Education Department Releases List of Federally Funded Charter Schools, though Incomplete

The U.S. Department of Education has released a list of the charter schools that have received federal funding since 2006.

The move comes in the wake of requests by the Center for Media and...

The U.S. Department of Education has released a list of the charter schools that have received federal funding since 2006.

The move comes in the wake of requests by the Center for Media and Democracy (CMD), dating back to 2014, for public disclosure of who had received federal taxpayer money. CMD had submitted requests for this and related information to the Department and several states.

In October 2015, CMD released its report "Charter School Black Hole: CMD Special Investigation Reveals Huge Info Gap on Charter School Spending," discussing the more than $3.7 billion dollars the federal government had spent on charters and the gaps in what the public could see about which charters received taxpayer money.

Two months later, the Department of Education issued a news release on the subject, titled "A Commitment to Transparency: Learning More about the Charter School Program." The data was released to the public on the eve of Christmas Eve.

According to the Department, "The dataset provides new and more detailed information on the over $1.5 billion that CSP [the Charter School Program] has provided, since 2006, to fund the start-up, replication, and expansion" of charters.

It includes information on which grant program funded each of the charter schools listed and how much. That is more information than the public has ever been given about the true reach of the CSP program into their communities, fueled by federal tax dollars.

It lists more 4,831 charter school with the amounts received in that period, but it does not indicate which of them closed. CMD has sought to assess the number of closed charters using other data as a proxy but ambiguities have impeded that effort.

In its December release, the agency noted that more than half of the charter schools in its list of nearly 5,000 were "operational" as of the last school year with complete data: "CSP planning and startup capital facilitated the creation of over 2,600 charter schools that were operational as of SY 2013-14; approximately 430 charter schools that served students but subsequently closed by SY 2013-14; and approximately 699 'prospective schools.'”

The fate of each of the more than 2,000 charter schools in the difference between 4,831 and 2,600 is not definitively known, although CMD's initial analysis indicates that far more than 430 charters have closed over the past two decades. The agency has not released a complete list of closed charters that received federal funds and how much.

The dataset also does not go back to the beginning of federal charter school funding in 1993, though it does cover the more recent period CMD sought information about. Accordingly, the dataset does not include all the charter schools that received federal tax monies but closed since the inception of the federal charter school program.

The list released in December also did not include the names of "prospective schools" that received federal funds but never opened, which CMD has called "ghost" schools--as with the 25 it found that never opened in Michigan in 2011 and 2012 but that received at least $1,7 million dollars, according to a state expenditure report.

So on January 13, 2016, CMD filed a new set of open records requests with the Department of Education asking that it fill in those gaps and also provide information about communications regarding closed charters and prospective charters.

This is part of a long-term investigation of charter schools that CMD started nearly five years ago.

In 2011, CMD began examining the close relationship between charter school businesses and legislators after a whistleblower provided it with all of the bills secretly voted on through the American Legislative Exchange Council (ALEC) where corporate lobbyists vote as equals with lawmakers on bills that are then pushed into law in statehouses across the country.

That award-winning investigation shed new light on an industry that had grown from an "experiment" in 1992 (in Minnesota) into an influential network with a league of federal and state lobbyists seeking increasing redistribution of funds from traditional public schools to other entities under the watchword of "choice."

Over the past nearly five years, CMD has documented the impact of the policies on American school children, despite the PR claims of the industry, which has an increasing number of allies within education agencies who are devoted to charter expansion at the expense of traditional public schools. CMD has written about numerous aspects of the charter school industry as well as corporations, non-profit groups, and policymakers involved in the effort to privatize public schools in numerous ways. CMD has also documented how budget difficulties following the Wall Street meltdown under George W. Bush have been seized on by some in the industry as opportunities to try to displace school boards and local democratic control of schools and spending. CMD has also documented how billionaire funders of ALEC, such as the Koch brothers, have pushed their hostility toward the idea of public schools under the guise of choice.

In 2014, CMD sought to determine how much money the federal government had spent on charters, through State Education Agencies (SEAs) or Charter Management Organizations (CMOs) or other vehicles and discovered that this information was not publicly available. Instead, key data about how Americans' tax dollars were being spent on the charter school experiment and its failures was largely hidden from public view.

