Letter to the Editor: Proposed Legislation in Maryland Would Sacrifice Standards of Charter Schools

Washington Post - March 3, 2015, by Anne Kaiser - I share The Post’s interest in a healthy environment for charter...

Washington Post - March 3, 2015, by Anne Kaiser - I share The Post’s interest in a healthy environment for charter schools in Maryland, as expressed in the Feb. 25 editorial “ Give charter schools a chance.” However, this goal cannot be achieved unless we maintain the high standards for accountability, equity and quality required by Maryland’s charter school law.Over the past decade, I have seen troubling results in states that lowered their standards. A 2014 Center for Popular Democracy report found $100 million in fraud, waste and abuse by charter schools in 14 states and the District. The National Education Policy Center found that charter school teachers face significantly lower compensation and poorer working conditions, leading to high turnover rates and the hiring of unqualified teachers. Michigan, Ohio, Delaware and Pennsylvania have seen wasted taxpayer dollars in their race to expand charter schools.Gov. Larry Hogan’s (R) legislation follows in these flawed footsteps by granting a disproportionate share of funding to charter schools at the expense of traditional public schools, permitting uncertified teachers, allowing union-busting by charter school operators and weakening safeguards for accountability. I will work hard through the legislative process to remove these harmful provisions so that we support charters without sacrificing standards.Anne Kaiser, Annapolis The writer, a Democrat, represents District 14 in the Maryland House, where she is majority leader.Source

Battleground Texas: Progressive Cities Fight Back Against Anti-Immigrant, Right-Wing Forces

Battleground Texas: Progressive Cities Fight Back Against Anti-Immigrant, Right-Wing Forces

Sarah Johnson, the executive director of Local Progress, a group that works with Casar and other local politicians on...

Sarah Johnson, the executive director of Local Progress, a group that works with Casar and other local politicians on passing progressive legislation, told Salon that the initiative "brings together the way that policing impacts both immigrant communities and more broadly communities of color that are overcriminalized."

Read the full article here.

CORRUPT CONGRESSMEN DEMAND DIVERSITY FROM FEDERAL RESERVE

CORRUPT CONGRESSMEN DEMAND DIVERSITY FROM FEDERAL RESERVE

Do you know what our divided and divisive political system needs? More tribalism. And who would know that better than...

Do you know what our divided and divisive political system needs? More tribalism.

And who would know that better than Cherokee Senator Elizabeth Warren who has a letter out complaining that there are too many white men on the board of the Federal Reserve. The letter is co-signed by the usual clown show of the Congressional Black Caucus and the Progressive Caucus.

The first signature belongs to John Conyers whose wife pleaded guilty to a conspiracy to commit bribery. Also present are the likes of Maxine Waters and Frederica Wilson, Gwen Moore, former Nation of Islam supporter Keith Ellison, Bernie Sanders, Al Franken, Bernice Johnson and Alcee Hastings, who was impeached for bribery.

Bernice Johnson had her own ethical issues.

Longtime Dallas congresswoman Eddie Bernice Johnson has awarded thousands of dollars in college scholarships to four relatives and a top aide's two children since 2005, using foundation funds set aside for black lawmakers' causes. Eddie Bernice Johnson

The recipients were ineligible under anti-nepotism rules of the Congressional Black Caucus Foundation, which provided the money. And all of the awards violated a foundation requirement that scholarship winners live or study in a caucus member's district.

What's This?

And Maxine Waters? She's got a record.

The influential congresswoman has helped family members make more than $1 million through business ventures with companies and causes that she has helped, according to her hometown newspaper.

A few years ago Waters was investigated by the House Ethics Committee for steering $12 million in federal bailout funds to a failing Massachusetts bank (that subsequently got shut down by the government) in which she and her board member husband held shares.

Waters has also come under fire for skirting federal elections rules with a shady fundraising gimmick that allows her to receive unlimited amounts of donations from certain contributors. For years the veteran Los Angeles lawmaker has raked in hundreds of thousands of dollars in short periods of time by selling her endorsement to other politicians and political causes for as much as $45,000 a pop instead of raising most of her campaign funds from individuals and political action committees.

Then there's Alan Grayson who has his own hedge fund.

