Demonstrators bring Dreamers, TPS cause to Trump’s doorstep

Demonstrators bring Dreamers, TPS cause to Trump’s doorstep

Several dozen demonstrators, organized by progressive groups and chanting in Spanish, brought the cause of the Dreamers...

Several dozen demonstrators, organized by progressive groups and chanting in Spanish, brought the cause of the Dreamers and Temporary Protected Status refugees—both groups targeted for eviction from the U.S. by Donald Trump—to the doorstep of the GOP president and his Republican backers on the evening of Feb. 1.

Read the full article here.

In Troubled Times, the Federal Reserve Must Work for Everyone

Global Shock It's true that many of the causes of the recent stock market turmoil are global, rather than...

Global Shock

It's true that many of the causes of the recent stock market turmoil are global, rather than domestic. But those distinctions are becoming less important in a world of unfettered capital flow. Regional markets, like regional ecosystems, are interconnected.

Europe is struggling because of a misguided attachment to growth-killing austerity policies. Like Republicans in this country, Europe's leaders are focused on unwise government cost-cutting measures that hurt the overall economy.

China's superheated markets have experienced a sharp downturn, and its devaluing of the yuan is likely to affect American monetary policy. Many of the so-called "emerging markets" are in grave trouble, their problems exacerbated by an anticipated interest rate hike from the U.S. Fed.

Plunging crude oil prices are a major factor in the events of the last few days. But questions remain about the underlying forces affecting those prices. Demand is somewhat weaker, and Saudi officials are refusing to cut production. But there is still some debate about whether these and other well-reported factors are enough to explain the fact that the price of a barrel of oil is roughly half what it was just over a year ago, in June 2014.

American Turmoil

Talk of recovery here in the U.S. has been significantly dampened by events of the last several days. The now-interrupted stock market boom had been Exhibit A in the case for recovery.

Exhibit B was the ongoing drop in the official unemployment rate. There, too, signs of underlying weakness can be found. The labor force participation rate remains very low for people in their peak working years, as economist Elise Gould notes, and has only come back about halfway from pre-2008 levels. Jared Bernstein notes that pressure to raise wages, which one would also expect in a recovering job market, also remains weak.

All this argues for a rational and coordinated policy, one in which the Federal Reserve and the U.S. government act together to restore a wounded economy. What would that look like?

It would not include raised interest rates -- something that nevertheless continues to be a topic of serious discussion. As Dean Baker points out, China's currency devaluation alone should have been enough to take that idea off the table. What's more, as Baker rightly notes, such a move would only make sense if the Fed "is worried that the U.S. economy was growing too quickly and creating too many jobs." That's a notion most Americans would probably reject as absurd. Most are not seeing their paychecks grow or their job opportunities multiply.

Anxiety about inflation, while all but omnipresent in some circles, is not a rational fear. A slow rise in prices (0.2 percent in the 12 months ending in July, as opposed to the Fed's recommended 2 percent per year) tells us that inflation is not exactly looming on the horizon.

Now what?

"Everything is going to be dictated by government policy," the chief investment officerof a well-known investment firm said this week. In that case, isn't it time for a national conversation about that policy?

Another investment strategist told the Wall Street Journal that today's challenges come at a time when "global central banks have exhausted almost all their tools ... It's difficult to see how central banks come in to support markets."

If they've exhausted all their commonly-used tools, it may be time to develop new ones -- not to support "markets," but to promote jobs and growth for everyone.

First, do no harm. The Fed needs to hold off on any move to raise interest rates. But inaction is not enough. It was given a dual mandate by Congress: to stabilize prices and keep employment at reasonable levels.

Activist groups like the "Fed Up" coalition, led by the Center for Popular Democracy (and including the Campaign for America's Future), are working to move the Fed toward that second objective. They've been pushing to change its governing boards, which are heavily dominated by big banks and other major financial interests, and have called for policies that focus on improving the economic lives of most Americans.

Those policies could take a number of forms. One idea comes from Jeremy Corbyn, the populist politician who's on track to become the next leader of Great Britain's Labour Party. Corbyn's economic plan includes "quantitative easing for people instead of banks." Corbyn proposes to grow the financial sector in a targeted way, by giving the Bank of England (the UK's version of the Fed) a mandate to "invest in new large scale housing, energy, transport and digital projects."

A headline on the website of the Financial Times says (with apparent surprise) that "Corbyn's "People's QE" could actually be a decent idea."

Corbyn also proposes to "strip out some of the huge tax reliefs and subsidies on offer to the corporate sector." The added revenue would go to "direct public investment," including the creation of a 'National Investment Bank' to "invest in the new infrastructure we need and in the hi-tech and innovative industries of the future."

Qualitative Easing

Call it "qualitative," rather than "quantitative," easing. It would increase the money supply, but for money that is to be invested in the real-world economy -- the one that creates jobs, lifts wages, and creates broad economic growth.

Could something like Corbyn's plan ever happen here? There's no reason why not. The Federal Reserve wasn't created by bankers, nor is it there to serve bankers -- although a lot of people inside and outside the Fed act as if it were. (The choice of a former Goldman Sachs executive for its latest major appointment won't help change that.)