When CMD sought the identities of the charter authorizers or CMOs that had been essentially designated via ALEC bills to determine which charters were eligible to receive federal funds, the feds suggested asking the CMOs, even though many of them are private entities not covered by Freedom of Information Act (FOIA) rules or state open records laws.

CMD was told to ask NACSA, the National Association of Charter School Associations, a private group created as a result of this new industry, but NACSA also did not maintain a public list of all the charters that had received federal funding and how much each had received.

Additionally, the states through their SEAs--where pro-charter staffers work within state education departments--varied greatly in how much information was provided to the public about which charters had received funds and how that taxpayer money had been spent--despite mounting news accounts of fraud and waste by charters, including numerous criminal indictments, as tallied at more than $200 million by the Center for Popular Democracy.

Under ALEC-style charter bills, charters were exempted from most state regulations including key financial reporting and controls, and a number of charters refused requests by the press under open records laws for such information.

Although some charters were managed by school districts, many were not, and with this deregulation has emerged an array of questionable practices, such as "public" or non-profit charters that outsource their administration to for-profit firms--in addition to the advent of for-profit charters, like K12's "virtual schools," another conduit for redistributing taxpayer dollars through yet another ALEC bill.

When CMD sought information on how much money had even been spent on charters, no one knew. So CMD calculated the figure the federal government has spent fueling the charter school industry and the current tally stands at more than $3.7 billion.

But, that revealing figure did not provide the public with the information it has a right to know about where all that money actually went, as noted in CMD's report "Charter School Black Hole."

So CMD requested information about which charters received such funds and how much.

In releasing the new dataset, the Department of Education is providing new transparency about charter school grantees, although significant gaps remain.

Source: PR Watch

‘If Texas votes how it looks, we win’: The grassroots effort behind Texas’ progressive movement

‘If Texas votes how it looks, we win’: The grassroots effort behind Texas’ progressive movement

“What’s happening in Texas is arguably a phenomenon unique to the state, but it also has national implications. The kind of work Brown’s organization does for local communities can be replicated...

“What’s happening in Texas is arguably a phenomenon unique to the state, but it also has national implications. The kind of work Brown’s organization does for local communities can be replicated elsewhere, argued Asya Pikovsky, who works with the Center for Popular Democracy Action. “Groups like [TOP] are demonstrating how to win power in red and purple states: focus on city elections, lean into progressive principles, and mobilize voters who have long been marginalized by fielding candidates who can effect real change,” Pikovsky told ThinkProgress. “We should expect to see the same dynamic repeated over and over again this year as organizers find new ways to leverage local elections to win far-reaching national change.”

Read the full article here.

Jeff Flake announces he’ll vote to confirm Brett Kavanaugh — will Collins and Murkowski follow suit?

Jeff Flake announces he’ll vote to confirm Brett Kavanaugh — will Collins and Murkowski follow suit?

Republican Sen. Jeff Flake of Arizona announced Friday morning that he would vote to confirm President Donald Trump's Supreme Court nominee Brett Kavanaugh.

...

Republican Sen. Jeff Flake of Arizona announced Friday morning that he would vote to confirm President Donald Trump's Supreme Court nominee Brett Kavanaugh.

Read the full article here.

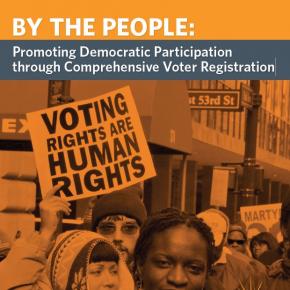

By The People: Promoting Democratic Participation Through Comprehensive Voter Registration

America suffers from disturbingly low voter registration and turnout rates. Almost 50 million eligible people were not even registered to vote in the 2012 election, and another 12 million had...

America suffers from disturbingly low voter registration and turnout rates. Almost 50 million eligible people were not even registered to vote in the 2012 election, and another 12 million had problems with their registration that kept them from voting. What’s more, many of these millions were low-income, youth, and people of color, all of whom are less likely to be registered. In order to strengthen our democracy, the United States must take dramatic and innovative steps to remedy our anemic voter turnout and registration.

