New York State Becomes First in the Nation to Provide Lawyers for All Immigrants Detained and Facing Deportation

New York State Becomes First in the Nation to Provide Lawyers for All Immigrants Detained and Facing Deportation

The Vera Institute of Justice and partner organizations today announced that detained New Yorkers in all upstate...

The Vera Institute of Justice and partner organizations today announced that detained New Yorkers in all upstate immigration courts will now be eligible to receive legal counsel during deportation proceedings. The 2018 New York State budget included a grant of $4 million to significantly expand the New York Immigrant Family Unity Project (NYIFUP), a groundbreaking public defense program for immigrants facing deportation that was launched in New York City in 2013...

Read full article here.

Gillibrand Has Received Big Campaign Donations from Puerto Rico Bondholders

Gillibrand Has Received Big Campaign Donations from Puerto Rico Bondholders

“Politicians that receive money from hedge fund managers like Seth Klarman and Dan Loeb should understand that their...

“Politicians that receive money from hedge fund managers like Seth Klarman and Dan Loeb should understand that their money is coming from people who have pushed austerity and privatization as the solution to Puerto Rico’s humanitarian crisis,” Julio Lopez Varona, co-director of the Community Dignity Campaign with the Center for Popular Democracy, told Sludge. “This solution has proven to help the rich get richer and the poor get poorer while pushing hundreds of thousands to leave the island.”

Read the full article here.

Appointment of Another Former Goldman Sachs Insider Shows Why Fed Presidential Appointment Process Needs Reform

Appointment of Another Former Goldman Sachs Insider Shows Why Fed Presidential Appointment Process Needs Reform

Jordan Haedtler, Campaign Manager for the Fed Up coalition, released the following statement following the Minneapolis...

Jordan Haedtler, Campaign Manager for the Fed Up coalition, released the following statement following the Minneapolis Federal Reserve Bank’s announcement that it would appoint Neel Kashkari as its president:

“For the past year, the Fed Up coalition has worked to develop relationships with the presidents of all 12 regional Federal Reserve Banks, and we look forward to developing a relationship with Neel Kashkari. When he ran for California Governor last year, Mr. Kashkari spent a week posing as a jobseeker in some of the hardest hit parts of the state. We hope Mr. Kashkari recognizes that job prospects remain far too weak for too many people, particularly Black and Latino people, and that his brief experiences searching for jobs in California are the real, lived experience for millions of people every day. Our partners in Minneapolis look forward to welcoming Mr. Kashkari to the Minneapolis region, and showing him the many communities in the region that are still struggling with economic recovery.

"Mr. Kashkari joins a Federal Reserve System that too often excludes the perspectives of working families and communities of color. We are very disappointed that his appointment marks the third presidential appointment this year of a regional Bank president with strong ties to Goldman Sachs. Come January, 1/3rd of the 12 regional Bank presidents will have served in senior roles at the investment bank that most epitomizes the problems that led to the financial crisis.

"Kashkari’s appointment illustrates the problem with the regional Bank president selection process. Federal Reserve Bank presidents are some of the most influential economic policymakers in the country, and they have an obligation to represent the public. Unfortunately, the public is completely shut out of the process for their selection, which is dominated by corporate and financial elites.

"We were very pleased when the Minneapolis Fed took a small and unprecedented step toward transparency by outlining the criteria for their next president. We wish the Minneapolis Fed had gone a step further, publishing the list of candidates being considered, and giving the public an opportunity for input. A history of working with labor and community groups, and an understanding of how working families and communities of color have been impacted by a sluggish economic recovery should qualify candidates for consideration. But the presidential appointments we have seen this year suggest that regional Banks are looking for a history of working at Goldman Sachs instead.”

###

www.populardemocracy.org

The Center for Popular Democracy promotes equity, opportunity, and a dynamic democracy in partnership with innovative base-building organizations, organizing networks and alliances, and progressive unions across the country. CPD builds the strength and capacity of democratic organizations to envision and advance a pro-worker, pro-immigrant, racial justice agenda.

