Here Are the City Policies That Democrats Need to be Talking About

Here Are the City Policies That Democrats Need to be Talking About

This has been an incredibly disturbing election year: to a degree unprecedented in our lifetimes, hatred and xenophobia...

This has been an incredibly disturbing election year: to a degree unprecedented in our lifetimes, hatred and xenophobia are being marshalled to support a reactionary nationalistic agenda. As leaders of Local Progress, a network of more than 500 progressive elected officials from cities and towns across the country, we stand together in support of a positive vision to make America great: economic inclusion, racial and gender equity, sustainable communities, and good government that serves the public interest.

This week, as Republicans and Democrats gather for their national conventions, Local Progress is releasing a national platform of our own. We adopted the platform on July 9 in Pittsburgh at our Fifth Annual Convening, which was attended by over 100 local elected officials from around the country and hosted by Pittsburgh Mayor Bill Peduto.

Our platform lays out a series of practical and transformational steps that the federal government can take to promote strong, equitable cities. On an array of issues – from affordable housing and environmental protection to workers’ rights and police reform – we’ve identified strategies Congress and the executive branch can take to support, incentivize, and collaborate with local government officials like us who are trying to help our constituents build dignified and secure lives. You can read our full platform here.

With conservatives in control of Congress and a large majority of statehouses, many of the most important policy developments in recent years have come from the local level. In our cities of Minneapolis and New York, for example, we’ve passed paid sick days laws that guarantee workers time off to care for themselves and their loved ones. Earned sick time is a worker rights issue, but it’s also about gender and racial equity, because those previously lacking paid sick days are overwhelmingly women and people of color. Our cities are also confronting the affordable housing crisis with inclusionary housing laws; pushing for reform of our police departments to eliminate discriminatory policing and keep our communities safe; and shifting budget priorities to invest in the infrastructure, programs and services that help all of our constituents thrive.

These city policies have transformed the national discourse. Hillary Clinton’s support for a higher federal minimum wage is a testament to the power of the workers, community-based organizations, and policy advocates who set such a worthy goal and to Sen. Bernie Sanders, who did so much to build momentum for the issue and pull her along. But it’s also a testament to Seattle, San Francisco, Los Angeles, Washington DC, and other cities that have actually passed $15 minimum wages and are shifting the boundaries of mainstream discourse. The members of Local Progress have been at the frontlines of these fights in cities around the country, and we are proud to stand in the trenches with constituents who are working so bravely to build a more just society.

But the fact is that we cannot do it alone. The devastation wrought by the water crisis in Flint brought national attention to a reality being felt across the country: localities are starved of the resources they need to provide crucial services for their residents, particularly for low-income families and communities of color. As public servants, we believe in the power of government to improve the lives of our constituents. However, too often federal and state governments are an obstacle, not an aid, to advancing local policies that address these urgent issues.

In too many states, cities do not receive the financial resources they need to build strong schools, run proper public transit systems, or keep parks clean and safe. And we are often prohibited from passing laws to raise the revenue we need. Beyond financial constraints, many states are preempting cities’ ability to pass common sense regulations: smart gun safety laws, livable wages for workers (a limitation that affects New York City), and a just transition to a clean energy economy.

In short, we need the federal government to help us. Here are a few examples, drawn from our platform, that show how the next Congress and Administration can help city governments make a huge difference in our constituents’ lives:

The Department of Education can double down on investments in community schools that have been proven to reduce inequities, as well as restorative justice programs to help end the school-to-prison pipeline. And it can evaluate for-profit charter schools to determine whether they are exacerbating segregation and adhering to basic standards of accountability.

Congress can support the creation and preservation of affordable housing with a significant expansion of the Section 8 voucher program and public housing, as well as a stronger commitment to programs that prevent homelessness. And the Department of Housing and Urban Development can ensure the distressed mortgages it sells help the community – rather than Wall Street speculators.

The Department of Transportation can partner with cities to strengthen Vision Zero and “complete streets” initiatives that improve access to public transit and prioritize safety, sustainability, and racial and economic equity.

The Department of Labor can collaborate with cities to enforce labor standards and respond to the challenges created by the on-demand economy.

And, of course, the federal government must help eliminate the racially disparate impact of local policing and criminal justice systems. The Department of Justice should strengthen its oversight of local police departments, ensure that special prosecutors conduct investigations of alleged police misconduct, and curtail the transfers of military equipment to local departments. And it should incentivize the creation of alternatives to incarceration such as mental health and addiction services in both states and localities.

