The Great Debate

A year ago the federal government and 49 states completed a $25 billion agreement with the...

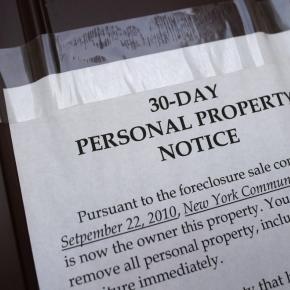

A year ago the federal government and 49 states completed a $25 billion agreement with the nation’s largest mortgage servicers to settle claims of “robo-signing” and unlawful foreclosure practices. President Barack Obama announced the creation of the federal-state mortgage securities working group in his 2012 State of the Union address. The nation seemed on the verge of transforming the way banks treat struggling homeowners ‑ particularly those with “underwater” mortgages, in which a homeowner owes more than the house is worth.

These promises, however, have yet to be fulfilled. The latest interim report on the national mortgage settlement is due out this week, and banks will likely again declare that it offers proof that they are fulfilling their obligations. But the communities hit hardest by the foreclosure crisis have yet to see any meaningful relief.

Time is running out to ensure that these communities receive their fair share under the settlement. But it is not too late to provide meaningful assistance. The settlement monitors need to demand greater transparency from banks, and they need to see that banks comply with the fair-lending requirements set out in the agreement. They also need to aggressively police the servicing reforms to ensure that all homeowners get a fair opportunity to save their homes.

This settlement was designed to begin a new chapter in the resolution of the nation’s foreclosure crisis. It provided much-needed funding for legal aid, housing counselors and other foreclosure prevention services. It also committed the banks to billions of dollars in consumer relief to help keep struggling families in their homes. Critics recognized that the settlement size was far too small to solve the entire housing crisis, but they hoped it could change the way banks deal with foreclosures.

Unfortunately, there is little transparency about how the banks are using this money. They have not provided any loan-level data to show which borrowers are receiving assistance.

Moreover, mortgage servicers have complete discretion over who receives help. Advocates fear the banks have been cherry-picking expensive loans that are deeply underwater to meet their settlement obligations quickly. This provides an important service for the borrowers in that category but little systematic relief for low- and moderate-income communities suffering the most from the foreclosure crisis.

The lack of loan transparency and the discretion vested in the banks also make it hard to ensure that settlement relief is keeping families in their homes. The last monitor’s report showed that more than half the “relief” cited by the banks came through roughly $13 billion worth of short-sale agreements ‑ in which a borrower sells his or her home for less than the value of the mortgage.

Short sales help borrowers resolve a foreclosure. But they do not keep families in their homes. The lender also profits more from a short sale than a foreclosure – hardly the kind of penalty commensurate with the settling of billions of dollars in legal claims.

Worse, there are anecdotal reports that banks are writing off worthless second liens without helping homeowners out of foreclosure with their primary lenders. The banks are taking credit for writing down billions of dollars in worthless second mortgages. But these write-offs won’t save a family’s home ‑ unless the primary loan is modified at the same time.

We need to do a better job of ensuring that future settlements ‑ and there are plenty of continuing investigations into the mortgage mess ‑ direct relief to the hardest-hit communities. Bank regulators at the Federal Reserve and the Office of the Comptroller of the Currency have announced billion-dollar settlements to replace the botched Independent Foreclosure Review. They must pledge to do more to ensure consumer relief before letting lenders off the hook for improper foreclosures. Homeowner advocacy organizations like the Campaign for a Fair Settlement are pressing for such solutions.

Obama must also provide leadership. Last year he told the Democratic National Convention, “When a family can no longer be tricked into signing a mortgage they can’t afford, that family is protected, but so is the value of other people’s homes ‑ and so is the entire economy.”

He was right. Ending predatory lending, and lifting the hardest-hit communities up out of the foreclosure crisis, will help the entire nation.

It is time to fulfill that promise.

Source:

“We matter”: Dozens with pre-existing conditions stage D.C. sit-in over GOP health care bill

“We matter”: Dozens with pre-existing conditions stage D.C. sit-in over GOP health care bill

Marthella Johnson was born with one kidney. At a young age, the 42-year-old resident of Little Rock, Arkansas, developed kidney stones.

Before the Affordable Care Act, many insurers...

Marthella Johnson was born with one kidney. At a young age, the 42-year-old resident of Little Rock, Arkansas, developed kidney stones.

Before the Affordable Care Act, many insurers considered kidney stones a pre-existing condition and wouldn’t insure people like Johnson. After it went into effect, Johnson said she was able to buy insurance through her state’s marketplace.