Economic Recovery? Not for Ferguson or Black America

MSNBC - March 13, 2015, by Jane Timm - “America is coming back,” President Obama declared late last month, touting...

MSNBC - March 13, 2015, by Jane Timm - “America is coming back,” President Obama declared late last month, touting strong job creation and rising wages. “We’ve risen from recession.” But for Ferguson, Missouri – and black America as a whole – the recovery still hasn’t come.

“Black unemployment rates are still at the height of the national unemployment rates during the Great Recession,” the Center for Popular Democracy’s Connie Razza told msnbc. “We’re still in a recession in black America.”

Indeed, while American unemployment is down to 5.5%, black unemployment is at 10.4%. While wages have risen over the last 15 years by 45 and 48 cents for Latino and white workers, respectively, they’ve fallen 44 cents for black workers, according to a study produced by Razza at the left-leaning organization. The net wealth of African-American families, too, is hurting. “As the wealth of the other groups is stabilizing in the wake of the recession, the wealth of the African-American community is declining,” Razza added.

Blacks have long faced unemployment rates that are double those of white workers – according to Pew, it’s been that way since 1954 – but sources say the recession has hurt black America, and the St. Louis region, particularly hard. “It’s not just a recession of jobs, it’s a recession of income; it’s a recession of wealth in the sense that a whole lot of homes in Ferguson are still under water. It’s a three-way disaster for people in that part of St. Louis county,” Dave Robertson, a political science professor at the University of Missouri at St. Louis, told msnbc. “In places like Ferguson, it’s not coming back quickly.

The most recent racial employment breakdown indicates that Missouri’s problems may be worse than the rest of the country’s, too. In Missouri, black unemployment was 15.7% in the fall of 2014 – triple the state’s 4.5% white unemployment at the time.

“It’s not just unemployment,” Robertson added. “It’s the poor wages, it’s the under-employment, it’s the part-time work.”

And economic inequality is fueling the protests and activist movement, sources said. “There’s a real sense of despair especially for those young folks. You just don’t have the economic opportunities for young people. Especially young people coming out of sub-standard school districts … not having the tools prepared for the economy,” Ferguson activist Umar Lee told msnbc. “And then there’s a shortage of jobs, leaving young people at a disadvantage, and so they just drop out.”

“That’s the driving force, we believe,” former state Sen. Maida Coleman told msnbc. She’s heading up Gov. Jay Nixon’s Office of Community Engagement, a state office formed in the wake of August’s protests to focus on low-income and minority communities. “What’s happening now is that we see a real need to address these high levels of unemployment, just as we are addressing education,” Coleman said. “The hopelessness needs to be addressed.”

But the problem extends beyond Ferguson; when there are jobs to be had, black Americans struggle to get hired.

A 2013 study found that black college grads had twice the unemployment rate of white college grads and that racial inequality actually grew during the recovery. A 2014 study by nonpartisan education and economic advocacy group the Young Invincibles found that black workers need college credit to compete with white high school drop-outs thanks to racial discrimination.

Getting an interview may be half the battle, too. A 2003 study found that very white-sounding names received 50% more callbacks for interviews than a very black-sounding name.

For these reasons, Razza and the Center for Popular Democracy are urging the Federal Reserve to keep interest rates low. The Fed had vowed to keep rates low until employment dipped below 6.5% and the recovery came in earnest, but Razza argued that the country needs to be closer to “full employment”—that is there are close to the same number of jobs as people who want to work—before the Fed can really stop intervening. “The fact that black Americas are still experiencing a recession is really … the canary in the coal mine of the recovery,” she said.

