‘Patriot’ Dimon dodges calls to disavow Trump policies

Jamie Dimon endured a rough ride at the annual meeting of America’s biggest bank on Tuesday morning, as shareholders...

Jamie Dimon endured a rough ride at the annual meeting of America’s biggest bank on Tuesday morning, as shareholders repeatedly attacked the JPMorgan Chase chief over his ties to the administration of Donald Trump.

In December Mr Dimon was named chairman of the Business Roundtable, a group of almost 200 CEOs which is among the most prominent lobbying groups in Washington. Mr Dimon, chief executive of JPMorgan for the past 11 years and chairman for 10, is also a member of Mr Trump’s strategic and policy forum, which meets regularly to shape the economic agenda.

At the meeting in Wilmington, Delaware, a succession of shareholders challenged Mr Dimon to publicly disavow some of Mr Trump’s policies, such as his curbs on immigration from predominantly Muslim countries and his building a wall on the border with Mexico. One shareholder noted that users had sent more than 4000 messages to a website, backersofhate.org, urging Mr Dimon to “distance himself from hateful policies of human suffering”.

After staying silent throughout several speeches from the floor, Mr Dimon defended the bank’s record on Mexico, its support for lesbian, gay, bisexual and transgender people, and its funding of private prisons.

Finally, he said of Mr Trump: “He is the president of the United States, he is the pilot flying the aeroplane. I’d try to help any president of the US because I’m a patriot. That does not mean I agree with every policy he is trying to implement.”

Mr Dimon has long been the most outspoken of the big-bank chiefs in the US, often using his shareholder letter as a platform for taking positions on matters of public policy, and for challenging the regulatory framework put in place since the 2008 crisis.

In the weeks after the presidential election, the 61 year old was approached by members of Mr Trump’s transition team to serve as Treasury secretary but declined, saying he was unsuited to the role, according to people familiar with the discussions.

As hostile questioning resumed after his remarks at the Tuesday meeting, Mr Dimon tried to lighten the mood, saying “you’re starting to hurt my feelings”. The shareholder admonished him by saying that just by hearing him out, the chief executive would earn more than $100.

“I hope it’s worth it!” said Mr Dimon, who was paid $28m last year.

“This is not a laughing matter,” the shareholder replied.

The meeting stood in contrast to the peaceful gathering at the Goldman Sachs building in Jersey City at the end of last month, when chief executive Lloyd Blankfein faced just two questions from the floor, both of them friendly. Mr Blankfein, who is also chairman of the board, closed the meeting within just 24 minutes.

Mr Dimon wrapped up Tuesday’s proceedings by saying the entire board “takes this feedback seriously”.

Ana Maria Archila, co-executive director of the Center for Popular Democracy, said after the meeting that until Mr Dimon takes a stronger stand her organisation would continue to associate JPMorgan Chase with Mr Trump’s “anti-immigration” agenda.

Ms Archila arrived in America 20 years ago to reunite with her father, who had fled political violence in Colombia.

“I don’t think we have a plan to really inflict economic damages on the bank just yet,” she said. “But what we do have a plan for, is to force them to clarify whose side they’re on.”

Jeff Flake Explains Why He Called for a Delay on the Kavanaugh Vote

Jeff Flake Explains Why He Called for a Delay on the Kavanaugh Vote

As for Ana Maria Archila and Maria Gallagher, the women who confronted him in the elevator, Flake said their...

As for Ana Maria Archila and Maria Gallagher, the women who confronted him in the elevator, Flake said their intervention was “poignant,” but that he believed “some of their concern was how Kavanaugh would rule on the court. They may have been there prior to the allegations against him because of his position on some issues.”

Read the full article here.

Immigration reform advocates rally in Lehigh Valley before heading to Washington, D.C.

Lehigh Valley Live - April 10, 2013 - Waving American flags and carrying handmade signs, Lehigh Valley residents and...