More than ever, we need strong cities and strong city leaders. The truth is that, right now, Congress is not working for the American people. Cities are leading the way, and will continue to do so. We hope that next year, with a new Congress and a President committed to inclusion, equity, and shared prosperity, Washington DC will give our nation’s cities the support we need to promote genuine social justice for America.

By RITCHIE TORRES AND LISA BENDER

Source

Will Maria response energize CT Puerto Rican voters?

A year after Hurricane Maria ravaged Puerto Rico, there is a debate about whether the storm has created political winds...

A year after Hurricane Maria ravaged Puerto Rico, there is a debate about whether the storm has created political winds that will prompt Connecticut’s Puerto Ricans to shed their reputation as unlikely voters.

Read the full article here.

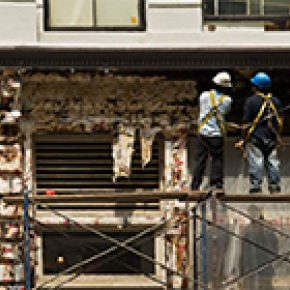

Industry Attacks on ‘Scaffold Law’ Put Construction Workers on Shaky Ground

In These Times - March 12, 2014, by Michelle Chen - New York City’s tens of thousands of construction workers face a...

In These Times - March 12, 2014, by Michelle Chen - New York City’s tens of thousands of construction workers face a precarious landscape at work. Teetering at the edge of rooftops, sidestepping mammoth cranes and noisy bulldozers, and navigating through half-collapsed walls and chemical-laden debris, they’re surrounded by hazards day in and day out. Yet many workers remain silent about unsafe conditions. For them, the risk of retaliation outweighs the risk to life and limb.

Given these hazards, one might assume that demanding employers take responsibility for worker safety is about as basic a precautionary measure as a hard hat. Yet, construction industry lobbyists are working hard to gut the Scaffold Law, a keystone piece of occupational safety legislation that has for more than a century added an extra layer of accountability for firms that fail to protect workers from harm. Complaining that the law cuts into their bottom line, opponents have in recent months pushed for reform legislation in Albany that could prove disastrous for the workers most at risk: non-union Asian and Latino workers doing small-scale and informal building jobs already off the regulatory radar of the federal Occupational Safety and Health Administration (OSHA).

The Scaffold Law, a state law on the books since 1885, states that worksites above the ground “shall be constructed, placed and operated as to give proper protection to a person so employed.” The law holds owners and contractors liable for injuries that result as a violation of those standards, and allows employees to sue for damages if they can demonstrate that such a violation occurred and caused the injury in question. Advocates say that the law thereby promotes safety standards such as provision of appropriate training and protective equipment, as well as checks to ensure that worksites are structurally sound.

Opponents say New York’s law is a frivolous measure unique to a notoriously litigious city. But in reality, lawmakers passed the Scaffold Law in response to alarming reports of injuries and deaths caused by unsafe conditions at building sites, including faulty scaffolds. And in fact, other states have passed similar safety laws over the years.

Illinois’ occupational safety record worsened after the state repealed the law in 1995. According to one analysis by a trial lawyers' group, “In 2004, the incidence rate of falls from scaffolding/staging in the construction industry in Illinois was more than triple the national rate.”

The firms and business groups, including the Associated Builders and Contractors, American Insurance Association and, in a nod to diversity, Association of Minority Enterprises NY, mobilizing against the law blame it for excessive litigation and insurance costs, saying that it puts undue emphasis on the employer rather than the “personal responsibility” of the worker. They say the law should be rewritten to allow for consideration of “comparative negligence,” to take into account workers’ alleged carelessness. Proposed changes to the law would explicitly direct juries to consider the degree to which the worker caused the accident. The idea is to create more legal wriggle room to limit the company's legal and financial liability toward victims.

Critics point out that under the current law, the courts are already tasked with adjudicating these factors in civil suits when determining whether the employer is legally at fault for a safety failure, since the law addresses only proven violations of safety codes. But more importantly, critics argue that the concept of “comparative” responsibility is absurd in light of the outsized power imbalance between construction workers and bosses.

Of course, the Scaffold Law provides just a thin layer of protection against an endemically oppressive labor market.

But the Center for Popular Democracy (CPD), a New York City-based advocacy group, argues that the Scaffold Law helps “protect workers from dangers at work that lead to disparate outcomes based on race, ethnicity, or language.”