Source

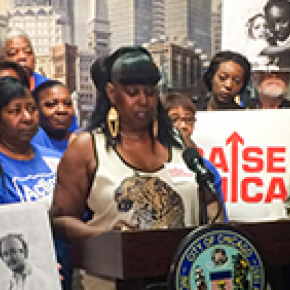

Chicago Group Pushing For $15 Minimum Wage

Huffington Post - May 28, 2014, by Joseph Erbentraut - A coalition of Chicago aldermen on Wednesday introduced an...

Huffington Post - May 28, 2014, by Joseph Erbentraut - A coalition of Chicago aldermen on Wednesday introduced an ordinance that would increase the minimum wage for many workers in the third-largest U.S. city to $15 an hour.

The ordinance calls for corporations with more than $50 million in annual sales to increase worker pay to at least $15 an hour with a year of the law's effective date. Smaller businesses would be allowed more than five years to raise pay. Twenty-one of the council's 50 members have signed on as cosponsors, Crain's Chicago Business reports.

The current minimum wage in Chicago is $8.25 an hour, a dollar more than the federal minimum wage.

Several aldermen joined low-wage workers at a press conference at City Hall on Wednesday, before the meeting where the ordinance was filed. Home care worker Darlene Pruitt, a 55-year-old mother of three and grandmother of 22, said she earns $10.65 an hour after five annual raises of a dime an hour working for the Help at Home agency. It's not enough, the West Side resident told The Huffington Post.

Pruitt said she has sometimes turned to a food pantry to make sure her family has enough to eat. "It's hard out there," Pruitt said. "The cost to live in Chicago and meet your basic needs -- rent, utilities, food, medication, clothes -- is high."

Pruitt said she is not afraid of retribution from her employer from speaking out because she is optimistic her efforts will help other workers like her who are in a similar position. If she earned more money, much of it would go right back into her community, she said.

The Center for Popular Democracy, in partnership with Raise Chicago, an advocacy group pushing for the higher wage, released a study Wednesday claiming the higher wage would decrease worker turnover and stimulate the local economy.

The study said the higher minimum wage would be responsible for $616 million in new economic activity and would help create 5,350 new jobs in its first phase. The higher wage also would add $45 million in sales tax revenues, but would raise consumer prices about 2 percent, according to the study.

Voters overwhelmingly backed the $15 minimum wage in a non-binding ballot question on about 5 percent of the city's ballots in the March primary election.

Business groups, however, have yet to be swayed.

Doug Whitley of the Illinois Chamber of Commerce told DNAinfo Chicago the proposed ordinance is "a ridiculously excessive reach on the part of a local government to try to instruct private-sector employers how to manage their businesses." The chamber said in a previous statement with other business groups that employers "cannot afford another minimum-wage increase" of any amount.

Mayor Rahm Emanuel has announced his support of a higher minimum wage, but for less than $15 an hour. Emanuel last week trumpeted the creation of a minimum wage "working group" tasked with creating a plan for increasing worker wages in the city and previously said he backed President Barack Obama's push for a $10.10 federal minimum wage.

Source

Supreme Court Deadlocks on Immigration, Leaving Millions in Limbo

Supreme Court Deadlocks on Immigration, Leaving Millions in Limbo

The U.S. Supreme Court has deadlocked on President Barack Obama’s executive order on immigration. The 4-4 tie on United...

The U.S. Supreme Court has deadlocked on President Barack Obama’s executive order on immigration.

The 4-4 tie on United States v. Texas (pdf) sets no precedent, but leaves in place a previous ruling by a lower court that blocks the Deferred Action for Parents of Americans (DAPA) order from going into effect, meaning five million undocumented immigrants are now at risk for deportation and being separated from their families.

In a press conference following the decision, Obama said, “This is a very clear reminder of why it’s so important for the Supreme Court to have a full bench,” castigating Republicans for refusing to meet with his Judge Merrick Garland, his nominee to replace the late Justice Antonin Scalia.