The Federal Reserve was created by the American people through an act of Congress. Its governors and its policies are there to protect and serve the public. The Fed should use its oversight capabilities to ensure that banks don't behave in a reckless manner or help private funds and other unsupervised institutions to behave recklessly.

We are still paying the price for allowing big-money interests to dominate both lawmaking on Capitol Hill and monetary policy at the Federal Reserve. That must change. Congress and the Fed, acting together, should ensure that our nation's policies benefit the many who are in need of help, not the few who already have more than they need.

Richard Eskow is a writer and editor with the Bernie 2016 campaign, the host of The Zero Hour radio program, and a Senior Fellow with the Campaign for America's Future. The opinions expressed here are his own.

Source: Huffington Post

The Housing Recovery Has Skipped Poor and Minority Neighborhoods

On October 11, 2009, when Isaac Dieudonne was two years old, his family moved into a new home in Miramar, Florida. As...

On October 11, 2009, when Isaac Dieudonne was two years old, his family moved into a new home in Miramar, Florida. As they began to unpack, young Isaac bounded out the front door in search of fun. The parents found him several minutes later, floating dead in the fetid pool of a foreclosed house.

Since the financial crisis began in 2008, approximately 5.7 million properties have completed the foreclosure process, and stories like this begin to answer the critical question of what happens to all those homes. While many are resold, too often they fall into disrepair, creating blight that drags down property values and turns communities into potential deathtraps, attracting not just mosquitoes and mold, but crime and tragedy.

According to expert reports, this neglect occurs disproportionately in communities of color, part of a disturbing pattern. While the Supreme Court has reaffirmed the ability to use the Fair Housing Act to challenge discriminatory effects in neighborhoods, the nation’s neighborhood layout looks more segregated than ever, exacerbating the racial wealth gap. There’s no point in having an anti-housing discrimination law if it isn't vigorously employed to prevent a real societal division that drags down minority families. The Justice Department, free of uncertainty about the Fair Housing Act’s future, needs to work to realize the law's intended purpose.

The housing recovery has skipped more low-income neighborhoods.Fifteen percent of homes worth less than $200,000 are still underwater, where the borrower owes more on the house than it’s worth. This is compared to only six percent of homes over $200,000. Property values in low-income neighborhoods have not bounced back to the degree of their wealthier counterparts.

An important study from Stanford University shows how this housing divide doesn’t align with socioeconomic status, but with race. Middle-class black households are more likely to live in neighborhoods with lower incomes than the average low-income white household. This creates fewer opportunities for minorities, as neighborhood poverty can predict the quality of schooling and the availability of jobs for the next generation. Areport from the American Civil Liberties Union shows that median household wealth for African-Americans continued to drop after the housing collapse, long after median wealth for whites stabilized. They project this to continue well into the next generation, with a drop in the average black family’s wealth by $98,000 more than it would have been without the Great Recession.

Foreclosures are largely responsible for this widening disparity. Predatory lending was directed at minority homeowners. Subprime mortgages weregiven disproportionately to minority borrowers, and after the housing bubble collapsed, these loans failed at higher rates. Racial segregation prior to the crisis turned these neighborhoods into targets, with subprime lending specialists going door-to-door and luring even those who owned their homes outright into refinances with dodgy terms. Banks like Wells Fargo and Bank of America paid fines for pushing minority borrowers into subprime loans, even when they qualified for better interest rates. But these fines—$175 million and $335 million, respectively—were substantially lower than they paid for other bubble-era abuses.

More black and Latino borrowers had their wealth exclusively tied up in their homes, and when they lost them, more of their wealth dissipated. Even after the collapse, the Federal Reserve found that from 2010-2013, net worth of nonwhite or Hispanic families fell 17 percent, compared to an increase of 2 percent for white families.

This wealth transferred in part to Wall Street. Private equity and hedge funds scooped up hundreds of thousands foreclosed properties in low-income communities, and converted them into rentals. This prevented minority homeowners from benefiting from any return in property values, and displaced many from their neighborhoods. And a recent survey of community organizations finds that this has created higher rents and more transient neighborhoods.

The Department of Housing and Urban Development, along with quasi-public mortgage giants Fannie Mae and Freddie Mac, auction off these homes to investors at a discount, according to a study from the Center for Popular Democracy. The U.S. Conference of Mayors recently passed a resolution urging these government lenders to sell instead to non-profits that would work to protect homes from foreclosure.

And then there is the disparate treatment of foreclosed properties repossessed by banks, known as real estate owned (REO). The National Fair Housing Alliance’s findings in 29 metropolitan areas indicate that REO in communities of color are twice more likely to have damaged doors and windows, overgrown weeds and trash on the premises and holes in the roof or structure. This violates the Fair Housing Act: Banks are responsible for maintenance and upkeep on all properties, and if they neglect that in black and Latino neighborhoods, the Justice Department can sanction them.

The failure to maintain foreclosed properties has multiple negative effects for communities. Blight creates health and safety concerns, acts asmagnets for crime, and lowers property values for neighboring homes. It also reduces the tax base for municipalities, as nobody pays property taxes on an empty house. The city of Detroit has already lost $500 million from foreclosures in the past few years; 78 percent of homes with subprime loans are know foreclosed or abandoned.

