Holding Wall Street Accountable

Demanding Wall Street be Accountable for Reckless Practices

Cracking Down on Wall Street Greed, Fighting Financialization

CPD and our allies are pushing for national leaders to take action in holding Wall Street accountable for their role in destroying home equity and stripping community wealth. We are working with affiliates, allies, and everyday people to confront the bankers, private equity managers, and hedge fund billionaires working at the bleeding edge of exploitation and profit in our extremely unequal economy.

We take on the Wall Street players who are:

-

...

Cracking Down on Wall Street Greed, Fighting Financialization

CPD and our allies are pushing for national leaders to take action in holding Wall Street accountable for their role in destroying home equity and stripping community wealth. We are working with affiliates, allies, and everyday people to confront the bankers, private equity managers, and hedge fund billionaires working at the bleeding edge of exploitation and profit in our extremely unequal economy.

We take on the Wall Street players who are:

-

Attacking businesses to cut pay and eliminate jobs and benefits;

-

Hoarding rental housing units to drive up rent and housing costs, maximizing their profits and driving up the number of evictions across the country;

-

Using their power, wealth, and campaign cash to push privatization and austerity;

-

Buying water liens, tax liens, and other debt instruments to foreclose on homeowners of color and take over their family homes;

-

Forcing more debt into every area of the economy, extracting more and more from poor, working-class, and middle-class people, expanding the racial wealth gap, and pushing the economy towards another greed-fueled crash;

-

Investing in dirty energy, fossil fuels, and toxic chemicals for short-term profits instead of investing in long-term environmental stability;

-

Funding racist political attacks that divide communities, fuel white supremacy, and give more power to the Trump administration and its political allies.

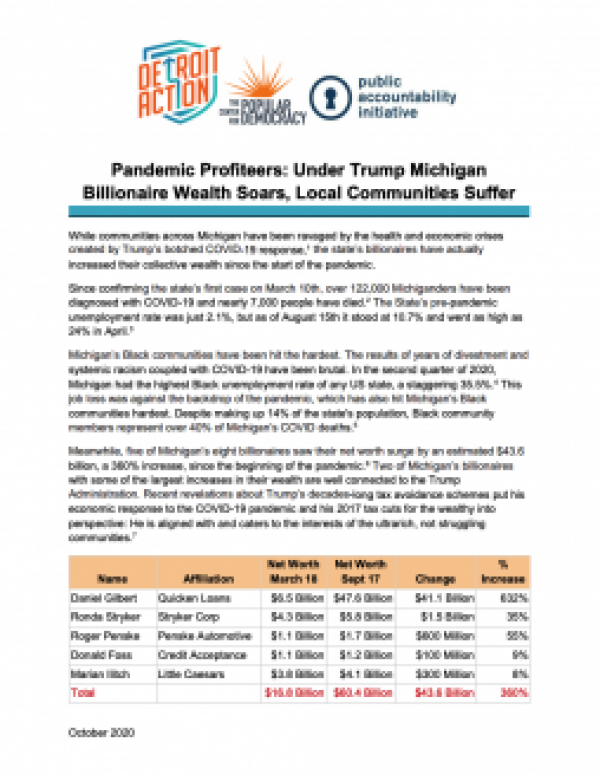

Research and Reports

We’ve published dozens of muckraking reports on hedge fund and private equity managers profiting from widening inequality, and our exposés, advocacy, and direct action protests have won broad press coverage in financial, political, community, and popular media. Recent reports on private equity’s role in the “retail apocalypse” and on billionaire corporate landlords in California boosted crucial campaigns to protect workers and renters. See a complete list of reports at the bottom of this page.