Rep. Alan Grayson manages hedge funds that use his name in their title, a practice prohibited by congressional ethics rules designed to prevent members from using their elected post for financial gain.

The specific ethics provisions tied to the funds Grayson manages, two of which are based in the Cayman Islands, sit in a sort of gray area and have never been examined by the House Ethics Committee.

Sure. Let's let these people dictate diversity at the Fed.

By Daniel Greenfield

Source

New York City Schools' Discriminatory and Damaging School-to-Prison Pipeline

New York City Schools' Discriminatory and Damaging School-to-Prison Pipeline

New York City schools feed young black and Latino youth into a school-to-prison pipeline by leveling criminal...

New York City schools feed young black and Latino youth into a school-to-prison pipeline by leveling criminal punishments on students for small infractions and normal youthful behavior.

Read the full article here.

Elevated Level of Part-Time Employment: Post-Recession Norm?

Wall Street Journal - November 12, 2014, by Nick Timiraos - Nearly 7 million Americans are stuck in part-time jobs that...

Wall Street Journal - November 12, 2014, by Nick Timiraos - Nearly 7 million Americans are stuck in part-time jobs that they don’t want.

The unemployment rate has fallen sharply over the past year, but that improvement is masking a still-bleak picture for millions of workers who say they can’t find full-time jobs.

Martina Morgan is deciding which bills to skip after her hours fell at Ikea in Renton, Wash. Sandra Sok says she’s been unable to consistently get full-time hours after she transferred to a Wal-Mart in Arizona from one in Colorado.

In Chicago, Jessica Davis is frustrated by her schedule dwindling to 23 hours a week at a McDonald’s even though her location has been hiring. “How can you not get people more hours but you hire more employees?” the 26-year-old Ms. Davis said.

The situation of these so-called involuntary part-time workers—those who would prefer to work more than 34 hours a week—has economists puzzling over whether a higher level of part-time employment might be a permanent legacy of the great recession. If so, it could force more workers to choose between underemployment or working multiple jobs to make ends meet, leading to less income growth and weaker discretionary spending.

Employers added some 3.3 million full-time workers over the past year, but the number of full-time workers in the U.S. is still around 2 million shy of the level before the recession began in 2007. Meanwhile, the ranks of workers who are part time for economic reasons has fallen by 740,000 this year to around 4.5% of the civilian workforce. That is down from a high of 5.9% in 2010 but remains well above the 2.7% average in the decade preceding the recession.

“There’s just less full-time jobs available than there used to be,” said Michelle Girard, chief economist at RBS Securities Inc.

The slow decline in part-time work is particularly acute when broken out by industries. For the retail and hospitality sectors, the number of involuntary part-time workers in October was nearly double its prerecession level. For construction, mining and manufacturing work, by contrast, the share of such part-time labor was just 9% above its pre-recession level.

Other data show that the ability of part-time service workers to find full-time work has been much slower during the current recovery. In goods-producing industries, around two-thirds of involuntary part-time workers in July 2013 had found full-time employment by July 2014, up from 60% in 2009, according to a study by the Federal Reserve Bank of Atlanta. But for service-sector workers, the rate has seen little improvement. Around 48% of involuntary part-time workers in July 2013 had found full-time work one year later, up from around 46% in 2009.

An important question for policy makers now is whether the elevated level of involuntary part-time work is due to cyclical factors, meaning it will fall as the economy heals, or to structural changes that have made employers more inclined to rely on a larger contingent workforce and avoid converting part-time workers to full-time positions.

On one side are economists like Ms. Girard, who say greater economic uncertainty and rising labor costs—from increases in the minimum wage, regulations or health-care expenses stemming from the Affordable Care Act—explain higher levels of part-time work. “There is a structural element to this at the very least,” she said.

The health-care law requires employers with 50 or more full-time equivalent workers to offer affordable insurance to employees working 30 or more hours a week or face fines. “Companies are just more inclined to hire part-time workers, not necessarily because of the health-care law, but for business reasons that make it a more attractive option,” Ms. Girard said.

Anecdotal reports have suggested employers have cut hours to prepare for the implementation of the health-care law, but that hasn’t been borne out by economic data.

An analysis by Bowen Garrett of the Urban Institute and Robert Kaestner at the University of Illinois at Chicago found a small increase in part-time work this year, but the increase occurred for part-time jobs with between 30 and 34 hours—above the 30-hour threshold that would be affected by the health-care law.