Last week, fifteen Senate Democrats, including leaders Chuck Schumerand Dick Durbin and ranking member of the Banking Committee Sherrod Brown, asked regulators to open an investigation into the treatment of foreclosed properties. “The same communities of color that were victimized by predatory lending may now be facing the double whammy of racial bias when it comes to the upkeep of foreclosed homes,” said Brown. But policing foreclosed properties would only begin to close the gap between white and non-white neighborhoods.

The entire point of the Fair Housing Act, passed shortly after Martin Luther King’s death in 1968, was to reverse the findings of the Kerner Commission, that the country “is moving toward two societies, one black, one white — separate and unequal.” But reading through these statistics, you wouldn’t know the Fair Housing Act existed. We are further than ever from what Justice Anthony Kennedy described as the act’s “role in moving the Nation toward a more integrated society.” It has been impotent in the face of multiple discriminatory shots at people of color, which has opened up a historically large wealth gap and crippled their opportunity.

Until we figure out another way for the middle class to build wealth other than purchasing a mortgage, the discriminatory effects of our housing system will further a permanent underclass among people of color in America. The Justice Department has an enormous amount of work to do.

Source: The New Republic

Tax reform stumbling block

Don’t look for a tax reform roll-out as soon as Congress comes back despite the aggressive timetable laid out by White...

Don’t look for a tax reform roll-out as soon as Congress comes back despite the aggressive timetable laid out by White House legislative director Marc Short. Part of the reason is that it probably won’t be ready yet. But it also has to wait until after the GOP congress passes a budget resolution, people close to the matter tell MM.

Because if Republicans lay out their tax reform plan beforehand, Democrats could use the budget vote-a-rama process in the Senate to try and attack individual pieces of the plan.

Read the full article here.

The New Education Reform Lie: Why Denver Is a Warning Sign, Not a Model, for Urban School Districts

The New Education Reform Lie: Why Denver Is a Warning Sign, Not a Model, for Urban School Districts

Scott Gilpin works in advertising, so he's used to dealing with people in the promotions business. He's just not used...

Scott Gilpin works in advertising, so he's used to dealing with people in the promotions business. He's just not used to seeing them operating a local public school.

Gilpin lives in Denver, where he grew up, graduated from high school and now has two children enrolled in the public school system. Recently, when he decided to get more involved in Denver school politics, he discovered that the most rapidly growing form of school in his community were charter schools. So he determined to check one out.

When he toured his first charter, a school in the Strive Preparatory network, he couldn't help but take note of the school’s staffing structure, which could have supported a mid-sized promotional campaign: his guide was the chief of external affairs for the network, and the school boasted a senior director of development and an associate director of recruitment, too.

Gilpin—who sent his children to the local public school they were zoned for, as his parents had done—wondered, "What kind of local public school needs to recruit its students?"

As Gilpin would learn, lots of new Denver schools are that "kind of school."

Across the city, Denver has opened 27 charter schools in the last five years, and plans to start up six more in the 2016-17 school year – effectively doubling the number of charter schools in the city in less than six years, according to a recent report from the Center for Popular Democracy, a left-leaning research and advocacy organization in Washington, DC. Yet this rush to expand charters is hardly justified by the performance of the ones already in operation.

According to CPD, based on the school performance framework Denver uses to evaluate its own schools, "Forty percent of Denver charter schools are performing below expectations.” And of those schools, 38 percent are performing significantly below expectations.

Nevertheless, numerous articles and reports in mainstream media outlets and education policy sites enthusiastically tout Denver as the place to see the next important new "reform" in education policy in action.

"Reformers are paying close attention to Denver," notes David Osborne of the Progressive Policy Institute in an op-ed recently published by U.S. News & World Report. Osborne declares Denver's education reform effort a success based on evidence of gains in "academic growth" and on-time high school graduation. He says Denver can show the rest of the nation "a way to transform … 20th-century school systems, built on the principles of bureaucracy, into 21st-century systems, built to deliver continuous improvement."

Recent reports from other Beltway-based think tanks, on both the right and the left of the political spectrum, also hail Denver as a model for advancing "school choice" and charter schools that have the power to "transform" the education of low-performing students. Earlier this year, the Brookings Institution named Denver the second-best of the nation's 100+ largest school districts that provide parents with options for "school choice."

But Gilpin and other Denverites tell a different story about Denver-style urban school reform.

Instead of a glowing example, they point to warning signs. Rather than a narrative of success, their stories reveal disturbing truths about Denver's version of modern urban school reform – how policy direction is often controlled by big money and insiders, why glowing promises of "improvement" should be regarded with skepticism, and what the movement's real impacts are, especially in communities dominated by poor families of color.

'Eye Opening' Revelations

Gilpin's initial foray into Denver school politics began in 2011 when he joined in a campaign in support of a new bond initiative to raise new funding for, "school renovations and classroom enrichment programs,” as the Denver Post put it.

The proposals passed in the 2012 ballot, but Gilpin's plunge into citizen involvement brought him up close to the often-unseen inner workings of contemporary urban education reform in Denver.

"What I found was eye-opening," Gilpin tells me in a phone conversation. Among those eye-openers were the intense lobbying and marketing efforts being undertaken to promote charter schools; their powerful and elite corps of backers; and the staggering amount of money, from taxpayers and private donors, that is being funneled to them.