Read the full article here.

Leadership at Fed’s regional banks is getting more diverse. But there’s still work to do, report argues.

Leadership at Fed’s regional banks is getting more diverse. But there’s still work to do, report argues.

“But diversity within the Federal Reserve’s regional banks hardly measures up, according to a new report compiled by Fed Up, a campaign of the Center for Popular Democracy, a left-leaning advocacy...

“But diversity within the Federal Reserve’s regional banks hardly measures up, according to a new report compiled by Fed Up, a campaign of the Center for Popular Democracy, a left-leaning advocacy group. The report highlights the lag in gender, racial and occupational diversity among the presidents and boards of directors of the regional reserve banks. Researchers say this serves to further isolate already marginalized groups such as women and communities of color from monetary policy.”

Read the full article here.

Women workers vow to fight back after Supreme Court ruling

Women workers vow to fight back after Supreme Court ruling

“In early 2017, I became network president and co-executive director at the Center for Popular Democracy, a national network of more than 50 grassroots community organizing groups in 34 states,...

“In early 2017, I became network president and co-executive director at the Center for Popular Democracy, a national network of more than 50 grassroots community organizing groups in 34 states, Puerto Rico, and Washington, D.C. In this capacity, I’ve had the opportunity to meet working women all across the country, and I’ve seen firsthand the commitment Freeman Brown is naming. Women, especially women of color, know that being a union member gives them greater economic security than their nonunion sisters have.”

Read the full article here.

Poll Says Americans Want Fed To Focus On Jobs, Hold Off On Rate Increases

NEW YORK--As the Federal Reserve gets ready to debate its interest rate policy stance next week, a poll released Thursday finds a strong majority of the American voters surveyed...

NEW YORK--As the Federal Reserve gets ready to debate its interest rate policy stance next week, a poll released Thursday finds a strong majority of the American voters surveyed want central bankers to refrain from boosting short- term interest rates--and to instead concentrate on using monetary policy to further boost the job market.

The poll also found that respondents have inflation concerns, but even so, they still want the Fed to do what it can to create more jobs and spur the sort of wage gains that have eluded much of the nation. The poll of 716 registered voters also found respondents wanting greater public input into the central bank's decision making.

The survey was conducted in early September by Public Policy Polling under the direction of the left-leading Center for Popular Democracy. The group has been actively arguing against any move to raise short-term interest rates from current levels. Over recent months, its activists have been meeting with regional Fed bank president to press their case. The group also brought their case this year's high-profile central bank research conference in Jackson Hole, Wyo.

In the survey, 62% of respondents said high unemployment remains a "major problem," and 60% said low wages and weak incomes were also significant concerns. Half said the same thing about inflation. Just over half of respondents said the Fed should use its policy tools to prioritize job creation and stronger wage gains--versus 38% who want the central bank to direct its main focus to controlling inflation.

"There is no threat of inflation," said Connie Razza, Director of Strategic Research with the CDP. The poll shows Americans believe "the U.S. economy is not healthy enough to raise rates right now," she said in a conference call with reporters discussing the survey.

Nearly two-thirds of respondents believe the economy could benefit from maintaining low rates, and a similar amount want to see the current ultralow rates maintained.

The Fed is set to meet Wednesday and Thursday next week to decide what to do with its near-zero short-term interest rate target. Until only recently, there were fairly broad-based expectations that officials would raise rates at the meeting, ending an unprecedented era of ultralow rates that have prevailed since the end of 2008.

But a sharp rise in global uncertainty spurred by questions about growth in China, as well as the waves of market volatility this situation has unleashed, has undone any sense of certainty about what the Fed will do next week.

Steady if unspectacular growth coupled with a solid drop in the unemployment rate underpin the case to raise rates. Arguing against is persistently weak inflation and weak wage growth, with the Fed failing to achieve its price target for over three years. The Fed is legally charged with promoting job growth and stable inflation, and for many there is a conflict right now between the employment and inflation environments. That makes interest-rate decisions difficult for central bankers.

The poll also found dissatisfaction with the Fed's democratic accountability. Some 71% of respondents said the public doesn't have enough input into central-bank decision making. A majority of respondents believe the financial sector is overrepresented on regional Fed boards of directors.

The poll is unusual in that the public's attitude about the central bank is rarely measured. As important as the Fed is to the economy's performance, its mission and tools are often little understood by the broader public. For most of the Fed's history, its officials were happy operating in the shadows. But over recent years the Fed has become much more open about its aims and activities. Still, a Pew Research from last year found that only a quarter of Americans could even name Janet Yellen as chairwoman of the Fed.