Other economists say higher levels of involuntary part-time work are mostly cyclical. Businesses don’t appear to be paying part-time workers more than full-time workers; that would be one clear sign of a shift in hiring preferences.

Elevated levels of involuntary part-time work in service jobs may reflect how low-wage employers ramped up hiring earlier in the recovery. More recently, the sector has absorbed those returning to work after long unemployment spells.

Part-time work in service jobs is “a stepping stone for the unemployed and for people out of the labor force,” said Adam Ozimek, an economist at Moody’s Analytics. Labor markets are “improving in just the way you would expect.”

Labor advocates, meanwhile, say technological changes in how businesses schedule employees are at fault. Software allows employers to schedule and cancel shifts rapidly based on business conditions.

Carrie Gleason, the director of the Fair Workweek Initiative at the Center for Popular Democracy, a labor advocacy group, said that could explain why more part-time workers say they want full-time work. “There’s now this persistent uncertainty in the jobs that hourly workers have today,” she said.

“I need to spend some time with my kids,” said Ms. Morgan, 32. “Two jobs? It’s too much.”

Ikea employees are guaranteed a minimum amount of hours every week. Those that can work “during peak times when our customers are in our stores have the opportunity to obtain more hours,” said Mona Liss, a company spokeswoman. The company in June also announced it would raise the average minimum hourly wage in its U.S. stores next year by 17%.

Meanwhile, the structural-cyclical debate has important implications for the Federal Reserve. If the changes are structural, wages might begin to rise sooner than expected, putting more pressure on the Fed to raise interest rates. If they’re cyclical, it would suggest that Fed policy can remain accommodative.

Fed Chairwoman Janet Yellen routinely highlights the elevated level of part-time work as a key measure of labor slack. “There are still ... too many who are working part-time but would prefer full-time work,” she said at a press conference in September.

Business surveys conducted by the Atlanta Fed have shown there are more part-time workers because “business conditions don’t justify converting them to full time,” said John Robertson, senior economist at the bank. But other businesses have said their reliance on a larger part-time workforce stemmed from the higher costs of hiring full-time workers.

“It would be wrong to say it’s all cyclical, and it would be wrong to say it’s all structural,” Mr. Robertson said. “We’re somewhere in the middle.”

Ulyses Coatl illustrates how any improvement might unfold. He worked for two years as a stylist at a Levi’s apparel store in lower Manhattan but quit his job in September because the hours had become too unpredictable. His schedule varied from as many as 34 hours a week to four hours, but had averaged around 18 hours in recent weeks, he said.

A Levi’s spokeswoman said the company is “always looking at ways to improve retail productivity, including store labor models and processes” that conform to “industry best practices.”

Wal-Mart says the majority of its workforce is full time, and the share of part-time workers has stayed about the same over the past decade. A spokeswoman said store employees can view all of the open shifts in their store, and that there are full-time positions available in the store at which Ms. Sok works.

Source

How Hillary Clinton can win in November

Hillary Clinton may be tempted to relax into her inevitable nomination as the Democratic presidential candidate given a...

Hillary Clinton may be tempted to relax into her inevitable nomination as the Democratic presidential candidate given a sizable delegate lead that looks likely to hold going into the Democratic convention — particularly if she wins the big prize of New York in April.

However, even after the convention, she will need to woo her opponent's supporters — many of whom claim they won't vote for her — to prevail in an unpredictable general election against an unconventional candidate like Donald Trump.

Bernie Sanders has been buoyed consistently by supporters disgusted with a political system awash in big money — and dismayed by Clinton's uncomfortably close relationship to Wall Street. There is a simple move Clinton can make to prove she is willing to take bold action against Wall Street: She can bring back the Glass-Steagall Act that put up a firewall between commercial and investment banking.

Over the course of recent Democratic debates, Clinton has remained opposed to reinstating Glass-Steagall even as Sanders used the rallying cry of breaking up the banks to help lock up several Midwest and Northeastern primaries.

The division between commercial and investment banking imposed by Glass-Steagall, enacted in 1933 amid the Great Depression, prevented banks from using customer deposits to take high-octane gambles in the market that could bring on another financial cataclysm.