Lehigh Valley Live - April 10, 2013 - Waving American flags and carrying handmade signs, Lehigh Valley residents and workers rallied for immigration reform this morning in Salisbury Township. Speaking in Spanish, about 40 people chanted "What do we want? Justice! When? Now!" and shared stories of their experiences as undocumented immigrants living and working in the region.

The Lehigh Valley Campaign for Citizenship demonstration outside U.S. Sen. Pat Toomey's office included representatives from local labor unions and kicked off the group's bus trip to Washington, D.C. There, they'll meet with Pennsylvania's Congressional legislators -- Sens. Toomey, R-Pa., and Bob Casey, D-Pa., plus U.S. Rep. Charlie Dent, a Republican whose district includes parts of Northampton and Lehigh counties. They'll join thousands of other immigration reform advocates in a march on the Capitol.

A clear, short path to citizenship, the preservation of families, the protection of workers' rights and the rejection of measures that would increase deportation are all key components of comprehensive immigration reform, according to Max Cohen, a Center for Popular Democracy spokesman who helped organize today's event.

When Jasmine Leonor's father, Reyes Leonor, was arrested on unspecified charges, jailed and targeted for deportation to Mexico, she, her mother and siblings were left in limbo, the 16-year-old Liberty High School student said.

They didn't know when or if Reyes Leonor would be allowed to return home to run his business, El Mariachi Mini Market in Bethlehem, she said. The teen fought back tears as she described her family's fears during that time and their continued frustration with the system that led to his detainment.

Reyes Leonor avoided deportation and is back home, but said the experience motivated him to join the fight for immigration reform. He spoke passionately about how important it is for immigrants and others to step up and join this cause.

"I was able to do it. Everyone needs to fight for their rights. Everyone needs to fight to stay here," Reyes Leonor said. "We have to fight to get what we get. We have to fight like warriors."

The nation's current immigration policy puts an unnecessary strain on families and wastes money on the deportation of people who are hardworking, law-abiding and looking for their slice of the American dream, demonstrators said. The messages on some of their signs -- "Keep Families Together: Immigration Reform Now" and "Stop Deportation, Stop Separation" -- highlighted that point.

Tatiana Tooley, a U.S.-born Allentown resident whose parents emigrated from Panama, said, "I cry for the families that don't have family unity" because of deportation.

Dennis Hower, president of Teamsters Local 773, said immigration reform would protect all laborers from exploitation by unscrupulous employers. When undocumented immigrants are underpaid, paid off the books or forced to work excessive hours, it undermines the rights of everyone in the workplace, he said.

"For us, it's a matter of fairness and doing what's right for all workers," said Hower, who is a Whitehall Township commissioner.

Source

What The Federal Reserve Would Look Like If Progressives Had Their Way

What The Federal Reserve Would Look Like If Progressives Had Their Way

The progressive Fed Up coalition released an ambitious Federal Reserve reform plan on Monday designed to increase...

The progressive Fed Up coalition released an ambitious Federal Reserve reform plan on Monday designed to increase discussion of Fed policy in the presidential campaign.

The reforms, which would require the passage of new legislation, would turn the Federal Reserve into a public entity akin to other federal agencies, with the goal of dramatically increasing the accountability of the world’s most powerful financial body.

Currently, the 12 regional Federal Reserve banks are owned by private commercial banks. As a result, financial executives dominate the regional Fed banks’ boards of directors, giving them an outsized role in key decisions like the selection of the banks’ influential presidents.

Four of the current presidents are alumni of Wall Street titan Goldman Sachs.

Fed Up and other progressives argue that the present governance structure undermines the Fed’s role as a regulator of the country’s financial institutions. These critics also argue that the influence of big banks tends to make Fed officials more sensitive to concerns about inflation, even as they hear little from ordinary workers affected by nominal changes in the unemployment rate.

Andrew Levin, a Dartmouth economist and former adviser to the Fed chair, who authored the proposal, said on a call with reporters that the changes would bring the Fed’s structure into line with major central banks in other countries. He mocked the plain conflict of interest inherent in giving the financial industry so much power over an institution charged with regulating it.

“It should be amazing for people in the public that banks actually own shares in the Fed. A lot of people would be shocked to hear that,” Levin said.