Occupational hazards, as well as labor abuse, are rife across the construction industry, particularly for more casual, unregulated work, such as the day laborer jobs that proliferated in the aftermath of Superstorm Sandy and the small-scale contractor projects on private suburban homes. Falls from heights made up over one-third of construction worker deaths in 2012, and construction workers suffer injuries that are more frequent and severe than workers in many other private-sector industries, according to data from the Bureau of Labor Statistics. According to an analysis by CPD, in New York City between 2003 and 2011, a stunning 74 percent of fatal construction-site falls investigated by OSHA involved Latino or immigrant workers, exceeding their representation in the general population and the construction workforce. Most occurred on smaller, non-union worksites, where undocumented labor is typically concentrated.

Other research from advocacy groups and occupational-safety authorities suggests Latino immigrant workers are deterred from speaking out about unsafe conditions, in part due to limited English ability or fear of exposing their immigration status. That compounds the oppression of economic precarity and discrimination; it’s hard to feel empowered to challenge your working conditions when you’re “off the books.”

CPD’s analysis highlights the perilous tightrope these workers traverse each day. In one case narrative in the report, two men were working at a height of 16 feet, and “They were moving and adjusting the scaffold when employee #1 fell. Employee #1 was not tied off to his lifeline. Employee #1 was pronounced dead at the hospital.”

Those who survive such workplace accidents may never fully heal. In an interview with WNYC last year, Pedro Corchado recalled an accident while working on a ladder in the Bronx in 2008. “The ladder collapsed on me,” he said. “I fell about 11 feet or so to the concrete floor. I suffered neck and lower back injuries that will be with me the rest of my life.”

Under the proposed reform, these workers might come under scrutiny for being “negligent”—Why did he get on a shaky ladder in the first place? Why wasn’t his lifeline securely tied? Advocates counter that question’s about the employer’s negligence—Who was charged with overseeing the worksite? Did inadequate equipment or poor management place workers in harm’s way?— ultimately hold more weight.

“The fact of the matter is, you could be doing everything right,” CPD Director of Strategic Research Connie Raza tells Working in These Times. “If you don't have the right equipment, you're not going to be able to keep yourself safe in every circumstance that comes up. And it is the owners' and the contractors' responsibility to make as safe a workplace as possible, but certainly as safe a workplace as legally required."

As for the business case against the law's cost, it is true that some of this uniquely litigious city’s largest civil settlements in recent years came from suits involving construction-related scaffold and ladder injuries.

But this is offset by the permissiveness of the federal regulatory environment. According to the AFL-CIO, the average penalty assessed for a “serious” violation of an OSHA standard, such as failing to provide appropriate mechanical safeguards or protective gear—in New York in 2012 was $2,164. (Criminal prosecutions are virtually unheard of, and the agency's inspection and enforcement capacity is severely hampered by chronic understaffing).

While the contractors at the top of the construction industry complain of lawsuits and insurance costs, Razza says the suggested reforms “would shift responsibility away from owners and contractors who control the work site, to workers who don't, and who are often really in a relationship where they feel threatened if they come forward with complaints ... The construction and insurance industries are trying to push back and save money, and the reason that the law is so important is that it saves lives."

Source

Activists urge Harvard to stop investing in Boston hedge fund that holds Puerto Rico debt

Activists urge Harvard to stop investing in Boston hedge fund that holds Puerto Rico debt

“As one of Baupost’s most significant outside investors, Harvard can exercise some influence on the hedge fund’s...

“As one of Baupost’s most significant outside investors, Harvard can exercise some influence on the hedge fund’s operations," said Julio López Varona, a member of Hedge Clippers. “They have a big endowment; their investment sets a tone.”

Read the full article here.

Fed Raises Key Interest Rate, Citing Strengthening Economy

WASHINGTON — The Federal Reserve raised its benchmark interest rate Wednesday for just the second time since the...

WASHINGTON — The Federal Reserve raised its benchmark interest rate Wednesday for just the second time since the financial crisis of 2008, saying the American economy is expanding at a healthy pace and setting itself up as a counterweight to President-elect Donald J. Trump’s push for considerably faster growth.

The Fed cited the steady growth of employment and other economic measures, and signaled that it expects to raise rates more quickly next year to prevent the economy from growing too quickly.