Then, in 1999, under heavy pressure from the financial industry, Glass-Steagall was repealed by President Bill Clinton, unleashing the rise of a number of behemoth banks with combined commercial and investment arms. Less than a decade later, most of them nearly combusted in the greatest financial crisis since the Great Depression, requiring billions in taxpayer bailout funds to stay afloat.

Today, Wall Street continues to be riddled with systemic risks. The Dodd-Frank financial reforms enacted in 2010 in the wake of the financial crisis helped reduce some of the risk, but as the new president of the Minneapolis Fed recently acknowledged, they didn't go far enough. "I believe the biggest banks are still too big to fail and continue to pose a significant, ongoing risk to our economy," Neel Kashkari — a Republican – told an audience at the Brookings Institution in Washington D.C. last month.

An even more unlikely proponent of reining in big banks is Asher Edelman, the inspiration for Gordon Gekko in the movie "Wall Street." In a recent interview with CNBC, Edelman called for banks to return to lending, which stimulates middle class spending and the overall economy, rather than speculation, which pads the balance sheets of the big banks, not to mention the pockets of the top 1 percent.

While the Volcker Rule — the set piece of the Dodd-Frank reforms — bans commercial banks from using customer deposits for speculative trading on the bank's own accounts, numerous exceptions permit commercial banks to engage in risky investment banking activities they would be unable to carry out under Glass-Steagall. It's not difficult to conjure a scenario in which using customer deposits to bolster market bets causes a global financial contagion on the order of — or greater than — what we witnessed in 2008.

Some argue that Glass-Steagall is unnecessary because many of the financial institutions that triggered the financial crisis, such as Bear Stearns, were purely focused on trading and didn't have commercial banking arms. But those failed investment banks were able to take their risky gambles because they could easily borrow from hybrid entities such as Citigroup. And we should not forget that commercial-investment bank hybrids like Citigroup and Bank of America were ultimately some of the biggest recipients of bailout money.

The solution must be a stronger wall between commercial and investment banking. Senators Elizabeth Warren andJohn McCain have already proposed bipartisan legislation to bring back an updated, stronger version of the Glass-Steagall legislation specifically focused on banning publicly supported banks from engaging in the type of practices that created the financial crisis.

Afraid of Congressional gridlock? A President Clinton could even avoid a dysfunctional Congress altogether by working with bank regulators to create many of the same activity limitations through executive action — but only if she appoints strong regulators dedicated to reining in Wall Street.

With an increasingly likely path to the general election ahead of her, Hillary Clinton in the next few months must strive to shed her image of being beholden to wealthy, Wall Street interests. Reinstating Glass-Steagall is a good way to start.

By Anita Jain

Source

Data on immigrants won't be safe from Trump, unless the data doesn't exist

Data on immigrants won't be safe from Trump, unless the data doesn't exist

When New York City implemented its IDNYC municipal ID system, it was meant to give undocumented immigrants a way to...

When New York City implemented its IDNYC municipal ID system, it was meant to give undocumented immigrants a way to access crucial services that require government identification. But as Donald Trump’s inauguration looms, a new lawsuit will test the wisdom of keeping sensitive data for the program.

A NEW LAWSUIT WILL TEST THE WISDOM OF HOLDING THE DATA

Two Republican state assembly members have sued to stop the destruction of records on hundreds of thousands of cardholders, and a court has decided that the records must remain, pending a hearing later this month. Soon after, Trump will take office, as advocates worry whether he’ll target the information to identify undocumented immigrants.

There is no guarantee the lawsuit will succeed, or that Trump will be able to use the records — which contain information on many people besides immigrants — for deportation purposes. But what looked like a clever bureaucratic gambit is unexpectedly something very different, and to immigrants, possibly more dangerous.

When it designed the IDNYC program, New York retained information on cardholders, but with a caveat: at the end of this year, the city would have the power to change how it holds the data. In an act of partisan gamesmanship, the clause in the local law amounted to a kill switch — one that was put in place, as one Councilman almost presciently put it, “in case a Tea Party Republican comes into office.”

THE CLEVER GAMBIT SUDDENLY LOOKS VERY DIFFERENT

The suit filed this week rests on New York’s state transparency law, known as the Freedom of Information Law, or FOIL. According to the suit, since there are no provisions in the law that allow for the destruction of government records, the city would be overstepping its bounds by destroying the IDNYC data, especially based on who is in office.