Ana Maria Archila, co-executive director at the Center for Popular Democracy, said in a statement Thursday, “Today, we mourn the Supreme Court deadlock on President Obama’s executive order. The lack of a decision allows the politically motivated ruling from the Fifth Circuit Court of Appeals to stand. Millions of immigrant families have lived in limbo for the past 18 months and this decision prolongs their agony.”

“If the highest court in the land cannot find a majority for justice and compassion, there is something truly broken in our system of laws, checks and balances,” she said.

The ACLU’s Immigration Rights Project director Cecillia Wang added, “Today’s non-decision in the DAPA case leaves the legal questions about the president’s immigration authority unanswered. But by leaving in place the injunction issued by the district judge, today’s 4-4 tie has a profound impact on millions of American families whose lives will remain in limbo, and who will now continue the fight.

“In setting the DAPA guidelines, President Obama exercised the same prosecutorial discretion his predecessors have wielded without controversy, and ultimately the courts should hold that the action was lawful,” Wang said.

According to SCOTUS blog, there will be a later appeal, so the Obama immigration policy “will be revived if [Hillary] Clinton wins and a Democratic nominee provides the 5th vote.”

Several cases have deadlocked since Scalia’s death in February.

DAPA was an expansion of the Deferred Action for Childhood Arrivals (DACA) program, which prevented the deportation of undocumented youths brought to the U.S. as children.

Texas led 26 Republican-controlled states in challenging the order, announced in November 2014. The previous ruling by a New Orleans federal appeals court stated that the Obama administration lacked the authority to shield the millions of immigrants from deportation and make them eligible for work permits without Congressional approval.

By Nadia Prupis

Source

Gov. Cuomo Signs New Legislation Making it Easier for Workers and the State Labor Department to Fight Wage Theft

New York Daily News - January 4, 2014, by Albor Ruiz - It feels good to be able to write about something positive for...

New York Daily News - January 4, 2014, by Albor Ruiz - It feels good to be able to write about something positive for New York workers in my first column of 2015. After all, measures that benefit them and rein in abuses by their bosses are as rare as snow in August.

It took a long time but on Monday Gov. Cuomo gave a last-minute Christmas gift to hundreds of thousands of low-wage laborers across the state by signing legislation making it easier for workers and the state Department of Labor to fight wage theft, which in New York has been an epidemic for many years.

“I am tired of waiting,” said Marcos Lino, who filed a complaint with the Department of Labor in 2008 after enduring four years of being shortchanged by his boss in a small Flushing grocery store. Six years have passed and his case is still unresolved.

Hopefully now Lino — and thousands more who, like him, have waited far too long to recover what is rightfully theirs — will finally get some justice.

“The groundbreaking legislation signed today will protect both workers from abuse, and law-abiding businesses from being undercut by employers who turn a profit by breaking the law,” said Andrew Friedman, co-executive director of the Center for Popular Democracy.

It should also help reduce the backlog at the Department of Labor.

The legislation, sponsored by Bronx Democratic Leader and now Assembly Labor chair Carl Heastie and state Sen. Diane Savino, improves on the landmark Wage Theft Prevention Act (WTPA), also sponsored by them and signed in 2010 by then-Gov. Paterson. The WTPA strengthened penalties for wage theft and protections for workers who report it.

“Mugging employees out of pay not only hurts families, it hurts communities. It makes honest employers less competitive,” Savino said when the WTPA was signed into law . “Businesses that are good citizens and pay their employees exactly what is owed them and on time, as is required by law, should not be at a disadvantage to companies that are illegally withholding wages from their workers.”

The New York Coalition to End Wage Theft supports the new legislation, which also has the backing of labor, community and religious groups, and law-abiding employers. It improves on retaliation protection for workers, transparency provisions to help advocates and workers identify cases of wage theft and helps facilitate wage theft policing.

But as Deborah Axt, co-executive director of Make The Road New York, warns, the new law is no panacea.

“Much remains to be done,” she said, “to eliminate the scourge of wage theft that still victimizes working families and responsible businesses alike.”