“My colleagues and I are recognizing the considerable progress the economy has made,” Janet L. Yellen, the Fed’s chairwoman, said at a news conference after the announcement. “We expect the economy will continue to perform well.”

The widely expected decision moves the Fed’s benchmark rate to a range of 0.5 percent to 0.75 percent, still very low by historical standards. Low rates support economic growth by encouraging borrowing and risk-taking.

The American economy has expanded by about 2 percent a year over the last six years, and the unemployment rate has fallen to 4.6 percent. The Fed’s assessment that the economy is growing at a healthy pace — not too hot, not too cold — is starkly at odds with Mr. Trump, who has promised 4 percent growth and has described job creation as “terrible” and economic growth as anemic.

Already on Wednesday, one Republican member of the House Financial Services Committee, Representative Roger Williams of Texas, criticized the Fed’s move.

“Today’s decision by the Fed to raise the interest rate is entirely premature and will be burdensome to a nation already struggling to pull itself out of this slow-growth Obama economy,” Mr. Williams said in a statement. “By making rates even higher, the Fed is effectively making our hardships even harder.”

Mr. Williams did not object when the Fed raised rates last December.

In announcing the decision after a two-day meeting of the Fed’s policy-making committee, the central bank gave little indication that Mr. Trump’s election had altered its economic outlook. The Fed said it still expected a slow economic expansion and a steady march toward higher rates. In separate forecasts also published Wednesday, Fed officials predicted three rate increases in 2017.

Rising Rate

The Federal Reserve raised its target rate for only the second time in more than a decade.

Note: Graphic shows the Federal Funds Target Rate previous to the December 2008 rate change; since then it is the upper limit of the Federal Funds Target Range.

By The New York Times | Source: Federal Reserve

For the first time in recent years, however, there is a real possibility of significant changes in fiscal policy. Republicans will control the White House and both chambers of Congress, and Mr. Trump has promised to increase economic growth and job creation through tax cuts and infrastructure spending.

Those measures could spur faster growth after a presidential campaign in which Mr. Trump regularly disparaged the economy’s performance under President Obama. But the Fed reiterated Wednesday that the economy is already expanding at roughly the maximum sustainable pace.

Fed officials also see evidence that the labor market is tightening. Several Fed districts reported labor shortages in the central bank’s most recent compilation of economic reports. In the Philadelphia district, construction workers are hard to find. Atlanta reported a shortage of nurses; Kansas City, truck drivers; Dallas, tech workers.

Faster growth, in the Fed’s judgment, would probably lead to higher inflation. As a result, if Republicans succeed in invigorating growth, the Fed is likely to raise rates more quickly. The greater the stimulus, the faster interest rates are likely to rise.

“Your expectation should depend very little on what you think that the F.O.M.C. is thinking and very much on your view of Trump policies and their macro effects,” said Jon Faust, a professor of economics at Johns Hopkins University and a former adviser to Ms. Yellen, referring to the Federal Open Market Committee. “Don’t focus on the Fed. As James Carville regularly reminded the other Clinton on the campaign trail: It’s the economy, stupid.”

Ms. Yellen emphasized that the Fed was not prejudging the likely course of events. She declined several times to comment on the merits of Mr. Trump’s plans or to predict their consequences for the economy.

“We’re operating under a cloud of uncertainty at the moment,” Ms. Yellen said.

Fed officials predicted that they would raise the Fed’s benchmark rate a little more quickly in the coming years, reaching 2.1 percent by the end of 2018. In September, they had predicted that it would reach 1.9 percent by the end of 2018. The new projections, however, reflect a significantly slower pace of increase than last December, when they expected the rate to reach 3.3 percent by 2018.

The combination of steady growth and faster rate increases indicates that some Fed officials expect the central bank to end up offsetting a modest increase in fiscal stimulus. But Ms. Yellen said most Fed officials were reserving judgment.

“Changes in fiscal policy or other economic policies could affect the economic outlook,” she said. “Of course, it is far too early to know how those changes will unfold.”

What Happens When the Fed Raises Rates, in One Rube Goldberg Machine

Exactly seven years ago, the Federal Reserve cut interest rates to almost zero in order to nurse the ailing economy back to health. Recently it changed direction. This is how it works.

The tensions between monetary and fiscal policy will develop slowly. Legislation takes time to write, and any economic impact would generally be felt in coming years. Political pressures, however, may build more quickly.