The dispute isn’t without precedent. In New Haven, Connecticut, a similar legal battle unfolded over the city’s municipal ID program. There, an anti-immigration group also sued the city under the state’s freedom of information law, with plans to turn the information over to ICE. In that case, the city beat back the lawsuit, but that won’t ensure the same outcome in New York.

“The city is violating state law,” Nicole Malliotakis, one of the Assembly members involved in the suit, told The Verge. “They are not doing what’s in the best interest of the citizens that they are representing.”

In many ways, the database debate parallels other stories of unintended consequences unfolding as the government prepares to transition from Obama to Trump. How will Trump use the surveillance apparatus created by Obama? What does this mean for the undocumented immigrants brought to the US as children, who are staying through an Obama executive order?

THE DATABASE DEBATE PARALLELS STORIES UNFOLDING ACROSS GOVERNMENT

As the Center for Popular Democracy, which advocates for immigrants’ rights, pointed out in a report last year, there are two generally accepted ways to safeguard sensitive data: explicitly prevent its release in the legislation, or never provide the data in the first place. Cities have already proven that not retaining underlying personal information is viable — San Francisco operates a program without using underlying application documents, for one example.

Win or lose, if there’s any lesson for privacy advocates and local governments to carry from the unexpected battle over its data, it may be that even planned self-destruction is no impenetrable barrier against misuse. The best way to keep sensitive data private may still be to never hold the data at all.

By Colin Lecher

Source

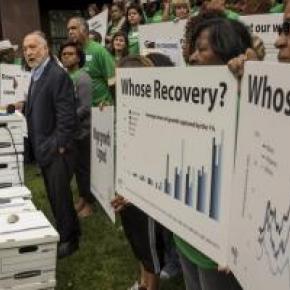

Activists Counter Federal Reserve Gathering With Push Against Interest Rate Hikes

The two-day event, ...

The two-day event, Whose Recovery: A National Convening on Inequality, Race, and the Federal Reserve, is organized by the Fed Up campaign, a coalition of groups led by the nonprofit Center for Popular Democracy. It serves as a counter-conference to the annual Federal Reserve Bank of Kansas City symposium, where Fed officials come together to discuss monetary policy -- and which is currently taking place at the same resort as the Fed Up gathering.

Fed Up’s member organizations brought over 100 primarily low-income grassroots activists from across the country for the gathering. It's a dramatic increase from its inaugural visit to Jackson Hole last year, when the campaign brought a group of 10 activists.

The size of Fed Up’s delegation of activists and presence of prominent economists -- including Nobel laureate Joseph Stiglitz -- attests to the rapid growth of a once-unlikely campaign that began just a year ago. Fed Up has managed to turn the esoteric issue of central bank interest rates into a key element of the progressive agenda -- and a rallying cry for low-income workers.

Rod Adams, a recent college graduate from Minneapolis, said he was attending the convention because he was disappointed in the job market. Despite his college degree, he currently makes $10.10 an hour working at the Mall of America.

“I have seen Wall Street’s recovery and corporate America’s recovery -- where is ours?” Adams demanded, eliciting cheers at a spirited press conference outside the Jackson Lake Lodge on Thursday.

The activists oppose the Federal Reserve increasing interest rates before the economy creates enough jobs to generate substantial wage growth for all workers. They believe that a premature interest rate hike would be especially harmful to workers in communities of color, who continue to suffer higher rates of unemployment than the overall population. Activists say this is partly the result of discrimination in the job market. Fed Up released a report on Thursday that uses original data to show that if there was the same low unemployment rate in every community in America, African-Americans and American Indians would experience the largest income gains.

The delegation plans to present officials attending the exclusive Fed symposium with an online petition opposing an interest rate hike that bears 110,000 signatures. The petition effort was the result of Fed Up's collaboration earlier this month with online progressive heavyweights including CREDO Action, Daily Kos, the Working Families Organization and Demand Progress. Robert Reich, former secretary of labor and an economist at the University of California, Berkeley, gave the petition drive a high-profile boost with a popular video promoting the effort.

A similar petition that Fed Up brought last year had 10,000 signatures.