Source

Black Lives Matter asks state Dems for 'reparations'

Will Black Lives Matter revive the debate over reparations? The case for reparations is typically made as a form of...

Will Black Lives Matter revive the debate over reparations?

The case for reparations is typically made as a form of economic compensation to descendants of slaves. These days, some racial activists also make the case for reparations as compensation for systemic discrimination in law enforcement.

Several black leaders addressed Democratic state legislators Friday at the State Innovation Exchange in Washington, D.C.

"Thinking about decriminalization with reparations," Marbre Shahly-Butts, deputy director of racial justice at the Center for Popular Democracy, said. "The idea is we that have extracted literally millions of dollars from communities, we have destroyed families. Mass incarceration has led to the destruction of communities across the country. We can track which communities, like we have that data. And so if we're going to be decriminalizing things like marijuana, all of the profit from that should go back to the folks we've extracted it from." That comment received widespread applause from the crowd of Democratic state legislators. Shahly-Butts was referring to decriminalizing more than drug crimes, but also loitering, bans on saggy pants and thousands of other laws that disproportionately affect blacks.

Shahly-Butts added, "'Reparations' makes people kind of uncomfortable, so we can call it 'reinvestment' if you want to. Use whatever language makes you happy inside."

Fellow panelist Dante Barry, executive director of the Million Hoodies Movement for Justice, also called for a type of reinvestment. "In terms of response around black youth unemployment, it gets back to this whole piece around reinvestment," Barry said. He spoke about New York City's plan to spend $100 million on 1,000 new cops. "What would you do with $100 million? How would we better use that money to provide jobs for unemployed youth, to provide housing, to have mental health access. … It's really about how do we rethink some of our budgetary needs and how we're putting power behind the way that we can really incorporate reinvestment in communities."

Barry must have decided "reinvestment" made him happier inside than "reparations."

When asked if she could pick just one policy change for state legislators to work on, Shahly-Butts replied, "State budgets and then reparations are my two go-to [ideas]." In response to the same question, Barry called for banning all guns on campus.

Source: Washington Examiner

Report: Threat of Foreclosure on Calif. Homes Disproportionately Affects Minorities

National Journal, The Next America - March 15, 2013 - Leading mortgage lender Wells Fargo is urged to be more...

National Journal, The Next America - March 15, 2013 - Leading mortgage lender Wells Fargo is urged to be more transparent about relief reporting and to grant principal reductions. An overwhelming majority of homes in California’s major cities that are in danger of foreclosure are also in majority-minority ZIP codes, according to a report released this week.

The report focuses particularly on homes with mortgages serviced by Wells Fargo. Of the 21 major California cities examined, more than eight in 10 homes in danger of foreclosure are in areas where at least half of its residents are minorities—evidence, the report’s authors say, that further supports the idea that the housing crisis has been particularly harmful to African-American and Hispanic homeowners.

The findings come on the heels of the housing-market decline and the ensuing Great Recession that ensnared many homeowners who have been fighting to maintain their financial standing and retain their homes. While the report focuses on the California economy, other Americans are in similar circumstances. Across the nation, homeowners—many of them minorities—struggle to stay afloat as they watch their savings plummet and their dreams of maintaining a middle-class American lifestyle disappear. In its place are notices of default and the impending threat of bankruptcy.

In California, a total of 65,466 homes are in the pipeline for foreclosure, many of them purchased before the housing market crash in 2007.

Coauthor Ady Barkan, of the Center for Popular Democracy, a national organization based in New York, said the report focuses on Wells Fargo because the bank is responsible for the highest number of homes in California’s foreclosure pipeline—in addition to being headquartered in the same state. As leading lender, the bank is responsible for mortgages for 11,616 California homes—nearly 1 in 5 homes in the pipeline.

The “foreclosure pipeline” refers to homes that have received a notice of default or a notice of trustee sale. While some homeowners eventually pay back the debt, more often the homes are foreclosed, Barkan said.