Specifically, Gilpin saw firsthand how bond money intended for renovations and instructional programs was instead used to purchase a 13-story building downtown to house, in part, a new charter school.

Gilpin then learned that the district's chief operations officer, David Suppes, had signed the intent-to-purchase agreement for the new building on August 10, nearly two weeks before the board approved the bond initiative on August 23. Gilpin also saw how school leadership overlapped with the vendors and contractors used by the schools, potentially creating conflicts of interest and cronyism.

As the Colorado Independent reports, two members of the controlling school board majority in 2013, Barbara O’Brien and Landri Taylor, headed up organizations that contracted directly with the city school district. The two consistently voted with attorney Mike Johnson, whose law firm earned $3.8 million from the district during his tenure on an advisory committee before stepping up to the board.

Taylor, who was appointed to the board in 2013 and had the advantage of running as an incumbent in 2015, was well known as a key backer of opening new charter schools. After winning the election in 2015, he abruptly resigned earlier this year for family reasons.

To replace Taylor, the board picked MiDian Holmes who, according to Chalkbeat Colorado, is "an active member in the school reform advocacy group Stand for Children," a pro-charter organization that has made large donations to school board candidates running on a pro-reform platform. (Holmes eventually resigned when background checks revealed she is a convicted child abuser, and the board seat is, at this date, vacant.)

This tight, sometimes hidden, collusion in Denver school governance has led Gilpin to believe Denver reform is the product of "an elite circle" of people with little to no input from the public. Other careful observers agree.

"Forced on Our Community”

"They invite the community to look at plans already being put into place," Earleen Brown tells me about the Denver school board in a conversation over the phone.

An African American grandmother from a Northeast Denver community populated predominantly by non-white, poor families, Brown sees the Denver school reform model from a very different vantage point from where Gilpin sees it. (Denver schools are majority Latino and African American, with 70 percent of students classified as low-income and nearly a third non-native English speakers.) But she shares many of his concerns.

Like Gilpin, Brown's involvement in Denver school politics began with a bond referendum, this one in 2008. In that effort, Brown contends, there was widespread belief money would go toward paying for either a new traditional comprehensive public high school in Northeast Denver or for a substantial renovation of the existing Montbello High School.

In 2009, after the bond passed, district officials approached parents in the Montbello neighborhood, a mostly African American community, with a set of four options for the struggling high school. The options followed guidelines from the Obama administration, which ranged from changing staffing to closing the school. Parents, Brown recalls, created a petition campaign that gathered over 300 names in favor of the option labeled "transformation," the choice generally agreed to be the least disruptive to the school.

But when district officials came back with their decision, they had picked a different option: turnaround, generally regarded as a much more disruptive process. And the next year, Montbello parents learned yet another option had been chosen for their school: closure. The last class to graduate from Montbello was in 2014, and the school is now no more.

Now the community has – instead of the traditional, comprehensive high school parents requested – an array of new charter schools. Housed in what used to be Montbello High are two innovation schools (schools that get much of the flexibility of charter schools but are not privately operated). One school has a very specialized program focused on international studies. The other is an arts-focused school that is already being scaled back due to academic distress.

Some of the new schools serving the Montbbello community are well known for enforcing the harshest forms of school discipline disproportionally on students of color. A 2015 report from a Denver-based education justice and civil and immigrant rights organization tracked Denver school discipline incidents – such as out-of-school suspension, expulsion, or referral to law enforcement – and the correlation of those incidents to race.

What the report shows, according to a review in the Colorado Independent, is that students of color in Denver schools are 219 percent more likely to receive harsher discipline than their white peers. The disparity is particularly acute among charter and innovation schools. According to the report, nine of the ten worst offenders in Denver are charter or innovation schools. The schools that replaced Montbello high are numbers five and two on the 10 worst list, with racial gaps in punishment that are 990.9 and 1,361.4 percent wider. (The worst school, a charter with a racial punishment gap of 2,991.2 percent, is now closed.)

The discriminatory treatment toward her community has led Brown to believe the whole Denver reform model has been "forced on our community."

What Big Money Wants

While some parents see the effort to remake Denver’s schools as an agenda controlled by a small circle of local actors, others point to big money and influence coming from outside.

When Emily Sirota and her family moved to Denver in 2007, she and her husband quickly became concerned the schools their children would eventually attend were too focused on test scores and competition, and that leadership was "divorced from the desires of families," she tells me in a phone call. Her concerns motivated her to run for school board in 2011.

The quick lesson Sirota learned about Denver education politics was that connections to big money had more to do with determining opposing forces than traditional party lines.

Sirota, who is a Democrat, aligns politically with many in Denver who participate in education advocacy and serve on appointed education committees and elected boards. But because she did not align with the reform orthodoxy of school closures and charter school expansions (a wave of reform that many trace to Michael Bennet, a former investment banker who was superintendent of the district from 2005 to 2009 and is now a Democratic U.S. Senator for Colorado), she was not on the side of big money.

As The Nation's John Nichols reported at the time, big money lined up with Sirota's opponent Anne Rowe. Rowe, a former owner of a Denver publishing business, has strong ties to the Denver Public Schools' political establishment and was founding co-chair of A+ Denver, an influential advocacy group that backs charter schools and the Denver reform model.