The Kansas City Federal Reserve Bank, which convenes the annual Jackson Hole symposium for Fed officials, declined to comment on this year's parallel protest conference.

Kansas City Fed President Esther George met with Fed Up activists during last year's symposium.

Janet Yellen, chair of the Federal Reserve Board of Governors, is not attending this year's symposium, precluding even the possibility of an impromptu encounter with protesters.

“Janet Yellen is missing a great opportunity to see what real people look like,” Adams said. “We are not data on a spreadsheet.”

Proponents of a Federal Reserve interest rate hike in the near future argue that the Fed should begin raising rates to prevent excessive price and asset inflation. The Fed has a dual mandate to maintain full employment and stable price inflation.

William Dudley, president of the Federal Reserve Bank of New York, signaled on Wednesday that they would postpone an interest rate hike that Fed officials had previously indicated would occur in September. Dudley said turmoil in China and other emerging market economies that sparked massive swings in the U.S. stock market earlier in the week made a September rate hike “less compelling.”

Josh Bivens, the progressive Economic Policy Institute’s research and policy director, applauded the Fed’s move away from an interest rate hike, but said the reason for the Fed’s decision confirmed the need for more grassroots activism.

“A week ago the case against raising rates for the labor market was clear as day, but all of a sudden when wealthy people lost money in the stock market the tide turned against a rate increase,” Bivens said at Thursday's press conference. “I’m happy rates are less likely to go up because of that, but it is a terrible reason.”

Source: Huffington Post

Report: Starbucks falls short on vow to make workers' schedules more fair

Despite a public pledge last year to ease scheduling burdens for its baristas, Starbucks has fallen short of its...

Despite a public pledge last year to ease scheduling burdens for its baristas, Starbucks has fallen short of its commitment on a number of fronts, according to a new report released Wednesday based on interviews with the coffee chain’s workers across the country.

The report, titled “The Grind: Striving for Scheduling Fairness at Starbucks” (PDF), said Starbucks baristas across the country were still complaining that they often don’t receive their work schedules soon enough before shifts and that they are under pressure to avoid taking sick days.

The New York-based advocacy group Center for Popular Democracy produced the report, which cited survey data collected from more than 200 Starbucks baristas in 37 states and compiled by Coworker.org, an online platform that supports workplace rights.

“More than six months after Starbucks publicly recommitted to scheduling policies and mandated ten days’ notice, the scheduling issues they sought to address still persist in their frontline stores,” the report said.

After a New York Times investigation in August 2014 highlighted the scheduling travails of a Starbucks worker and single mother named Janette Navarro, the company announced that it would strive to improve work schedules for its employees, whom the company calls “partners.” The workers’ survey cited in Wednesday’s report was conducted in March this year.

“Taking care of our partners is a responsibility I take very personally,” Cliff Burrows, a high-level Starbucks executive, said in an internal company email at the time, according to the New York Times and other news outlets. Burrows was quoted as saying the company would work to aid “stability and consistency” in the schedules of its more than 130,000 baristas.

Burrows pledged then that the company would improve its scheduling software to make it easier on employees to plan their lives.

But the directive has only partially trickled down to the company's more than 12,000 U.S. locations, Wednesday's report says.

“They’ve made some improvements, but they’ve been minor,” said Carrie Gleason, co-author of the report. “A fair workweek at Starbucks exists in some stores,” she said, but “the issue is inconsistency.”

Starbucks did not respond to a request for comment on the report's findings before the time of publication.

The report said many baristas noted a high incidence of so-called “clopening” shifts, in which a person closes and opens in consecutive shifts, often leaving a span of only a few hours in which to return home before working again.

Last year Starbucks' Burrows pledged an end to the dreaded clopening shifts, saying “district managers must help store managers problem-solve issues specific to individual stores to make this happen.”

But the report indicated that such shifts were still widespread, with nearly a quarter of workers regularly getting them.

“I feel that baristas should have a minimum of 10 hours in between shifts. Everyone should have a fair chance to get home, settled, and be able to sleep for eight hours before having to get up for another shift," the survey report quoted an Illinois Starbucks worker as saying.

But the majority of workers who do clopening shifts are able to get fewer than seven hours of sleep, the report said.