Wells Fargo spokeswoman Vickie Adams took a contrary view, saying that the term “pipeline” can be overused and doesn’t take into consideration the complexities of the mortgage-lending industry. She added that the bank offers various programs and workshops to help educate its customers on their options to prevent losing their home.

“It’s always challenging to articulate some of the specifics of what some perceive to be a pipeline of sorts,” she said. “The facts are when a home has come to foreclosure, there are oftentimes that a customer is able to find options to prevent [it].… In foreclosure, no one wins. What we do is try to provide a great deal of support to the community in a number of ways.”

The wide variety of data sources that reports use can often create conclusions that aren’t necessarily in line with standard industry practices, Adams added.

“We all understand everyone’s right to raise issues they believe are important, but I think it’s really important, again, to look at the data and understand what the data says and use the measures that are appropriate for the industry,” she added.

According to the report, the opaque nature of Wells Fargo’s reporting data has made it difficult to track who is receiving the help. The report’s authors urge the bank to practice more-transparent reporting practices that include race, ZIP code, and income data for all foreclosures, short sales, and principal reductions.

According to Adams, the data for relief efforts and other information is available through industry publications such as RealtyTrac and Inside Mortgage Finance, as well as government sources.

Last year, the bank settled a lawsuit with the Justice Department, which alleged that the financial institution had discriminated against minority borrowers during the housing bubble, charging higher fees and rates to minorities than whites, even when they had the same credit risk.

The Wells Fargo case wasn’t unique: Lawsuits surrounding discriminatory housing practices and predatory sub-prime mortgage lending hit major banks everywhere.

(RELATED: Big Banks, Racial Discrimination Linked in Housing Crisis)

Using data from the Home Mortgage Disclosure Act Database, the report found that between 2007 and 2009, Wells Fargo was 188 percent more likely to put African-Americans into riskier sub-prime loans than white borrowers with similar credit history; the risk for Hispanics was 117 percent.

Adams maintains that Wells Fargo is a “fair and responsible lender” that adheres to regulations according to the Fair Lending Act. She added that the bank works closely with various advocacy and real estate organizations to help minority and low-income borrowers.

The report, co-authored by the Alliance of Californians for Community Empowerment, Center for Popular Democracy, and the Home Defenders League, asks Wells Fargo to commit to principal reductions in the interest of saving homeowners from complete financial ruin.

Between 2009 and 2012, Wells Fargo granted $6.3 billion in principal forgiveness; their goal is to hit $7 billion by 2014, Adams said.

“We take it very seriously, and we work very hard at it. We really are focused on excellence, helping our customers succeed financially, and we have a culture of continuously improving our home-lending activity,” Adams said.

The report argues that allowing all 65,466 homes in California to be foreclosed would be a detriment to the state and local economy. Foreclosure would cause the homes to lose 22 percent of their value, at an estimated cost of $7.6 billion. Maintenance costs for vacant homes would cost the government $19,227, resulting in a total cost of nearly $467 million for taxpayers.

“Communities have already sustained significant harm from the foreclosure crisis; unless Wells Fargo changes its practices, more harm will be done in coming months and years. New homes continue to enter the pipeline, inflicting tremendous stress and damage on homeowners and communities until Wells Fargo adopts significant new policies,” the report states.

Source

Pressure On Hillary To Pick A Progressive Running Mate Mounts

Pressure On Hillary To Pick A Progressive Running Mate Mounts

Few people outside the Beltway and San Antonio, where he was mayor, have ever heard of Julián Castro, the centrist...