“It would be like if lawyers owned shares in the FBI,” he added.

In the new system Levin devised, the selection process of the regional banks’ directors would be supervised by the Washington-based Federal Reserve Board of Governors, with involvement from individual governors and members of Congress in the relevant Fed bank’s jurisdiction. The majority of each bank’s directors would need to come from small businesses and nonprofits. These more diverse boards, in turn, would have to make public their process for selecting a bank president.

Members of the Fed Board of Governors, unlike the regional Fed banks, are appointed by the president and confirmed by the Senate, which is one reason why Fed reform advocates consider them more accountable to the public.

Levin and Fed Up made clear that they view the new governance structure as a way of generating greater ethnic and racial diversity among Fed officials as well. Levin noted that in the Fed’s existence of more than a century, not one of the regional Fed presidents has been African American.

Levin called the statistic “clear evidence that something is broken.”

In making the Fed a public institution, the modified system envisioned by Levin would subject the regional Fed banks to the Freedom of Information Act and the oversight of the Fed Board of Governors’ inspector general.

The entire Fed, including the Fed Board of Governors, would also undergo an annual review by the Government Accountability Office, a government body tasked with evaluating the efficacy and accountability of federal agencies.

The Federal Reserve Board of Governors declined to comment on the new plan, but chairwoman Janet Yellen has opposed past efforts to audit the Fed.

In addition, Levin’s plan changes the terms of both regional Fed bank presidents and Fed governors to seven years. Currently, regional Fed presidents serve for five years, and can be reappointed to a second term — which almost always occurs, thanks to a process that Levin and Fed Up say is typically no more than a formality. Fed Board governors now serve 14-year terms.

The Federal Reserve Board of Governors declined to comment on the reform plan. But Fed chair Janet Yellen has condemned legislation in the past that would audit the Fed’s finances, claiming it would “politicize” the institution’s decisionmaking. Yellen’s stance suggests she would likely oppose the even broader GAO review.

Joseph Gagnon, a senior fellow at the Peterson Institute for International Economics who was a top economist at the Fed for many years, said of the reform plan that he is “more concerned that there are already too many limits on the Fed’s power to help the economy.”

Gagnon nonetheless said he views most of the new proposals favorably. His biggest specific objection is to the plan’s seven-year term limits, which he worries would open the Fed up to more political pressure by allowing a single president to decide its makeup.

The rollout of the Fed Up-backed proposal is timed — and packaged — to encourage presidential candidates to speak out. The coalition sent out model questions for the candidates to accompany the release of the reform proposal.

“It is important that we have a president who sees the need for sensible, pragmatic, nonpartisan reforms that will put the Fed on a path to serve the public for the next hundred years,” Levin said.

Sen. Bernie Sanders (I-Vt.) has released his own plan to make the Fed more accountable to the public. His campaign expressed support for the spirit of Fed Up’s reform proposal.

Warren Gunnels, top policy adviser for Sen. Bernie Sanders (I-Vt.), joined the call to express support for the spirit of Fed Up’s proposed reforms.

Sanders “believes we need to structurally reform the Fed so that it is a democratic institution that is responsive to ordinary Americans not just CEOs on Wall Street,” Gunnels said.

Gunnels would not say if Sanders endorsed the proposal, however, claiming the senator needed more time to review it.

He instead pointed to the Federal Reserve platform Sanders laid out in a Dec. 23 New York Times op-ed. In the column, Sanders says he would bar financial industry executives from serving on the boards of regional Fed banks altogether, make Fed assistance to banks contingent on concrete measures of service to the public, such as lending to low-income workers, and preclude the Fed from raising its benchmark interest rate until unemployment is below 4 percent.

Ady Barkan, Fed Up’s campaign director, said that the coalition had invited all five presidential candidates to join the press call, but only Sanders’ campaign had agreed to participate.

Hillary Clinton’s campaign did not respond to a HuffPost request for comment on Fed Up’s proposal, nor did the remaining Republican presidential candidates Sen. Ted Cruz (R-Texas), Ohio Gov. John Kasich (R) and Donald Trump.