“By the People: Promoting Democratic Participation through Comprehensive Voter Registration,” identifies Automatic Voter Registration (AVR) as the critical transformative policy that can result in the registration of millions of new voters. By shifting the responsibility of voter registration from the individual to the government, AVR ensures a more robust democracy. Automatic Voter Registration should be part of a suite of reforms including pre-registration of 16- and 17- year olds, portable registration, and other policies that make election administration more efficient.

Download the full report here

The Fed should not raise interest rates until wages go up

Shawn Sebastian, Fed Up Campaign co-director, and Marshall Steinbaum, Roosevelt Institute research director, discuss agreeing with Trump about the Fed raising interest rates and why wages haven't...

Shawn Sebastian, Fed Up Campaign co-director, and Marshall Steinbaum, Roosevelt Institute research director, discuss agreeing with Trump about the Fed raising interest rates and why wages haven't risen.

Watch the clip here.

The Actions of the Federal Reserve Bank Have Created an Economy That Hurts Workers And Has Devastated The Black Community

Atlanta Black Star - March 4, 2015, by Nick Chiles - The actions of the Federal Reserve have typically been undertaken to benefit banks and the financial services sector collectively known as Wall...

Atlanta Black Star - March 4, 2015, by Nick Chiles - The actions of the Federal Reserve have typically been undertaken to benefit banks and the financial services sector collectively known as Wall Street, but a new report by the Center for Popular Democracy reveals that the Fed’s traditional policies substantially contribute to the dire economic conditions of African-Americans across the country.

While there have been many reports showing how badly African-Americans suffered from the Great Recession and how middle and low-income Americans have not benefitted from the so-called economic recovery, which was really just a recovery for Wall Street, this report is one of the first to link the fortunes of specific groups like African-Americans to the actions of the Federal Reserve.

The Federal Reserve, the nation’s central bank, remains a shadowy presence to most rank-and-file Americans, who would hardly think of the Federal Reserve when assigning blame for their financial struggles.

The intentions of the Center for Popular Democracy, with assistance from the Economic Policy Institute, are clear just by reading the name of its report—”Wall Street, Main Street, and Martin Luther King Jr. Boulevard: Why African Americans Must Not Be Left Out of the Federal Reserve’s Full-Employment Mandate.”

In the explanation for the report’s rather trite title, the primary author, Connie M. Razza of the Center for Popular Democracy, said Martin Luther King Jr. Boulevard refers to African-American communities because “hundreds of U.S. cities have streets named for Martin Luther King Jr., often located in persistently lower-income Black neighborhoods.”

The report’s premise is that the Fed’s goal of keeping the national employment rate at about 5.2 percent—which the Fed considers “full employment” because it allows for movement in the job market—is actually devastating to the African-American community. The reason: When the national unemployment rate stays in the vicinity of 5.2 percent, the African-American unemployment rate is typically about 11 percent.

But because the Fed is dominated by the interests of Wall Street, the impact of its policies on Main Street or on African-Americans is not ever truly considered.

“Although the Great Recession officially ended nearly six years ago, the American economy is still far from healthy,” the report states. “Wall Street has had a robust recovery. Large corporations are making record profits. But the labor market remains weak.”

As Razza points out, the policy decisions of the Federal Reserve directly affect Main Street and MLK Blvd. The Fed’s primary job is keeping inflation stable, regulating the financial system, and ensuring full employment. But corporate and finance executives generally want to limit wage growth so that they maximize their future profits.

“But most people in America earn their living from wages, not capital income, and it is in their interest to see full employment whereby wages grow faster than prices in order to lift working and middle-class families’ living standards,” Razza writes.

Typically the Feds resolve this dilemma in favor of Wall Street, by intentionally limiting wage growth and keeping unemployment excessively high.

“The Fed’s policy choices over the past 35 years have led to increased inequality, stagnant or falling wages and an American Dream that is inaccessible to tens of millions of families—particularly Black families,” the report says.

As detailed in the report, the last eight years have been catastrophic for the nation’s African-American community in virtually every financial indicator studied by economists:

* In January 2015, the national African-American unemployment rate was 10.3 percent, more than twice the current white unemployment rate and higher than the 10.0 percent U.S. unemployment rate reached in October 2010, at the height of the recession.