"The focus on the Fed is extraordinary," Josh Bivens, director of Research and Policy at Economic Policy Institute, said on the conference call. The Fed "is the only engine we have for this recovery, and that's why it's getting all the attention," he said.

Source: Nasdaq

'Nueva York en un Minuto': el fiscal general Jeff Sessions le declara la guerra a la pandilla MS-13

'Nueva York en un Minuto': el fiscal general Jeff Sessions le declara la guerra a la pandilla MS-13

En otras noticias, la dueña de una floristería de Nueva Jersey es acusada de robar flores de un cementerio y el expresidente dominicano Leonel Fernández está en Manhattan para presentar su nuevo...

En otras noticias, la dueña de una floristería de Nueva Jersey es acusada de robar flores de un cementerio y el expresidente dominicano Leonel Fernández está en Manhattan para presentar su nuevo libro.

Lea el artículo completo aquí.

Critics of Fed on Left and Right Prepare to Head to Jackson Hole

At least two groups—one on the right and one from the left—are expected to show up in some fashion to press the Fed to change its policies.

The conference, ...

At least two groups—one on the right and one from the left—are expected to show up in some fashion to press the Fed to change its policies.

The conference, Aug. 27-29, will draw Fed officials, foreign central bankers, academic economists, reporters and others to talk about inflation and monetary policy in view of Grand Teton mountain range.

Just a short-drive away from the conference, the conservative American Principles Project has scheduled another conference to discuss how the group believes the Fed has failed to defend the dollar and promote prosperity. This gathering is titled, “Central Banks: The Problem or the Solution?”

Liberal-leaning activists from the Fed Up Coalition–representing unions, community activists and policy advocates–are also expected to gather in Jackson Hole, much as they did last year, to urge the Fed to change its structure to become more open and democratic.

The group opposes raising short-term interest rates from near zero now. The members want the Fed to maintain its ultra-easy policy to spur the economy and lift more of the nation’s workers out of troubled economic conditions. Members of the group have been meeting with Fed officials lately to voice their concerns.

The Kansas City Fed conference in Jackson Hole gives central bank officials a chance to socialize, hike, debate major issues facing the global economy and occasionally make major policy speeches. Attendance is strictly by invitation-only.

APP monetary-policy director Steven Lonegan said the aim of his event is to refocus the Fed on defending the dollar. “We are really challenging the Fed toe to toe on their own turf” by coming to Jackson Hole, he said.

The broader mission of the conference, Mr. Lonegan said, was to engage the nation’s political candidates to speak about the Fed. He said all known candidates have been asked to appear at the event, although none have so far accepted.

The APP event includes representatives from the Heritage Foundation, economists, Fox Business Network personality John Stossel, and a member of the British Parliament, according to the conference program.

Source: Wall Street Journal

Dems to Fed: Increase your diversity

Democrats in Congress are pushing the Federal Reserve to emphasize diversity when filling top policymaking roles.

In a new letter sent to Fed Chairwoman Janet Yellen, the lawmakers noted...

Democrats in Congress are pushing the Federal Reserve to emphasize diversity when filling top policymaking roles.

In a new letter sent to Fed Chairwoman Janet Yellen, the lawmakers noted that the overwhelming majority of top central bank positions are filled by white men, and they urged a rapid change.

“The importance of ensuring that such positions are filled by persons that reflect and represent the interests of our diverse country cannot be overstated,” they wrote. “When the voices of women, African-Americans, Latinos, Asian Pacific Americans, and representatives of consumers and labor are excluded from key discussions, their interests are too often neglected.”

The letter, spearheaded by Sen. Elizabeth Warren (Mass.) and Rep. John Conyers Jr. (Mich.), garnered signatures from 11 senators and 116 House Democrats. Sen. Bernie Sanders (I-Vt.), a Democratic presidential contender, signed the letter, as did every Democrat in the Congressional Black Caucus.

Hillary Clinton jumped into the fray as well, issuing a statement Thursday echoing that message and calling for reforms at the Fed to limit Wall Street input.

"Secretary Clinton believes that the Fed needs to be more representative of America as a whole as well as that commonsense reforms -- like getting bankers off the boards of regional Federal Reserve banks -- are long overdue," said a campaign spokesperson.

The members called for the Fed to consider a range of factors when filling upcoming vacancies, including a candidate's ethnicity, economic and professional background.