Nichols notes that Rowe received strong financial support from "donors who, in several cases, have ties to groups that promote charter schools and vouchers" across the country, including the Alliance for Choice in Education, Stand for Children, and Democrats for Education Reform.

That funding disadvantage – Rowe out-raised Sirota by more than $90,000 – was "one of the biggest reasons" she lost, Sirota contends. An article for In These Times points out that many of the same donors who funded her opponent also funded two other establishment candidates – Allegra Haynes, who won her race, and Jennifer Draper Carson, who lost hers by just 73 votes.

"Denver school board elections are just the latest examples of elections being bought," says Jeannie Kaplan, an eight-year veteran of the Denver school board. Kaplan, who has lived in Denver for over 40 years and raised children in the local public schools, first ran for school board in 2005 in an open seat contest she won. Kaplan was term-limited out in 2013 and could no longer run. Two years later, deep-pocketed privatizers poured money into the school board race and swept the election to take a 7-0 majority. As Kaplan describes on her personal blog, a key to the election sweep was late money coming into the race to preserve the at-large seat held by the pro-reform Haynes.

Campaign funding reports show that Haynes outspent her opponent Robert Speth by more than 2 to 1.

An article in the American Prospect on the increasing role of big money in school board races reports that Democrats for Education Reform, a PAC founded by hedge fund managers that pushes hard to expand charter schools nationwide, ”contributed a quarter-million dollars to launch the Raising Colorado super PAC, which went on to spend $90,000 running ads and mailing flyers" in support of Haynes and Lisa Flores, another pro-reform candidate who also won. (According to the Center for Media and Democracy, DFER has poured millions of dollars of "dark money" into elections in Colorado and other states to tilt elections to candidates who favor charters and other "reform" measures.)

As Kaplan writes in a blog post,”Public education in Denver, despite what you may have heard or read about in the press, is a system in chaos. It is a system run by a cabal. It is a system where politics, pardon the expression, trumps good policy and the truth."

'Highly Politicized’

So how did education reform in Denver become mostly about politics and power?

"Denver school reform has become highly politicized because the ideas supporting it are highly controversial," Chris Lubienski, an education scholar and a professor of education policy, organization, and leadership at the University of Illinois, tells me over the phone.

From 2011 to 2015, Lubienski and a team of other education researchers conducted a study to ascertain how intermediary organizations (IOs) supported by foundations and philanthropists influence public opinion on education in Denver. These organizations, which “serve a number of functions in school reform, including advocacy, consultation, policy design, alternative teacher and leadership preparation, and research,” tend to promote reforms that "are often highly contested by parents, public education advocates, and teachers unions," the report contends. "In addition, the research evidence on the efficacy of these reforms is similarly unsettled."

"In Denver, reform ideas emerged from a very small handful of people," Lubienski tells me. "Reformers who work there may believe the origin of these ideas is in research and is homegrown,” but he points to influence centers outside Denver, such as Silicon Valley and Washington, D.C., as more likely incubators of these reforms.

Lubienski also questions claims from Denver reform proponents that a democratic process produced their policies. "Their origins are not as democratic as is suggested," he shares. "Having policy decisions result from more of a consensus-based approach is admirable. But in Denver, that consensus is not as well developed as many people say it is."

In Denver, according to the study, only three foundations – the Daniels, Piton, and Donnell-Kay Foundations – fund most of the IOs driving change in the system. "Without this hub of funding," the report concludes, "and alignment around the importance of [these] reforms, it is unlikely that such reforms would have moved forward at the size and scope that we witness in Denver."

The study from Lubienski et. al., also cites the influence of a small number of national foundations, principally the Bill and Melinda Gates Foundation, that advocate for expansions of charter schools. Other sources, such as the Denver Post, document the influence of the Walton Family Foundation, the philanthropic organization created by the wealth of the family that owns the Walmart retail chain. According to the Post, in 2011, WFF awarded Denver with nearly $8 million in grant money, "more than many of the nation’s largest cities," because of "the strength and profile of [Denver's] charter-school world."

The Problem With 'Portfolio' Reform

Though the evidence that the reforms these foundations are pushing actually work is nowhere near as convincing reformers would have you believe, efforts to root charters deep within Denver’s educational soil continue apace.

The mechanism reformers have used to seed the growth of charters across the city is the "portfolio model” — an approach that “shifts decision-making away from district superintendents and other central-office leaders,” according to the National Education Policy Center. Four strategies form the core foundation of such an approach: “school-level decentralization of management; the reconstitution or closing of ‘failing’ schools; the expansion of choice, primarily through charter schools; and performance-based (generally test-based) accountability.”

In Denver's case, the portfolio approach has led to the rapid expansion of charters while closing supposedly failed public schools. As Osborne writes in his U.S. News op-ed, "Since 2005 [Denver] has closed or replaced 48 schools and opened more than 70, the majority of them charters." Of Denver's 223 schools, 55 are charters and another 38 are "innovation schools" which Osborne describes as being "like charters."

To feed the system's numerous new charter schools, Denver has implemented an enrollment process that gives parents the opportunity to list up to 5 schools for their children to attend rather than simply relying on proximity. To help guide parents in making their school choices, the district uses a school ranking system with color-coded labels for schools – blue at the top (for "distinguished), green, yellow, orange, and red (for "accredited on probation") at the bottom. The rankings are used not only by parents, but also by the district to determine which schools need interventions and closure.