Getting Democratic politicians, in particular, to make the Fed a policy cause could prove a difficult task for a number of reasons.

In recent years, Fed reform has tended to be the province of conservative lawmakers eager to rein in the Fed’s unprecedented efforts to aid financial institutions and stimulate economic demand in the wake of the 2008 financial crisis. Democrats have cast themselves as defenders of the Fed in those circumstances, since the central bank’s actions were viewed as crucial to the recovery.

It doesn’t help matters that the Fed is an issue that’s simply not on the public’s radar.

And there is also the risk of being seen as breaching protocol by commenting on an independent, nonpartisan institution.

“I don’t think many voters understand enough to care about it,” Ari Rabin-Havt, a progressive radio host and onetime aide to Democratic Senate Minority Leader Harry Reid (D-Nev.), said in an interview earlier this month. “The people who do care about it somewhat, view it as a ‘temple.’”

But economists and policy experts argue that it would be a mistake for Democrats to ignore the Fed. “Central banks became and still are the only game in town” when governments want to boost economic demand and employment, according a column by New York University economist Nouriel Roubini. That’s partly as a result of the ideological backlash across the developed world against using public spending as a fiscal stimulus, and the delayed effect of other reforms.

And the Fed is especially important in the American context, because the government is likely to remain divided regardless of who wins the presidency, narrowing the possibilities of ameliorative fiscal measures.

“If the economy starts to weaken again, we cannot trust Congress to act,” Mike Konczal, a fellow at the Roosevelt Institute, said earlier this month. “We will need a Fed that is ahead of the curve.”

Short of embracing reforms to the Federal Reserve’s governance, Democrats could make a bigger issue out of the two empty Fed governor seats. President Barack Obama named nominees for the positions many months ago, but Senate Republicans have failed to give them hearings.

Tim Duy, an economist at the University of Oregon, said he is “wary” of the candidates even articulating what kind of people they would nominate to the Fed Board of Governors lest they jeopardize the central bank’s independence. But he said calling for filling the empty governor seats is fair game.

“I would like [the presidential candidates] to at least say that we should have a Fed at full power, because that’s what makes for effective monetary policy,” Duy said earlier this month. “That should be a priority for Democrats and Republicans.”

By Daniel Marans

Source

Here's Why The Movement For Black Lives' Demands Came At The Perfect Time

Here's Why The Movement For Black Lives' Demands Came At The Perfect Time

Last week, the DNC took over Philadelphia, television sets, and social media platforms around the country. Viewers...

Last week, the DNC took over Philadelphia, television sets, and social media platforms around the country. Viewers tweeted quotes and zingers from prominent elected officials, and celebrity actors alike. For the most part, it was a vibrant convention with many celebratory acknowledgements for Hillary Clinton becoming the first woman major-party presidential nominee. But here's why The Movement For Black Lives demands, released on Monday, actually came at the perfect time. There's still a long road ahead for full equality, and every political party should continue to be challenged – even during the "glass ceiling"-shattering historic moments.

Many supporters of Vermont Sen. Bernie Sanders and Green Party candidate Jill Stein (or those simply anti-establishment) exercised their right to protest at the DNC, but even still, the underlying message last week was clear: Unite to stop Donald Trump. The Republican presidential nominee poses a real threat to already-marginalized communities in America should he be elected President – but he's not the only threat. For black lives particularly, police violence, and economic freedom are some of the lingering systemic issues that have long oppressed black communities. And it's a deep-rooted problem that continues to need attention – especially as candidates in the general election are eagerly vying for the trust of American citizens from now until November.

The Movement For Black Lives is a collective of more than 50 organizations that represent Black people across the United States, including Black Lives Matter. The collective released a comprehensive platform of demands that aim to combat the systemic marginalization of black communities:

“Black humanity and dignity requires Black political will and power. Despite constant exploitation and perpetual oppression, Black people have bravely and brilliantly been the driving force pushing the U.S. towards the ideals it articulates but has never achieved. In recent years we have taken to the streets, launched massive campaigns, and impacted elections, but our elected leaders have failed to address the legitimate demands of our Movement. We can no longer wait.”