They note that while unemployment has fallen sharply over the last several months, minority groups still fall behind. White unemployment is 4.3 percent, Hispanic unemployment is 6.1 percent, and black unemployment is 8.8 percent.

The lawmakers noted that every member of the Federal Open Market Committee (FOMC), which sets the nation’s interest rate policy, is white.

In response to the lawmaker critique, the Fed said it was committing to boosting diversity, and touted its recent efforts along those lines.

"We have focused considerable attention in recent years on recruiting directors with diverse backgrounds and experiences," said a Fed spokesperson. "By law, we consider the interests of agriculture, commerce, industry, services, labor, and consumers. We also are aiming to increase ethnic and gender diversity. "

Thursday’s letter is the latest in a growing leftward push to influence the Fed, as liberals view the central bank as disproportionately influenced by input from Wall Street. With the economy on the mend and the Fed eyeing upcoming interest rate increases, they argue that too many Americans lower on the economic scale are not yet feeling those economic gains and need more support from the central bank.

Yellen was previously asked about diversity at the Fed at a congressional hearing earlier this year, and she committed to look into the matter.

Did you know 67% of all job growth comes from small businesses? Read More

A top priority for the lawmakers is ensuring increased diversity at the 12 regional Fed banks scattered across the country. Those banks occupy five rotating seats on the FOMC. But their boards are mostly filled by commercial banks, which directly back each institution.

Democrats have said for years that the arrangement ensures that the financial sector enjoys a prime seat in communicating with the Fed. Thursday’s letter noted that no regional bank head is black or Latino, and no African-American has ever helmed a regional Fed bank in the organization's 100-year history.

By Peter Schroeder

Source

Two Federal Reserve Openings Provide One Chance to Counter Trump

The Federal Reserve is facing a significant change in leadership that goes beyond the installation of a new chairman. It is also awaiting the appointment of two other top officials who will play a...

The Federal Reserve is facing a significant change in leadership that goes beyond the installation of a new chairman. It is also awaiting the appointment of two other top officials who will play a crucial role in shaping Fed policy.

President Trump, who has already nominated Jerome H. Powell as the Fed’s next chairman, also gets to pick a new vice chairman. But the other open position, the presidency of the Federal Reserve Bank of New York, is not Mr. Trump’s choice to make.

Read the full article here.

U.S Workers say the economy needs more support

BetaWired - November 15, 2014 - Jean Andre an American activist decided to visit the Federal Reserve Board’s headquarters on Friday to express his concerns about getting a decent job. Janet L....

BetaWired - November 15, 2014 - Jean Andre an American activist decided to visit the Federal Reserve Board’s headquarters on Friday to express his concerns about getting a decent job. Janet L. Yellen, the Fed’s chairwoman, agreed to meet him together with about 30 workers concerning the plight of Americans searching for work and struggling to make a living.

Accompanied by Fed’s board of governors officials; Stanley Fischer, the vice chairman; Lael Brainard; and Jerome H. Powell, the jobless Americans had a chance to express their views for about an hour.

Ady Barkan, a lawyer with the Center for Popular Democracy, an advocacy group based in New York that orchestrated the meeting said “The Federal Reserve is too important of an institution to be insulated from the voices and perspectives of working families, we think that the Fed needs to listen more and be more responsive, and we’re very grateful for this first opportunity.”

The Fed declined to comment, citing a policy of silence about private meetings but the workers described what they said in the meeting that was closed to the media. Ady Barkan’s group is campaigning for the Fed to carry on with its stimulus program, citing the high level of unemployment, particularly in minority communities, and the slow pace of wage growth. The group further argued that the Fed could help drive wages up by keeping interest rates low.

According to Josh Bivens, an economist at the Economic Policy Institute, a liberal research group, “monetary policy would be “the single most important determinant of wage growth” and that he was glad to see workers recognize the Fed’s importance. A conservative group, American Principles in Action, criticized the meeting as “highly political” and inappropriate expressing that it would seek a related meeting to share its view that the Fed’s stimulus campaign is damaging the economy.

The labor and community groups at the meeting wore green T-shirts that said “What Recovery?” on the front, with a chart demonstrating meager wage gains on the back. They also compelled Yellen to change the way the Fed chooses the presidents of its regional banks.

On Thursday, The Federal Reserve Bank of Dallas stated that its president, Richard W. Fisher, would step down on March 19 2015. Furthermore, Charles I. Plosser, president of the Federal Reserve Bank of Philadelphia, plans to retire at the beginning of March.

Source

2 months ago

2 months ago