As Chalkbeat notes, Denver also has "enrollment zones" where students "are given a preference at the schools in the zone and are guaranteed a spot at one of them, though not necessarily their first pick. The zones are set up to encourage — some would say force — families to participate in the choice process."

But research experts are skeptical the portfolio approach alone will yield good results.

In an op-ed for Education Week, Montclair State University professor Katrina Bulkley joins with Columbia Teachers College professors Jeffrey Henig and Henry Levin to caution, "The portfolio-management approach to urban education is a work in progress."

NEPC adds further caution, writing, "There exists a very limited body of generally accepted research about the effects of portfolio district reform."

NEPC managing director William Mathis, one of the report’s authors, tells me that it is, in particular, the combination of reforms that confounds research into portfolio results. "There are so many factors at play that describing causality is problematic,” Mathis notes. “Portfolios mean different things in different places.”

"If you don't change what happens in the classroom, you don't really change anything," Mathis contends. And he finds little evidence a portfolio approach will necessarily result in improvements in curriculum and instruction.

Former school board member Jeannie Kaplan also questions the success of such reforms. In an op-ed published last year in the Denver Post, Kaplan spotlighted numerous negative outcomes after many years of portfolio-based reform, including growing achievement gaps between white and non-white students, a school system stubbornly segregated along racial lines, and high staff turnover rates in schools.

Her op-ed pointed to a 2015 analysis from the University of Washington’s Center on Reinventing Public Education (an organization that advocates the portfolio approach), which looked at the 50 largest urban school districts in the country that have been actively engaged in education reform. Kaplan noted that, "Of them, Denver Public Schools was dead last in both reading and math, with gaps of 38 percent and 30 percent respectively. The average for the other districts was around 14 percent for each subject.

“As for graduation rates, Denver ranked 45th out of the 50 districts."

Whose Choice?

So far, less than 27 percent of families have opted to participate in Denver’s choice program, according to a Chalkbeat analysis. The remaining 73 percent have chosen to remain in their current local schools.*

That same analysis attributes the low participation rate to the extremely small percentage of parents who opt to "choice out of" their current school when their children are not in a "transition year" – for instance, moving from an elementary school into a middle school. An older article in the Denver Post reported numerous parents feeling "stressed out" over the choice process.

That said, some parents do find there are advantages to the choice system. For instance, when Scott Gilpin looked to enroll one of their daughters in a school, they used the enrollment process to "choice into" an innovation school that offered a dual language program. Similarly, when Emily Sirota looked for a school for her oldest daughter, she found an innovation school that had an expeditionary approach more to her liking.

But there's also evidence Denver's system of choice leads to a lot of outcomes that look more like forced choice. For instance, Gilpin notes that the enrollment zones set up to encourage choice often result in students being placed in charters whether their families indicated that as their top choice or not.

When Sirota visited the neighborhood school her family was zoned for, she noticed extremely large class sizes and the lack of adequate facility space for the students. Upper grades in the elementary school were housed in portable buildings. No doubt, such conditions dis-incentivize parents from choosing that school.

"Choice sounds good," says Earleen Brown, but "there aren't five high performing schools in our area to choose from," she says. Although there are some "blue schools" in Brown's Northeast neighborhood, she argues their high ranking is often mostly due to Denver's methodology that rewards schools for recent growth in test scores, even when the percent of students who are on grade level in the school is still quite low.

Also, many of the traditional public schools in Brown's community have been closed or had charter schools "co-located" in them (an arrangement where a charter takes over a portion of a public school's facility). So for some families in Northeast Denver "being able to enroll in a nearby traditional public school is a choice you don't get," she notes. Certainly, for parents who wanted Montbello High School to serve as a traditional, comprehensive high school, that choice was simply overruled by the district.

"We really have no choice in our community," Brown maintains.

What Parents Want

Given all of the obvious flaws and questionable results attached to Denver’s current reform model, one can’t help but wonder why is this approach is being lifted up as a "model of excellence" to be replicated across the nation.

Of course, we've seen this type of bluster in support of charter schools and education reform before. For years, the New Orleans school system was held up as a reform model for other urban communities to emulate.

NOLA schools, essentially wiped out by Hurricane Katrina, provided reformers with "a clean slate" to remake an urban public school system based on their own ideas alone, which consisted primarily of converting the district into a nearly all charter school entity and turning school enrollment into a choice process.

Former Louisiana governor Bobby Jindal claimed NOLA-style reform had laid down a path for schools everywhere else to follow. David Osborne, in another of his laudatory commentaries about education reform, wrote in 2015, "New Orleans made charter schools work." Politico reported, “Mayors and governors from Nevada to Tennessee" were in full throttle campaigns to "replicate the New Orleans model.”

Except that, for a host of reasons, the New Orleans model turned out to be impossible to replicate. In fact, in Denver today there’s little discussion of education reform being patterned after New Orleans. In Osborne's promotion of the Denver model, in fact, he contrasts the Denver approach with New Orleans’, and lauds it for being an approach to education reform that hasn't required state intervention or other forms of "insulation from local electoral politics."

But it's not clear that the form of electoral politics practiced in Denver has yet given parents what they want as much as it has delivered outcomes desired by an elite few.