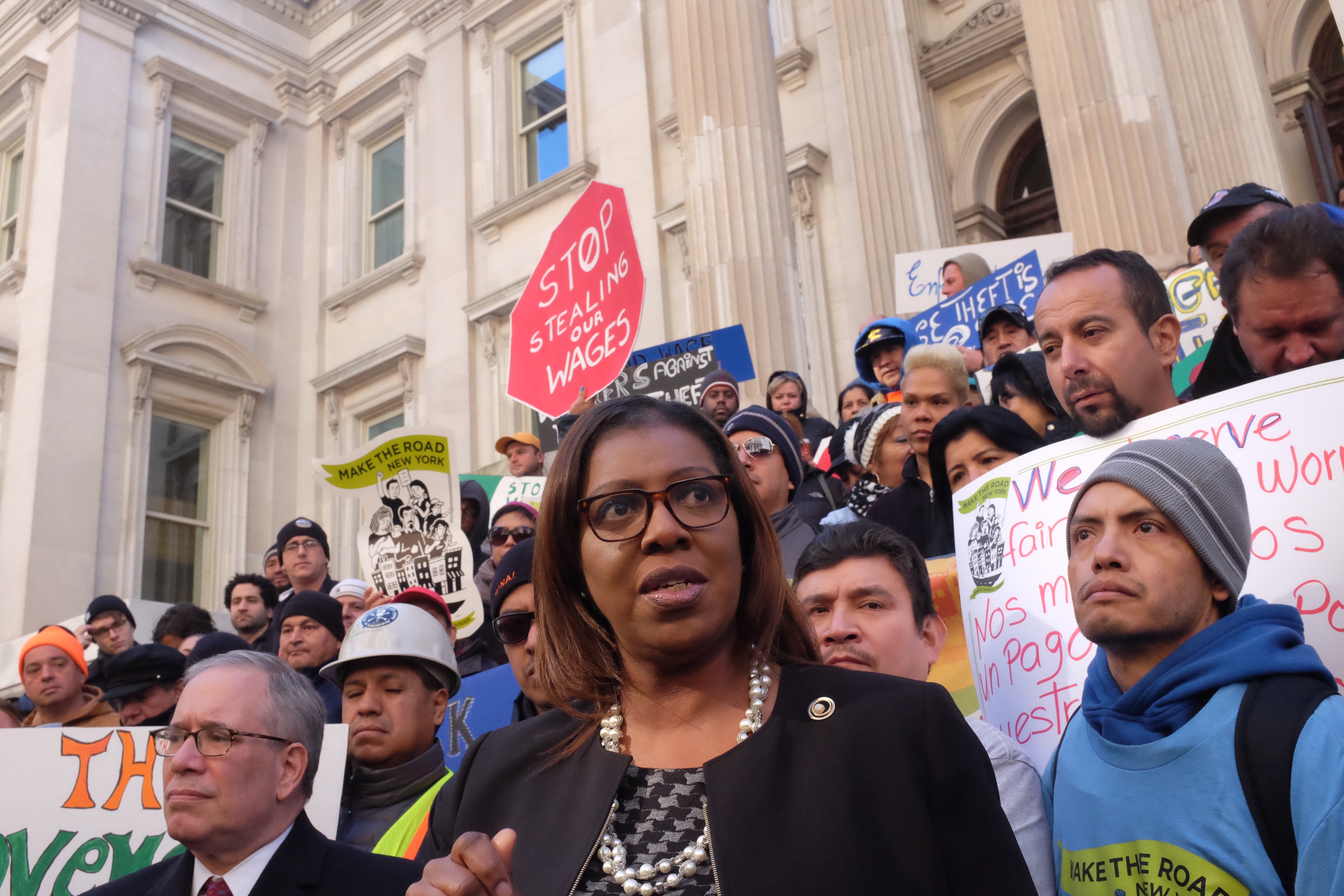

Advocacy and Actions

We’ve carried out powerful and successful campaigns to fight back against Wall Street greed and win real gains for workers and communities. We worked with laid-off Toys “R” Us workers and our allies at United For Respect to win a measure of justice and a $20 million severance fund after private equity and hedge fund managers drove the company into bankruptcy. We then continued the work with allies, including Americans For Financial Reform, working with leading lawmakers to develop and introduce the Stop Wall Street Looting Act, which would outlaw many of the practices that destroyed Toys “R” Us and continuing to explode inequality in our economy.

Deep Organizing in Communities

We’re building a solid foundation of education, engagement, and action to fight financialization. We’re working with CPD affiliates, labor allies, and community allies in dozens of states to develop local, state, and federal campaigns that will make a difference in the neighborhoods where our members live and work. We’re linking the fight for fairness to tax justice and educational justice campaigns, housing justice campaigns, environmental justice campaigns and worker organizing all over the country.

Fighting for Our Future

We’re expanding our legislative fights against financialization to include specific measures to outlaw hedge funds, tax the rich, and invest in communities. We’re also creating a plan to meet the next Wall Street-caused economic crash with a popular response that insists on justice and equity.

Campaign Blog

New York Affiliates Take on Harmful Hedge Funds

New Reports on Justice Transformation and Worker Justice

New CPD Report Reveals Tax Act Hurts Workers

New Report Connects Private Equity to California’s Housing Crisis

CPD Releases Landmark Report on Private Equity

The Banks Still Financing Private Prisons

Wells Fargo Divests From Private Prisons & Immigrant Detention Industry

Corporate Backers of Hate Moves JPMorgan Chase to Divest from Private Prisons

Amazon Pulls Out Of Planned NYC Headquarters

News

News

According to a new report from the American Investment Council (AIC) that...

Looking at economies around the world, it’s easy to think that reconciling markets with justice...

Over the past year, private prison giants CoreCivic and GEO Group have been abandoned by Wall...

The Pittsburgh-based PNC Bank is the largest bank in Pennsylvania and operates banks in 19...

According to a new report from the Center for Popular Democracy and the Private Equity...

Wall Street is destroying retail jobs, according to a new study from the Center for Popular...

The report was researched and written by Jim Baker (Private Equity Stakeholder Project), Maggie...

Dubbed "Pirate Equity: How Wall Street Firms are Pillaging American Retail," the report from the...

The Center for Popular Democracy, Americans for Financial Reform Education Fund, Strong Economy...