Mr. Trump has made clear in the past that he likes low interest rates — and some of his plans, like infrastructure investment, will be much easier to fund if rates remain low.

“The Fed is in a tricky place,” said Michael Feroli, chief United States economist at JPMorgan Chase. “They’re trying not to prejudge how Congress and the administration duke it out, but once they see that, I think they will respond.”

There is also uncertainty about the Fed’s leadership. Ms. Yellen’s term as chairwoman ends in February 2018, and Mr. Trump has said he would prefer a Republican.

Ms. Yellen could remain on the board, a possibility she said Wednesday she had not ruled out. But the Fed, under different leadership, might well choose a different path forward. Some conservative economists, notably John Taylor of Stanford University, argue that the bank should already have raised rates above 1 percent.

The economy, for now, keeps plodding along. Steady job growth has reduced the unemployment rate to a level the Fed considers healthy. A little unemployment is natural as people change jobs and businesses close. Ms. Yellen and other Fed officials have said they see some signs of stronger wage growth. Inflation, too, has picked up a little in recent months, although both wages and inflation continue to rise more slowly than the Fed would like to see.

Ms. Yellen described the rate increase as “a vote of confidence in the economy.”

The decision was made by a unanimous vote of the 10 members of the Federal Open Market Committee, the first time in recent months the Fed has acted by consensus.

Some economists argue that the Fed should wait until inflation strengthens before raising rates, to test whether a stronger economy would persuade some people sidelined during the downturn to start looking for jobs. That would expand the labor force. Unemployment remains particularly high among minorities.

That view, however, has found little support among Fed officials, who worry that interest rates will have to be raised more quickly if they wait too long, increasing the chances of pushing the economy into recession.

“Apparently, Fed officials think the economy is growing too quickly,” said Ady Barkan, the director of Fed Up, a coalition of liberal groups that has pressed the Fed to continue its stimulus campaign. “I doubt you can find many other Americans who share that opinion. And it’s a strange conclusion to draw in the wake of an election that was so heavily impacted by voters’ economic discontent.”

By BINYAMIN APPELBAUM

Source

Zara Employee Humiliated By Managers For Her Braids

Twenty year-old Zara employee, Cree Ballah from Toronto, Canada, has spoken out after she was recently humiliated by...

Twenty year-old Zara employee, Cree Ballah from Toronto, Canada, has spoken out after she was recently humiliated by two of her managers for having what the fashion chain staff members deemed an ‘inappropriate’ hairstyle.

Ballah, who is of African American decent, was wearing four box braids pulled into a low, simple ponytail when she was reprimanded.

Originally, the young sales assistant was told by a manager that her hair was not in keeping with Zara’s image, telling her, “We’re going for a clean professional look with Zara and the hairstyle you have now is not the look for Zara.”

Afterwards, another manager pulled Ballah aside, lead her out of the store and attempted to ‘fix’ her hair in the middle of the crowded mall, leaving the Zara employee feeling humiliated and offended.

“My hair type is also linked to my race, so to me, I felt like it was direct discrimination against my ethnicity in the sense of what comes along with it,” Ballah told CBC News in a recent interview.

“My hair type is out of my control and I try to control it to the best of my ability, which wasn’t up to standard for Zara.”

This isn’t the first time the Spanish retail giant has been in hot water for its questionable treatment of employees. Last year, a survey conducted by the Center for Popular Democracy (CDP) found Zara was demonstrating racial bias not only towards its employees but its customers as well.

The report established darker-skinned employees were far less likely to get a raise or be promoted and were twice as unhappy with their working hours compared to their fairer-skinned peers. As well as this, the report discovered employees were trained to report ‘special orders’ to in-store management.

‘Special orders’ are considered to be suspicious looking customers who, after being reported, are tailed by a Zara staff member to ensure no items are stolen. Results uncovered the majority of employees used the code on African American and Latino shoppers, and, according to the CPD survey, an actual member of staff of African American decent was deemed as a ‘special order’ when entering the store on his day off to collect a paycheque.

Adding insult to injury, the brand released a line of shirts emblazoned with the slogan ‘White Is The New Black’ on them in 2014, causing public outcry for their racially insensitive message.

And while the fashion chain has continued to escape largely unscathed under pleas of ignorance, its run-in with Ballah may be the final straw, with the ex-staffer currently pursuing her options, which include taking the issue to the Ontario Human Rights Commission.