In Earleen Brown's case, what she wants is pretty specific: She'd like to see the district act on her community's desire to have a comprehensive, public high school.

Jeannie Kaplan advocates the adoption of models she has seen work in the past that provided schools resources to stay open longer hours and provide a fuller range of services including tutoring, health care, and extra-curricular activities. "Now we call these 'community schools,'" she explains. What Denver needs most, she believes "is the money [to fund] this."

"We need more focus on the schools in our neighborhoods, rather than popping up new charter schools here and there," Emily Sirota maintains. And she'd like to see smaller class sizes, guaranteed recess for kids, and a more equitable system that ensures a high level of quality curriculum and instruction in all schools, not just the ones the better-off children attend.

As for Scott Gilpin, he wants to see spending on education in Denver going more toward the classroom instead of to administration, consultants, and school board elections. He thinks less emphasis on testing would not only free up more time for instruction; it would make teachers' jobs more rewarding — which would, in turn, lower teacher attrition rates.

What Denver parents seem to want most from education policy in their community is for leaders to find a different way to talk about these issues, and to solicit, and honor, parent input before decisions are made.

Whether they will ever get what they want in this regard remains an unsettlingly open question.

* Though officials from Denver Public Schools argue that in the transition grades (kindergarten and grades 6 and 9) participation levels are now at 84%, overall participation rates across all grades remain at just 26.5%.

Jeff Bryant is director of the Education Opportunity Network, a partnership effort of the Institute for America's Future and the Opportunity to Learn Campaign. He has written extensively about public education policy.

By Jeff Bryant

Source

A National Solution

New York Times - June 25, 2014, by Peter Markowitz - For too many years our nation’s discourse around immigration has...

New York Times - June 25, 2014, by Peter Markowitz - For too many years our nation’s discourse around immigration has been distorted by anti-immigrant activists who have advanced bold but regressive state immigration policies. State laws in Arizona and elsewhere have powerfully, but inaccurately, framed the immigration issue through the lenses of criminality and terrorism. While these laws have not generally fared well in court, their impact on our national perception of immigration has impeded federal immigration reform. Meanwhile, states like New York continue to suffer the consequences of our broken immigration laws. Our families continue to be fractured by a torrent of deportations. Our economic growth continues to be impeded by the barriers our immigrant labor force faces. And our democracy continues to be undermined by the exclusion of a broad class of New York residents.

The New York Is Home Act, recently introduced by New York State Senator Gustavo Rivera and Assembly Member Karim Camara, with support from the Center for Popular Democracy and Make the Road New York, charts a path forward on immigration — a path that like-minded states and ultimately the federal government could follow. The legislation would grant state citizenship to noncitizens who can prove three years of residency and tax payment and who demonstrate a commitment to abiding by state laws and the state constitution.

The bill is an ambitious but sensible assertion of a state’s well-established power to define the bounds of its own political community. Unlike the Arizona law, this legislation is carefully crafted to respect the unique province of the federal government. As misguided and brutal as the federal immigration regime is, New York cannot alter federal deportation policy. However, it is absolutely within New York’s power to facilitate the full inclusion of immigrants in our state. By granting state citizenship, we would extend the full bundle of rights a state can deliver — the right to vote in state elections, to drive, to access higher education, among others — and we would define the full range of responsibilities that come along with citizenship, including tax payment, jury service and respect for state law. By reorienting our national conversation on immigration around the more accurate and productive themes of family, economic vitality and political inclusion, this legislation will move us toward a real solution to our nation’s immigration quagmire.

Source

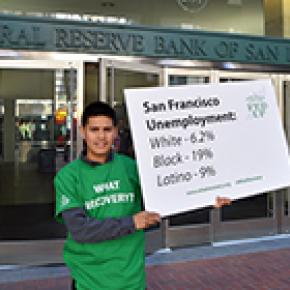

Report: Black Unemployment in Bay Area More Than Three Times the Average

SF Examiner - March 6, 2014, by Chris Roberts - After 200 unanswered job applications, Ebony Eisler finally landed a $...

SF Examiner - March 6, 2014, by Chris Roberts - After 200 unanswered job applications, Ebony Eisler finally landed a $15 an hour position as a medical assistant in Mission Bay. But since she's a temp worker, she earns less than her co-workers, who make $20 to $25 per hour for the same work.

Still, as a black woman in San Francisco, she is fortunate. The unemployment rate for black people in the Bay Area is 19 percent, according to 2013 U.S. Census Bureau data crunched by the Economic Policy Institute.

Blacks are unemployed at more than three times the rate of workers of other races, according to this data. The Bay Area finished 2013 with a 6 percent total unemployment rate, according to the Bureau of Labor Statistics.

In San Francisco, unemployment has dropped rapidly since Mayor Ed Lee took office in January 2011, when the jobless rate was 9.5 percent. The most recent figures from the state Employment Development Department — which does not publish jobless rates by race — pegged The City's unemployment rate at 3.8 percent, by far the rosiest employment figures since the first dot-com boom at the turn of the millennium.

The wide gulf in the jobless rate between ethnic groups living in the same city belies the idea that The City and state have fully recovered from the Great Recession, according to advocates with the leftist Center for Popular Democracy.