The process to create the demands took one year – beginning last year when 2,000 people gathered in Cleveland to discuss ideas for the movement, the site read. In a breakdown of one the platform demands for political power, the collective called for an end to super PACs, and "unchecked corporate donations" that influence political elections, along with ensuring voting rights, and an increase in funding for HBCUs.

What's especially interesting about the platform, is that some of the demands, like, reparations, are often viewed unfavorably and do not make the conversation in major-party platform settings like the DNC. But some polls suggest that significant percentages of black Americans support reparations – therefore making it an important conversation, at the very least, for all political candidates.

In an interview with The New York Times, Marbre Stahly-Butts, a leader in the Movement for Black Lives Policy Table, explained why the demands "go beyond individual candidates."

"On both sides of aisle, the candidates have really failed to address the demands and the concerns of our people," she said.

And as police violence continues to disproportionately affect Black lives, among other systemic issues, it continues to be important to push for justice, during and after the general election.

By KIMBERLEY RICHARDS

Source

Fed Should “Freeze Interest Rates, Involve Citizens” Says Neighborhoods Organizing For Change

The Uptake - March 10, 2015, by Bill Sorem - Not everybody is benefiting equally from the economic recovery. A new...

The Uptake - March 10, 2015, by Bill Sorem - Not everybody is benefiting equally from the economic recovery. A new report shows in Minnesota blacks are suffering disproportionally to whites when it comes to employment.

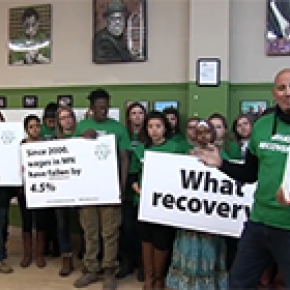

Anthony Newby, Executive Director of Neighborhoods Organizing for Change (NOC), delivered a report of about the current economic state of people of color in Minnesota and specifically the current and possible role of the Federal Reserve Bank. The new report from the Center for Popular Democracy says since 2000, wages in Minnesota have declined by 4.5%, current unemployment rate for blacks is 10.9% vs a white rate of 2.8%.

This is the link to the full report “Wall Street, Main Street, and Martin Luther King Jr. Boulevard: Why African Americans Must Not Be Left Out of the Federal Reserve’s Full-Employment Mandate”

Newby argues that the Fed in addition to controlling interest rates, can control the rate of unemployment. He and Rev. Paul Slack, ISIAH President, ask that interest rates be kept at the current levels and that the Fed work to reduce unemployment.

Why there is a Federal Reserve

The nation’s central bank, the Federal Reserve, was created on December 23, 1913, with the enactment of the Federal Reserve Act, largely in response to a series of financial panics. There had been strong resistance to a central bank since the founding of the nation. The Fed was given the power to print money, establish bank interest rates and a number of sweeping powers. It is an independent entity within government, ownership of each of the 12 banks is claimed be the member banks, but the actual fiscal ownership is obscure. The ability to print money and loan it to the government is at the heart of its power and for many, a controversial power. President Kennedy challenged the authority of the Fed with Executive Order 11110, June 4, 1963 and he attempted to eliminate our current paper money, the Federal Reserve Note replacing it with US Notes. He did not succeed.

Newby further requested more transparency in the actions of the Fed and asked for more ordinary citizen participation. The current president of the Federal Reserve Bank of Minneapolis, Narayana Kocherlakota, has indicated a willingness to keep interest rates low and to move towards more citizen participation in the actions of the Fed. However, he retires in a year. Newby would like citizens to have input on his successor.

Rev. Slack asked for justice and compassion in the Fed policies, in part to undo past unfair actions.

Source

N.J. company named among worst for wage theft fined $3.2 million

NEW YORK-- The New York City Comptroller levied a huge fine on a Parsippany company that cheated dozens of workers,...