By Isabelle Gillespie

Source

Divest From Prisons, Invest in People—What Justice for Black Lives Really Looks Like

Divest From Prisons, Invest in People—What Justice for Black Lives Really Looks Like

Instead of addressing the roots of drug addiction, mental illness, and poverty, we’ve come to accept policing and...

Instead of addressing the roots of drug addiction, mental illness, and poverty, we’ve come to accept policing and incarceration as catch-all solutions. It’s time for a change.

Read the full article here.

Left-Wing Group is Investing $7 Million in Grassroots for November General Election

Left-Wing Group is Investing $7 Million in Grassroots for November General Election

What is the GOP and the conservative Right doing in response? A leading left-wing community organizing group is...

What is the GOP and the conservative Right doing in response?

A leading left-wing community organizing group is building a massive grassroots advocacy and voter turnout operation in battleground states that could decide November’s presidential and Senate elections, documents obtained by the Washington Free Beacon reveal.

The Center for Popular Democracy is working to raise more than $7 million to support local and state-level organizing work that it hopes will translate issue-oriented advocacy into political power in November.

Documents detailing those efforts shed new light on how the left’s organizing apparatus is collaborating with prominent progressive groups such as MoveOn.org, labor unions, and foundations to build a campaign apparatus that can win short-term policy victories and translate those victories into a lasting political operation.

By Spencer Irvine

Source

Young Women of Color Are Running to Win

In the Senate, Kerri Evelyn Harris is challenging centrist Senator Tom Carper, one of the few Democrats in the Senate...

In the Senate, Kerri Evelyn Harris is challenging centrist Senator Tom Carper, one of the few Democrats in the Senate who supports Social Security cuts and who recently voted to roll back Dodd-Frank. According to my analysis of American National Election Studies 2016 survey data, 92 percent of Democratic primary voters support more, not less, government regulation of banks, and a mere 3 percent support cuts to Social Security. Given her decade as an organizer, most recently with the Center for Popular Democracy, Harris is approaching the race the way a community organizer would.

Read the full article here.

Latinos make up majority of fatal falls at construction sites in NY

Al Jazeera America – October 24, 2013, by Dexter Mullins and Roxana Saberi - Latino and immigrant workers are at a...

Al Jazeera America – October 24, 2013, by Dexter Mullins and Roxana Saberi -

Latino and immigrant workers are at a disproportionate risk of dying from construction-site accidents in New York, according to a new report conducted by the Center for Popular Democracy.

The report, “Fatal Inequality: Workplace Safety Eludes Construction Workers of Color in New York State,” is based on investigations from the Occupational Safety and Health Administration (OSHA) from 2003 to 2011 that analyze fatalities from falls at construction sites.

According to the findings, 60 percent of the 136 fall-related fatalities in New York state were Latinos or immigrants. In New York City, the number was 74 percent. Queens and Brooklyn were the two most dangerous boroughs to work in during the years studied. In Queens 88 percent of those who died were Latinos or immigrants, and in Brooklyn 87 percent of those who fell were Latinos or immigrants.

Latinos comprise only about 35 percent of all construction workers in New York City.

“Latino workers are the most vulnerable workers in the nation, and we’ve been talking about this for a number of years,” Hector Sanchez of the Labor Council for Latin American Advancement told Al Jazeera. “This report is a reminder of what is happening and why Latino workers are the ones who suffer the most from deaths and injuries in the workplace. It’s important to understand what the consequences of this are and why they are happening.”

The vast majority, 86 percent, of the Latino or immigrant workers’ deaths were at sites run by nonunion employers, where workers often are reluctant to report safety violations out of fear of retaliation from contractors. The report also says that Latinos are more likely to work at nonunion sites, which have more safety violations.

A New York state law requires contractors and construction company owners to provide all necessary equipment to keep workers on site safe or be held fully liable if lack of safety measures result in the injury or death of a worker. According to the report, construction and insurance companies are trying to have the law amended so that workplace safety would be the responsibility of the workers.

OSHA, which is tasked with inspecting work sites, has 113 inspectors in New York state. According to the report, if OSHA were to inspect every construction site in the state, it would take the workers 107 years to visit each site once. At 85 percent of sites where a worker fell and died, OSHA found there was a “serious, gravity 10″ violation of workplace safety standards.

The Center for Popular Democracy is pushing for construction companies to do more to improve worker safety and has also called on OSHA to hire and train more inspectors and stiffen penalties for safety violations.

Source

2 months ago

2 months ago