unions have been weakened by some of the same forces that are driving down wages overall, such as globalization and automation. And while unions benefit their members, economists disagree over whether they are good for the economy as a whole. Liberal economists note that overall wages tend to be higher in union-friendly states; conservative economists counter that unemployment tends to be higher in those states, too.

But this much is clear: For all of the glow that surrounds manufacturing jobs in political rhetoric, there is nothing inherently special about them. Some pay well; others don’t. They are not immune from the forces that have led to slow wage growth in other sectors of the economy. When politicians pledge to protect manufacturing jobs, they really mean a certain kind of job: well-paid, long-lasting, with opportunities for advancement. Those aren’t qualities associated with working on a factory floor; they’re qualities associated with being a member of a union.

#FedSoWhite

When the Federal Reserve’s policy-making Open Market Committee meets next month to decide whether to raise interest rates, every one of the 10 voting members will be white. Eleven of the 12 regional Fed bank presidents, who rotate voting responsibility, are white, and not one is black or Latino. (Minneapolis Fed President Neel Kashkari is Indian-American.) The Fed does a bit better when it comes to gender balance — Chair Janet Yellen is a woman, as are three other voting FOMC members. But overall, the people making U.S. monetary policy are disproportionately white men.

Does that matter? More than 100 members of Congress think so. In a letter to Yellen on Thursday, 11 senators and 116 members of the House of Representatives — all of them Democrats — wrote that they are “deeply concerned that the Federal Reserve has not yet fulfilled its statutory and moral obligation to ensure that its leadership reflects the composition of our diverse nation.” The letter is only the latest effort to draw more attention to the Fed’s lack of diversity: A report earlier this year from the liberal Center for Popular Democracy highlighted the issue, and several members of Congress also asked Yellen about it when she testified on Capitol Hill in February. (Bernie Sanders signed the letter. Hillary Clinton, who wasn’t eligible to sign since she isn’t in Congress, said she agreed with the message.)

It isn’t clear whether policy would be any different if the Fed were more diverse. But the letter writers and their allies argue that at the very least the Fed’s lack of representation could be skewing the way policymakers view the economy. By law, the Fed must balance two competing goals: maintaining stable prices (which the Fed defines as inflation of about 2 percent per year) and promoting full employment. In recent months, Yellen and her colleagues have begun the process of raising interest rates — concluding, in effect, that with the unemployment rate down to 5 percent, the “full employment” part of their mandate is largely complete. But the unemployment rate for African-Americans was 8.8 percent in April, as high as the white unemployment rate was in the middle of the recession. For them, “full employment” remains a long way off.

The long road back

Last week I noted that Americans who graduated from college during the recession are still struggling to make up for the slow start to their careers. The Wall Street Journal this week told the even more harrowing tale of people who lost jobs during the recession, many of whom still bear deep financial and psychological scars.

That isn’t surprising. Losing a job is a significant setback in any context, but it is far worse when a bad economy makes it hard to get back to work quickly. People who are laid off in a recession are far more likely to become unemployed for more than six months, which can then make it harder to find a job even once the economy improves. One estimate cited by the Journal found that people who lose jobs during a recession continue to make 15 to 20 percent less than their peers who kept their jobs, even a decade or more after the recession ended. And that is just in the typical recession; the most recent downturn was far worse.

Number of the week

Just under 8 million Americans were looking for work in March, and employers had 5.8 million jobs available to be filled. Economists look at the ratio of those numbers as a gauge of the health of the labor market, and by that measure, the economy is looking good: There were 1.4 unemployed workers for every open position in March, the fewest since 2001.

Don’t take the workers-per-job ratio too literally, though. The official definition of “unemployment” leaves out plenty of people who want jobs, and the government count of job openings is also incomplete, counting only positions for which companies are actively recruiting. But alternative measures of both unemployment and openings show the same trend: There are more jobs and fewer workers to fill them. That’s good news for workers who want jobs, and also for those who already have them — at some point, companies that want to attract workers will have to start offering higher pay.

Elsewhere

Americans are having fewer babies. Janet Adamy looks at the causes and consequences of the U.S. “baby lull.”

Eduardo Porter argues the government should do more to create good jobs for those displaced by the transition toward a service-based economy.

Timothy O’Brien, who saw Donald Trump’s tax returns as part of a lawsuit a decade ago, provides some hints as to what voters might learn if Trump ever releases the documents publicly.

Lam Thuy Vo and Josh Zumbrun dive into the data on the jobs created since the start of the recession.

In much of the country, poor people don’t have access to broadband internet, according to a Center for Public Integrity investigation.

By Ben Casselman

Source

2 months ago

2 months ago