NEW YORK-- The New York City Comptroller levied a huge fine on a Parsippany company that cheated dozens of workers, mostly immigrant laborers, out of millions of dollars in wages for work on city projects.

K.S. Contracting, owned by Paresh Shah, was ordered to pay $3.2 million and will also be barred from receiving state contracts for five years.

In its statement the comptroller's office did not identify the headquarters of Shah's company, but an Internet search turned up multiple Parsippany addresses for the business. State records tie Shah to at least one of those addresses, The Daily Record reported.

The company, named in 2015 as one of the worst wage theft violators in the city by the Center for Popular Democracy, was awarded more than $21 million in contracts between 2007 and 2010.

K.S. Contracting came under investigation in May 2010, when an employee filed a complaint. An investigation over the next several years uncovered a kickback scheme targeting immigrant employees, Comptroller Scott M. Stringer said.

Following a four-day administrative trial in May 2016, Stringer's office learned that checks were regularly issued to just half the workforce, which was ordered to cash them and return the money to supervisors. The cash was then given to all the workers at a rate significantly below the prevailing wage.

At least 36 workers were cheated out of $1.7 million in wages between 2008 and 2011, with some workers who were to be paid a combined wage and benefits package of $50 an hour receiving just $90 a day in cash. Most of the victims were workers of Latino, West Indian or South Asian descent, Stringer said.

"With President Trump taking clear aim at immigrants across the country, we need to stand up and protect the foreign-born New Yorkers who keep our City running. Every New Yorker has rights, and my office won't back down in defending them," New York Stringer said in a statement.

"Contractors might think they can take advantage of immigrants, but today we're sending a strong message: my office will fight for every worker in New York City. This is about basic fairness and accountability."

By Paul Milo

Source

Metro Phoenix Woman Fights For Toys R Us Workers' Severance Pay

Auerbach got mad and got moving. With the help of two groups, Rise Up Retail and Center for Popular Democracy, she...

Auerbach got mad and got moving. With the help of two groups, Rise Up Retail and Center for Popular Democracy, she joined other former employees to lobby politicians in Washington, D.C., and to march into the lobbies of companies they hold responsible.

Read the full article here.

Open Letter to the Governor of Puerto Rico Ricardo Roselló

Sign-On Letter Condemning the Actions of the Puerto Rican Government on May Day and Demanding Justice for the Puerto...

May 3, 2018

We, the undersigned organizations, stand in solidarity with the Puerto Rican people and organizations that came together on May 1, 2018 to march against inhumane austerity measures that continue to drive a massive exodus of families in search of a better life. We stand with the millions of Puerto Ricans who remain on the island and fight every day to sustain their families and improve their collective quality of life. We write today to condemn the inhumane and violent police actions of the government of Ricardo Rosselló.

On May 1, 2018, thousands of Puerto Rican people, including elderly adults and children, who were exercising their First Amendment right to protest were met with state violence through the use of tear gas and violence at the hands of the police. Images captured at the event, corroborated by first-hand accounts, show crowds of people fighting to catch their breath as they ran away from police in riot gear. This type of scene has no place in a democratic society. The right to assemble and express frustration at the government is essential to the practice of democracy. We are deeply disturbed by Governor Roselló’s defense of the police brutality and demand that the local government take the appropriate actions to prosecute those who gave and executed the orders for these actions to take place.

On May 1, 2018, thousands of Puerto Ricans came out to protest the measures that the governor and the fiscal control board have put forward over the last two years. These measures adversely affect working class Puerto Ricans, and include:

Privatizing of the public school system and the power company; Doubling the tuition costs in Puerto Rico's public university; Closing over 300 schools; Slashing labor rights; Raising taxes; and Cutting pensions.This dire situation is forcing families to flee the island en masse. The Center for Puerto Rican Studies estimates that Puerto Rico could lose 14% of its population, 470,000 people, by 2019.

On May Day, the people of Puerto Rico came out with clear demands for their government. Today we stand with them and echo their demands in solidarity, and we commit to advocate for them in the United States.