The group released the unemployment figures by ethnicity Thursday as part of a national campaign to convince the Federal Reserve Bank to keep interest rates low in order for the economic recovery to trickle down to all workers.

So far, "the recovery is based on white America alone," said Eisler, 36, a Bayview resident who holds an associates degree and a certified nursing assistant license. Her current job, the best she could find, does not cover her $1,800 a month rent, she said.

Statewide, the jobless rate for black people is 14 percent, according to the Economic Policy Institute, compared to 6.1 percent for whites, 8.5 percent for Latinos and 5.9 percent for Asians.

Source

Woman who confronted Flake 'relieved' he called for delaying Kavanaugh vote

Woman who confronted Flake 'relieved' he called for delaying Kavanaugh vote

Maria Gallagher, who on Friday confronted Sen. Jeff Flake with her story of sexual assault, said she was "relieved"...

Maria Gallagher, who on Friday confronted Sen. Jeff Flake with her story of sexual assault, said she was "relieved" when the Arizona Republican called for an FBI investigation into allegations against Supreme Court nominee Brett Kavanaugh.

Gallagher, a resident of New York, stood next to Ana Maria Archila, co-executive director of the Center for Popular Democracy, earlier Friday as the two held open the doors of an elevator Flake was taking on his way to the Senate Judiciary Committee. Soon after, Flake said he would vote to advance Kavanaugh's nomination to the Senate floor, but he said he wanted a vote in the full body delayed for one week while the FBI investigated the allegations.

Read the full article here.

Why Texans Are Fighting Anti-Immigrant Legislation

Austin, Tex. — I’m a member of the Austin City Council, and this month Texas State Troopers arrested me for refusing to...

Austin, Tex. — I’m a member of the Austin City Council, and this month Texas State Troopers arrested me for refusing to leave Gov. Greg Abbott’s office during a protest against the anti-immigrant Senate Bill 4.

The bill, which Mr. Abbott signed May 6, represents the most dangerous type of legislative threat facing immigrants in our country. It has been called a “show me your papers” bill because it allows police officers — including those on college campuses — to question the immigration status of anyone they arrest, or even simply detain, including during traffic stops.

Read the full article here.

No indictment in Eric Garner police killing

Reports indicate that a grand jury has decided not to indict NYPD Officer Daniel Pantaleo in the death of Eric Garner,...

Reports indicate that a grand jury has decided not to indict NYPD Officer Daniel Pantaleo in the death of Eric Garner, an unarmed Black man. Garner died in July in Staten Island of neck compression, combined with asphyxia as a result of a chokehold applied while police officers were arresting him for the suspected sale of untaxed cigarettes. The incident was captured on cellphone video by Ramsey Orta who was a bystander. Garner had broken up a fight when officers attempted to arrest him. Pantaleo put Garner on the ground by the use of force, which included the use of a headlock resulting in Garner’s death. The city’s medical examiner later ruled the death a homicide. The NYPD is banned from using chokeholds, however, chokeholds are not illegal.

At a press conference Wednesday night, the Rev. Al Sharpton and Garner's family spoke about the grand jury's decision. Sharpton announced plans for a national march in Washington, D.C. on December 13 to urge the U.S. Department of Justice to investigate the string of recent police killings of unarmed Blacks.

"We are dealing with a national crisis," he said. "We are not advocating violence, we are asking that police violence stop. Now you have a man chocked to death on videotape and says 11 times 'I can't breathe.'" Garner's wife, Esaw, said she did not accept the apology give by Pantaleo on Wednesday after the grand jury didn't indict him. She said she plans to move forward to get justice for her late husband.

"I'm determined to get justice for my husband," she said. "He should be here celebrating Christmas and Thanksgiving and he can't. My husband's death will not be in vain. As long as I have breath in my body I will fight the fight."

Several Black and Latino congressional members, including Gregory Meeks and Yvette Clark, held a press conference in Washington, D.C. after the grand jury's decision was announced. The legislatures called for the Justice Department to step into the case. The U.S. Department of Justice is going to investigate Garner's death, according to reports. U.S. Attorney General Eric Holder announced that a federal civil rights investigation would be opened in the case.

Mayor Bill de Blasio, Public Advocate Leticia James and several city council members held a press conference in Staten Island on Wednesday to address the issue. De Blasio said that frustration over the grand jury's decision is understandable. "It's a very emotional day for our city. It's a very painful day for so many New Yorkers," he said. "We're grieving – again – over the loss of Eric Garner, who was a father, a husband, a good man – who should be with us."

The decision in the Garner killing by a grand jury comes just over a week after a grand jury in Ferguson, Mo. decided to not indict Officer Darren Wilson for the shooting death of Michael Brown. Peaceful demonstrations along with rioting followed the announcement of that decision. Police Commissioner Bill Bratton met with several elected officials in Staten Island before the decision was announced anticipating the reaction to the decision. Demonstrations were being announced via social media on Wednesday and took place Times Square, Grand Central and Union Square. A gathering was also planned for the nationally televised Rockefeller Center Christmas tree lighting set to take place in the evening.

Several groups including Communities United for Police Reform Justice Committee, Make the Road NY, VOCAL-NY, Center for Popular Democracy, Color of Change, Million Hoodies and Freedom Side announced they are organizing demonstration.

Source: Amsterdam News

2 months ago

2 months ago