* The contraction in public-sector jobs—which are disproportionately held by Black people and women—has meant that the African-American workforce has been disproportionately impacted by the recession. In 2011, the number of African-Americans who were unemployed and had most recently been employed in state or local government was higher than their share in the decline of state and local government job loss, suggesting that they were disproportionately laid off and faced more barriers to finding work after losing their public-sector jobs, according to the report. The loss of public-sector jobs also has potential implications for wage inequality since African-Americans and women who are employed in public service have historically suffered significantly less wage inequality than their peers in the private sector.

* Wages have been stagnant or falling for the vast majority of workers since 2000, the report states. While at the median, wages for white workers have risen only 2.5 percent in 14 years, African-American workers have seen a wage cut of 3.1 percent over the same period. In fact, in two-thirds of the states for which data are available, the median real wages of African-American workers declined between 2000 and 2014. The fastest declines were in Michigan (down 15.8 percent), Ohio (down 13.7 percent) and South Carolina (down 11.6 percent).

* Between 1989 and 2001—a period of comparatively robust job growth and a tight labor market during the late 1990s—the wealth gap between whites and African-Americans narrowed. In 2001, Black households had roughly 16 percent the wealth of white households, compared with 6 percent in 1989. By 2013, median African-American household wealth was only 8 percent that of whites.

The report states that the wealth disparity began growing during the housing boom, precisely because of the racist practices of American banks. Between 2004 and 2007, at the height of the boom, white household wealth increased 23 percent, while African-American household wealth actually declined by 24 percent.

“The convergence of wage stagnation and banks’ preying on African-American communities with risky mortgage products (which banks backed with overvaluations of collateral property), led to African-American borrowers being more likely to receive subprime loans than white borrowers,” the report says. “These loans were frequently made as second mortgages, drawing down equity that homeowners had built up. Discriminatory subprime lending practices drained wealth from African-American homeowners before the recession and certainly made Black wealth significantly more vulnerable during the housing crisis.”

One of the most telling statistics in the report is the detailing of the jobs that the economy has regained during the recovery. If the public needed a clear indication of why so many people are still struggling though Wall Street is back, here it is:

While lower-wage industries accounted for 22 percent of job losses during the recession, they account for 44 percent of employment growth over the past four years. That means lower-wage industries today employ 1.85 million more workers than at the start of the recession.

Mid-wage industries accounted for 37 percent of job losses, but 26 percent of recent employment growth. There are now 958,000 fewer jobs in mid-wage industries than at the start of the recession.

Higher-wage industries accounted for 41 percent of job losses, but 30 percent of recent employment growth. There are now 976,000 fewer jobs in higher-wage industries than at the start of the recession.

And here’s another startling fact showing how much America’s economy has been tilted in favor of corporate America and against workers for a generation. Between 1948 and 1973, the hourly compensation of a typical worker in America grew in tandem with productivity. But since 1973, productivity grew 74.4 percent while the hourly compensation of a typical worker grew just 9.2 percent.

“This divergence between pay and productivity growth has meant that workers are not fully benefiting from productivity improvements,” the report says. “The economy—specifically, employers—can afford much higher pay, but is not providing it.”

So what should the Fed do to help Main Street and MLK Blvd. begin to enjoy the economic “recovery?” The report suggests a change in the structure of the Federal Reserve System so that fewer representatives from the financial industry and corporate America are appointed to the Fed’s governing board and more regular people are added. This would make the Fed more sensitive to the needs of Main Street and MLK Blvd., so that “the voices of consumers and working families can be heard.”

The Center for Popular Democracy suggests that the Fed keep interest rates low “so that the numbers of job openings and job seekers are balanced and everybody who wants to can find a good job.”

In addition, it wants the Feds to provide low- and zero-interest loans so that cities and states can invest in public works projects like renewable energy generation, public transit and affordable housing that will create good new jobs.

The Fed should study the harmful effects of inequality, according to the Center, and examine how policies like raising the minimum wage and guaranteeing a fair work week can strengthen the economy and expand the middle class.

Source

Why You Should Care About the Federal Reserve’s Secrecy and Elitism

New Republic - Last weekend, Cee Cee Butler, a 34-year-old McDonald’s worker from Washington D.C., became sick with the flu, or at least something that resembled the flu. Her phone had been cut...