Few people outside the Beltway and San Antonio, where he was mayor, have ever heard of Julián Castro, the centrist Democrat Clinton picked as her running mate over a year ago. (It's supposed to be a surprise so… shhhhhhhhh.) Anyway, once she settled on Castro she asked him to get a tutor and learn to speak passable español– he already had one, a Jewish lady from Laredo– and she told Obama to give him some cabinet position to raise his stature. (His twin brother, Joaquín, is a New Dem congressman and vigorous Hillary surrogate.) They figured he wouldn't be able to screw anything up if they made him Secretary of Housing and Urban Development. He's been told to stop telling reporters that “Joaquín and I got into Stanford because of affirmative action. I scored 1210 on my SATs, which was lower than the median matriculating student. But I did fine in college and in law school. So did Joaquín. I’m a strong supporter of affirmative action because I’ve seen it work in my own life.” His appeal to fellow Hispanic voters may be limited by his own assimilation. He's the son of Rosie Castro, an inspiring activist who helped found La Raza but he supports “free” trade, including NAFTA, advocates an energy policy that includes fossil fuels, believes in balanced budgets and refers to David Souter as his ideal Supreme Court justice. Hillary's kind of Democrat.

Castro “has all the assets to become the next favorite son,” is how John A. Garcia, a political-science professor at the University of Arizona, puts it. “He has an elite education, which has given him a national network, and a quiet, serious public persona that appeals to a lot of younger Hispanic voters,” Garcia says. “People look at him and say, ‘Finally, we have somebody who won’t screw up.’ Of course, he’s still young, and he might be too good to be true, but if I were betting on the next national Hispanic political leader, I’d bet on Julián.”

In 1984, Mexican-American political activists were thrilled when Walter Mondale publicly considered Cisneros for the Democratic vice-presidential nomination. But second place no longer seems such a great prize. “In 1984, there were 20 million Hispanics in America,” according to the political activist Antonio Gonzalez, who heads the William C. Velasquez Institute. “Today, we are 50 million, and more and more people are registering to vote.” Who they will vote for and what issues will cement their party loyalty is one of the great questions of American politics. This year Democrats hope to exploit the ire among Hispanics over the new G.O.P.-inspired law in Arizona that empowers local police forces to crack down on illegal immigrants.

This week, progressive groups shined a different kind of light on Julian-boy-wonder than he's been used to. I got this from Rootstrikers, for example, yesterday:

Imagine if the federal government was helping big bankers on Wall Street profit off the foreclosure crisis they helped create.

Sadly, you don’t have to imagine.

Under Secretary Julian Castro, the federal housing department has operated an egregious Wall Street giveaway.

The program is supposed to stabilize communities by transferring overdue mortgage loans to institutions that will help homeowners avoid foreclosure– instead, 98% of recent mortgage sales have gone straight to Wall Street, and at a HUGE discount.

Today, we’re launching a major campaign at DontSellOurHomesToWallStreet.org with partners representing some of the hardest hit communities. We’re demanding that Secretary Castro stops selling our communities to Wall Street and focuses on helping people stay in their homes.

Housing advocates have been advocating for fixes to this “Distressed Assets Stabilization Program” for years.

Big names have spoken up too– last year, Sen. Elizabeth Warren called out the department for “lining up with the Wall Street speculators.”

Under pressure, last April Secretary Castro’s Department of Housing and Urban Development promised to reform the program and help homeowners avoid foreclosure by selling more overdue mortgage loans to nonprofit community organizations rather than Wall Street banks.

Those were empty promises. The two most recent sales under Secretary Castro have sent 98% of the mortgages straight to Wall Street– and at rock-bottom prices.

A measly 1% got sold to nonprofit community organizations, which can better work with homeowners to figure out a plan to keep them in their homes.

Just last week, Progressive Caucus Co-Chair Raul Grijalva sent a letter to Secretary Castro calling for fundamental reforms of HUD’s mortgage sales.

Today, we’re joining that effort alongside a national coalition of 14 housing advocacy, civil rights, and progressive groups, from Presente.org to the Working Families Party to MoveOn.org.