We further demand immediate accountability for the May Day violence. Our demands are as follows:

Stop austerity: The Government of Puerto Rico should stop all austerity measures and invest in the working people of Puerto Rico by strengthening labor rights, raising the minimum wage, and promoting other policies that allow families in the island to live with dignity. Living with dignity includes rebuilding Puerto Rico’s power grid with 100% clean and renewable energy and keeping the power grid and power generation in public hands under community control, so as to mitigate the climate crisis and adapt for future extreme weather. Cancel the debt: The Government of Puerto Rico should not make, and the U.S. government should stop promoting, any more debt payments to billionaire bondholders. Instead, all government efforts should focus on securing payments to pension holders. The Puerto Rican government should also prosecute any individual that has profited from the debt crisis. Prosecute: The Government of Puerto Rico should conduct a full, transparent and impartial investigation into the police violence during the May Day actions and prosecute every police officer and civil servant who instructed and executed these acts of violence against the Puerto Rican people. We also encourage human right organizations to conduct their own independent investigations and oversight to guarantee that this process is done with full transparency.We, the undersigned organizations, stand in solidarity with the Puerto Rican people and their demands, condemn the actions of the Puerto Rican government, and demand that the local government take the appropriate actions to prosecute those who instructed and executed these actions.

Sincerely,

215 People Alliance 32BJ SEIU About Face: Veterans Against the War Action Center for Race and the Economy Action NC Alliance for Puerto Rico-Massachusetts Alliance for Quality Education American Family Voices Americas for Conservation Arkansas United Community Coalition Black Voters Matter Fund Blue Future CASA Center for Popular Democracy Chicago Boricua Resistance! Climate Hawks Vote Coalition for Education Justice Coalition for Humane Immigrant Rights of Los Angeles (CHIRLA) Courage Campaign CT PR Agenda Delaware Alliance for Community Advancement DiaspoRicans DiaspoRiqueños Florida Immigrant Rights Coalition- FLIC HANA Center Harry Potter Alliance Hedge Clippers Institute for Policy Studies, New Internationalism Project Journey for Justice Alliance Korean Resource Center (KRC) Lil Sis Maine People’s Alliance Make the Road CT Make the Road NJ Make the Road NV Make the Road NY Make the Road PA Maryland Communities United Massachusets Jobs with Justice Massachusetts Education Justice Alliance Massachusetts Immigrant and Refugee Advocacy Coalition- MIRA Mi Familia Vota Movement Voter Project NAKASEC - Virginia National Economic and Social Rights Initiative National Korean American Service & Education Consortium (NAKASEC) New Haven Association of Legal Services Attorneys NYCC OLÉ in Albuquerque, NM One America Organize Florida Pennsylvania Student Power Network PICC Pineros y Campesinos Unidos del Noroeste (PCUN) Presente Action Progressive Caucus Action Fund Progressive Leadership Alliance of Nevada (PLAN) Promise Arizona (PAZ) Public Higher Education Network of Massachusetts Refund America Proyect Resource Generation Services, Immigrant Rights, and Education Network (SIREN) SPACEs Student Power Networks Sunrise Movement TakeAction Minnesota The Bully Project The Shalom Center United Action CT United for a New Economy United We DREAM VAMOS4PR WeChoose Coalition Womens March Youth Progressive Action Catalyst

www.populardemocracy.org

###

Center for Popular Democracy promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country. CPD builds the strength and capacity of democratic organizations to envision and advance a pro-worker, pro-immigrant, racial justice agenda.

Media Contact: Samy Nemir, (929) 285-9623, solivares@populardemocracy.org

Letter: No point putting faith in GOP lawmakers

Anyone who buys the GOP story that they are going to give us better health care is a sucker. We will get hosed by the...

Anyone who buys the GOP story that they are going to give us better health care is a sucker. We will get hosed by the lying GOP. Anyone who votes for this garbage of a health care proposal should be voted out of office. If this becomes law, every working man and woman should change their dependents, then let us see how these leeches get by with no salary. We do that and the federal government has no income.

Read the full letter here.

2 months ago

2 months ago