New Republic - Last weekend, Cee Cee Butler, a 34-year-old McDonald’s worker from Washington D.C., became sick with the flu, or at least something that resembled the flu. Her phone had been cut off and she missed work Friday, Saturday and Sunday. “I did a ‘no-call, no-show’ for three days and I’ve never done that in over the year and a half I’ve been working here at McDonald's,” she said. “They terminated me Tuesday morning. So I lost my job, my rent is going up in December, I have two kids—19 and 5, a girl and boy—and I can’t afford to take care of them.”

On Friday, Butler gathered outside the Federal Reserve building with around two dozen activists from labor unions and progressive groups before an afternoon meeting with Fed Chair Janet Yellen. The groups are part of a new campaign called “Fed Up” that is pressuring Yellen and her colleagues to keep interest rates at zero until the recovery strengthens and wages rise. “The economy is not working for the vast majority of people,” said Ady Barkan, a lawyer from The Center for Popular Democracy, which is the lead organizer of the campaign. Fed Up wants to rectify that problem by putting direct pressure on the Federal Reserve itself—a quest that may not captivate the public’s attention but could have a very real effect on the lives of working Americans.

In August, for instance, members of Fed Up staged protests outside of the Federal Reserve’s annual monetary policy conference in Jackson Hole, Wyoming. Many reporters there said it was the first time they could remember protestors at the conference—but their tactics must have worked, because Yellen agreed to meet with the protesters Friday afternoon in the boardroom where the Federal Open Markets Committee (FOMC) meets eight times a year to set monetary policy. Three other Federal Reserve governors—Vice Chair Stanley Fischer, Jerome Powell and Lael Brainard—joined the meeting and the activists said that Yellen was engaged throughout and was moved by the stories she heard. They hope that this meeting was just the first of many in the future.

The message the Fed Up campaign delivered is the same one voters sent loud and clear last week: The recovery is not being felt by millions of Americans. Exit polls indicated that 45 percent of voters considered the economy the most important issue of the midterms. Wage growth for low-income workers, like janitors and fast food workers, are barely keeping up with inflation. “That’s not an economic recovery,” said Jean Andre, who does location support for film production and is a member of New York Communities for Change. “That’s not the way thing should be.”

But the slow recovery isn’t always noticeable in leading economic indicators. The unemployment rate, for instance, has fallen 2.1 percentage points since the start of 2013 and is now at 5.8 percent, its lowest point in more than six years. As a result, some economists inside and outside the Fed, including inflation hawk Charles Plosser, have called for a hike in interest rates in the near future. “Beginning to raise rates sooner rather than later reduces the chance that inflation will accelerate and, in so doing, require policy to become fairly aggressive with perhaps unsettling consequences,” Plosser, the president of the Federal Reserve Bank of Philadelphia, said Wednesday.

Plosser’s worry about rising inflation, even though it is nowhere to be found, could prove dangerous. If the FOMC listens to the hawks, it will prematurely raise rates and choke off the recovery before workers see wage growth. So far, Yellen has done a good job ignoring Plosser and Co. And, luckily, Plosser and Richard Fisher, the president of the Dallas Federal Reserve Bank and another hawk at the FOMC, announced that they would retire in the spring of 2015, opening up two positions that have a significant impact on monetary policy. Fed Up sees their retirements as a boon—and is keen to have a say in the selection process.

Under the current rules, Plosser and Fisher’s replacements will be chosen by the board of the Philadelphia and Dallas reserve banks, respectively. Each board has nine members, three from banks and six from nonbanks—companies and organizations that are not financial institutions. Because of Dodd-Frank restrictions, only the six non-bank members are involved in selecting the replacements. But of those six members, three are chosen by banks and three are chosen by the Fed board in Washington. Workers and consumers are supposed to be represented on the board, but of the 108 members, 91 are from financial institutions and corporations. Just two are leaders of labor groups and another 15 represent non-profit organizations.

Fed Up has a list of demands to make the replacement process more transparent and to ensure the public has adequate representation within the central bank. They want a public schedule of the process, a list of criteria for how the replacements will be chosen, a chance for members to question the candidates, and public forums where citizens can discuss monetary policy with candidates and the search committee. These reforms, they hope, will keep presidents like Plosser and Fisher—who activists say are disconnected from the daily struggles of their constituents—out of office. “We need a president in Philadelphia who will listen to working people,” said Kati Slipp, the director of Pennsylvania Working Families. “Charles Plosser hasn’t been or he would not believe that our economy has really recovered.” In fact, Fed Up is already getting results. On Friday morning, the Philadelphia Fed announced that it was setting up an email to receive inquiries about the search process. “That would never have happened if this campaign hadn’t happened,” Slipp said. The campaign said it expected the same things from the Dallas Fed.