And here’s another reason our pressure is likely to work:

Julian Castro is widely rumored to be a likely vice-presidential nominee. But becoming vice president will be tough if he doesn’t first prove he’s willing to take on Wall Street, and not just pad their profit margins.

Politico's Edward-Issac Dovere asserted yesterday that the dozen groups stirring the pot on Castro were sending a message to Hillary. “They’re just as open with their political aims,” he wrote: “to publicly discredit Castro as a progressive, latching onto the mortgage issue to seed enough suspicion to keep him off Clinton’s shortlist.

“It’s a situation where the Clinton campaign wants Castro to be a major asset to her chances of winning the White House, and unless he changes his position related to foreclosures and loans, he’ll be a toxic asset to the Clinton campaign,” said Matt Nelson, the managing director for Presente.org, the nation’s largest Latino organizing group that focuses on social justice.

“All year, we’ve seen the candidates tripping over themselves to show how tough they’ll be on Wall Street,” said Kurt Walters, the campaign manager for Root Strikers, a 501(c4) group of Demand Progress and its 2 million affiliated activists, who is planning to deliver the petitions to Castro’s office when they’re ready. “Then to turn around and take a step backwards on that exact question, and put someone who has been doing the exact opposite– I think it would be tough for a lot of people who care about Wall Street accountability to get excited about that pick.”

…“If Secretary Castro fails to create significant momentum in terms of stopping the sale of mortgages to Wall Street, then I do think it disqualifies him. But there’s time left on the clock,” said Jonathan Westin, the director of New York Communities for Change, which was formed out of the remains of the community activist group ACORN. “I think a lot of the progressive movement would not be in support of a Castro ticket if he fails to make traction here.”

…Maurice Weeks, an Atlanta-based organizer who works on housing justice in communities of color for the Center for Popular Democracy/CPD Action, said that Castro’s lack of action at HUD is breeding more gentrification and suffering in a way that should make blacks and Latinos pay attention.

…[Color of Change's Brandi] Collins said this complaint about Castro’s leadership is reflective of a whole range of issues her organization has had with what members say is the secretary’s closeness to Wall Street and lack of attention to black and brown communities.

“If he’s not showing up for our communities while the cameras aren’t there, we don’t know that he’ll show up when he’s on his way to the White House,” Collins said.

According to Julia Gordon, formerly at the Center for American Progress and currently an executive vice president at the National Community Stabilization Trust, the coalition may have a point– if only because it is taking advantage of opaque accounting at HUD. Gordon said she’s met often with HUD about these issues but hasn’t seen the kind of progress she’d like or evidence that the program matches the claims that officials make.

“We know it’s been good for investors. According to HUD, it’s been good for the fund, although the level of detail that they release to account for it is minimal. We really don’t know how good it’s been for the homeowners, and that’s where this wave of protests is coming from,” Gordon said… “Both HUD and [the Federal Housing Finance Agency] have let down communities by not focusing on what they want the buyer to do with these,” Gordon said, arguing that they’ve been focused instead on offloading the debt. “They’re just like, ‘Get it away from me.’”

The idea that Castro would be the first Latino on a national ticket means something, Nelson said, though he argued that this only adds to the burden for the secretary to show leadership on the mortgage issue in the way progressives want at this moment of added attention to their concerns.

Nelson said that at Presente, they think of it like a parable– it doesn’t make it any better to be hurt if the hurt is coming from one of their own.

There are two trees in a forest, Nelson said, and they see an ax coming to chop them down. “Don’t worry,” says one tree to the other, “the handle’s one of us.”

“Basically,” Nelson said, “we’re fighting to make sure Castro isn’t the handle.”

I'd guess Elizabeth Warren would be Bernie's first choice and that, given his age, she'd be the nominee for president in 2020. What a one-two punch that would be! Imagine a first woman president that is going to make voters think, we should get more like that!

“When fascism comes to America, it will be wrapped in the flag and carrying the cross.” — Sinclair Lewis

Source

22 hours ago

24 hours ago