“Because I was frequently scheduled for clopening shifts, I got just four or five hours of sleep a night. I was doing all I could to get ahead, but Starbucks’ scheduling practices made me question whether that was possible,” said Ciara Moran, a former Starbucks barista wrote in a petition she launched with Coworker.org, asking for further scheduling reforms.

The report released Wednesday said that 48 percent of surveyed Starbucks workers said they received their work schedules a week or less in advance, and that 40 percent reported they had experienced pressure to avoid taking sick days.

"Employees say that it can be extremely difficult to take sick days because they face pressure to work while sick, fear negative consequences or are forced to find their own replacement," the report said.

The report suggested that the experiences of individual workers varied considerably, depending on store locations and personnel.

“Many of us have different experiences at Starbucks, depending on our manager,” Moran said, asking others to support the cause “for consistent protections across the company, starting with healthy schedules across the board.”

“On a corporate level there isn’t that level of accountability. They’re not looking whether their polices are going far enough,” Gleason said. “For Starbucks, it can be a model for the industry for how to deliver a sustainable workweek.”

“I think they need to engage their workforce in a different way,” she said.

Source: Al Jazeera America

Commentary: Emeryville action could change working world

Like many people, when the alarm goes off, I hit snooze a few times and wish for more sleep. But what gets me out of...

Like many people, when the alarm goes off, I hit snooze a few times and wish for more sleep. But what gets me out of bed is that precious hour I have with my young son. We eat breakfast together, we race to see who can get dressed first, and then I walk him to school.

I’m lucky– as a salaried employee at an organization that values flexibility and family, I can arrange my schedule around my son if need be. But for people working low-wage hourly jobs, that kind of control over their scheduling is virtually unheard of.

Today, corporations that pay low wages rarely provide their employees with full-time work or reliable hours. Take Manuel, who works at one of Emeryville’s many retail chains. He had his hours cut from 20 a week down to four, and then nothing for two weeks — throwing his family into massive debt.

Emeryville may be the first city in the East Bay to change that, where the City Council is voting on a Fair Workweek policy on Oct. 18. This is part of a simple set of standards needed to ensure that working people can afford to stay in the East Bay region.

What is a Fair Workweek? It means employers must provide reliable, predictable hours so their employees can budget. Workers get schedules two weeks in advance so they can plan childcare, second jobs, family time, and even rest. And when more hours are available, current employees get priority so they can get closer to full-time work.

In Emeryville, the policy would only apply to large companies with more than 12 locations worldwide. These simple improvements would cost employers almost nothing if they follow the law and have a huge impact on the lives of thousands of Emeryville workers. Hundreds of thousands more working people would benefit if other East Bay cities follow suit.

Emeryville’s own Economic Development Advisory Committee – the city’s business advisory group – said even they agree that increasing stability of schedules, reducing employee turnover, and decreasing underemployment in Emeryville is important. And that’s what a Fair Workweek policy would do.

Many companies are already doing the right thing. This policy would reinforce that good behavior and target companies that are bad actors. However, global, multi-billion dollar corporations and their lobbyists are coming out against this low-cost policy, claiming it will kill the economic climate. But I wonder: how exactly would reliable schedules hurt companies like IKEA, The Gap or Home Depot?

Before the recession, big business painted doomsday scenarios saying that raising wages would force them to close shop. During the Great Recession, working people bore the brunt of tough times in the form of reduced pay, slashed benefits, and a cutback to part-time hours. And now that big business has not only recovered but is booming, companies are back to the mantra that improving standards for their workers will hurt them.

Common sense tells us that business — especially big business — is doing fine. Look at quarterly earning reports of Emeryville’s global retail chains. Sales tax revenue in Emeryville was up 2.4 percent in 2015 compared to the previous year according to the city’s Finance Department. Retail vacancies in the region are at a post-recession low of 6 percent. And of course, there are growing lines of cars and customers coming in and out of Emeryville’s shopping centers.

While business is thriving, working people have waited long enough for something so very basic: a single job that pays enough with enough hours to allow folks to meet their basic needs.

Raising the minimum wage helped struggling workers. Now we must finish the job by providing reliable, predictable hours. This economic boom shouldn’t just be a boon for shareholders. It should also lift the working people who are the backbone of our economy.

By Jennifer Lin

Source

29 days ago

29 days ago