After Republicans destroyed Democrats in the midterms, many liberal commentators argued that a fresh agenda for raising wages could help the Democratic Party win back voters, particularly those in the white working class. But the problem isn’t that Democrats’ ideas—raising the minimum wage, investing in infrastructure and strengthening the safety net—won’t help middle- and lower-class Americans. It’s that the weak recovery has destroyed those ideas’ political salience. It’s a political problem much more than a policy one.

Such arguments almost always ignore monetary policy. After all, no one but Ron Paul fanatics care about the Federal Reserve. And the Fed is independent from the federal government. If a Democratic candidate’s economic message was to fill the FOMC with economists committed to keeping interest rates low or even adopting a different monetary policy regime altogether, voters would likely roll their eyes. It would be a political disaster. But given congressional gridlock, it might also be far more effective at boosting the recovery.

The Fed Up campaign isn’t going to change that. Millions of Americans will not suddenly realize that the most important economic actor in the United States is not the president or Congress but the Federal Reserve. They will not understand that some inflation is needed, especially right now, to convince businesses to invest and consumers to spend money to get the economy back going again. But the campaign may convince some Americans of the Fed’s importance. That’s why Cee Cee Butler, the former McDonald's worker who was fired Tuesday, and Jean Andre, the man who scouts out locations for films, spent a cold Friday morning outside the Fed.

“I just got out of the shelter two years ago and here I am about to be back in one. I’m not trying to go back there,” Butler said. “My daughter will never walk in my shoes. She doesn’t need to. That’s why my voice needs to be heard.”

Source

Labor Advocates Ready To Push For Paid Sick Leave, Pay Equity In Maryland

Workers issues aren't just something highlighted on Labor Day. In fact, next year's session of the Maryland General Assembly will likely be full of them.

Labor...

Workers issues aren't just something highlighted on Labor Day. In fact, next year's session of the Maryland General Assembly will likely be full of them.

Labor advocates have been rallying around the "Fair Work Week" bill, which would make employers post schedules for workers at least three weeks in advance. Supporters says workers at bars, restaurants, and in the hospitality industry are especially susceptible to sudden schedule changes.

But that will be far from the only bill to help workers that lawmakers will debate next year in Annapolis, according to Montgomery County Del. David Moon.

"We also hope to see paid sick leave, which has been a top priority for a lot of justice advocates, move in the next session. Women's pay equity has been another top priority that didn't move in the last legislative session. And lastly collective bargaining rights at community colleges has been a topic," he says.

Since state lawmakers adjourned for the year in April, the Montgomery County Council enacted a paid sick leave law at the local level, but it doesn't take affect until next year.

Most employers in Maryland's most populous jurisdiction will have to offer workers one-hour of paid sick leave for every 30 hours worked. The most those workers can accrue is one week of paid sick leave per year.

Source: WAMU 88.5

Líderes del Congreso reanudarán negociación con la Casa Blanca sobre futuro de “Dreamers”

Líderes del Congreso reanudarán negociación con la Casa Blanca sobre futuro de “Dreamers”

Grupos como “United We Dream”, “Women´s March” y “CPD Action” reiteraron hoy que, en las próximas primarias, apoyarán a candidatos rivales que estén dispuestos a proteger a la comunidad inmigrante...

Grupos como “United We Dream”, “Women´s March” y “CPD Action” reiteraron hoy que, en las próximas primarias, apoyarán a candidatos rivales que estén dispuestos a proteger a la comunidad inmigrante, si los demócratas no cumplen su promesa a los “Dreamers.”

Lea el artículo completo aquí.

The Week Ahead in New York Politics, May 1

What to watch for this week in New York politics:

President Donald Trump is due back in New York City for the first time since taking office this week -- see below for details and expect...

What to watch for this week in New York politics:

President Donald Trump is due back in New York City for the first time since taking office this week -- see below for details and expect protests, traffic gridlock, and political statements from all corners.

Read full article here.

2 months ago

2 months ago