Pain & Profit: : The Act 22 "Charities" that Take from Puerto Ricans and Give Little in Return

Published By

Center for Popular DemocracySince the law passed, cryptocurrency billionaires, Wall Street executives, and wealthy developers have flocked to Puerto Rico.2 Community groups are sounding the alarm on numerous ways this law negatively affects Puerto Ricans.3 The wealthy Act 22 beneficiaries are hoarding properties and speculating in the real estate market,4 leading to soaring housing costs and rapid displacement. They are evicting and pricing out long-term residents to make way for investors and short-term vacation rentals.

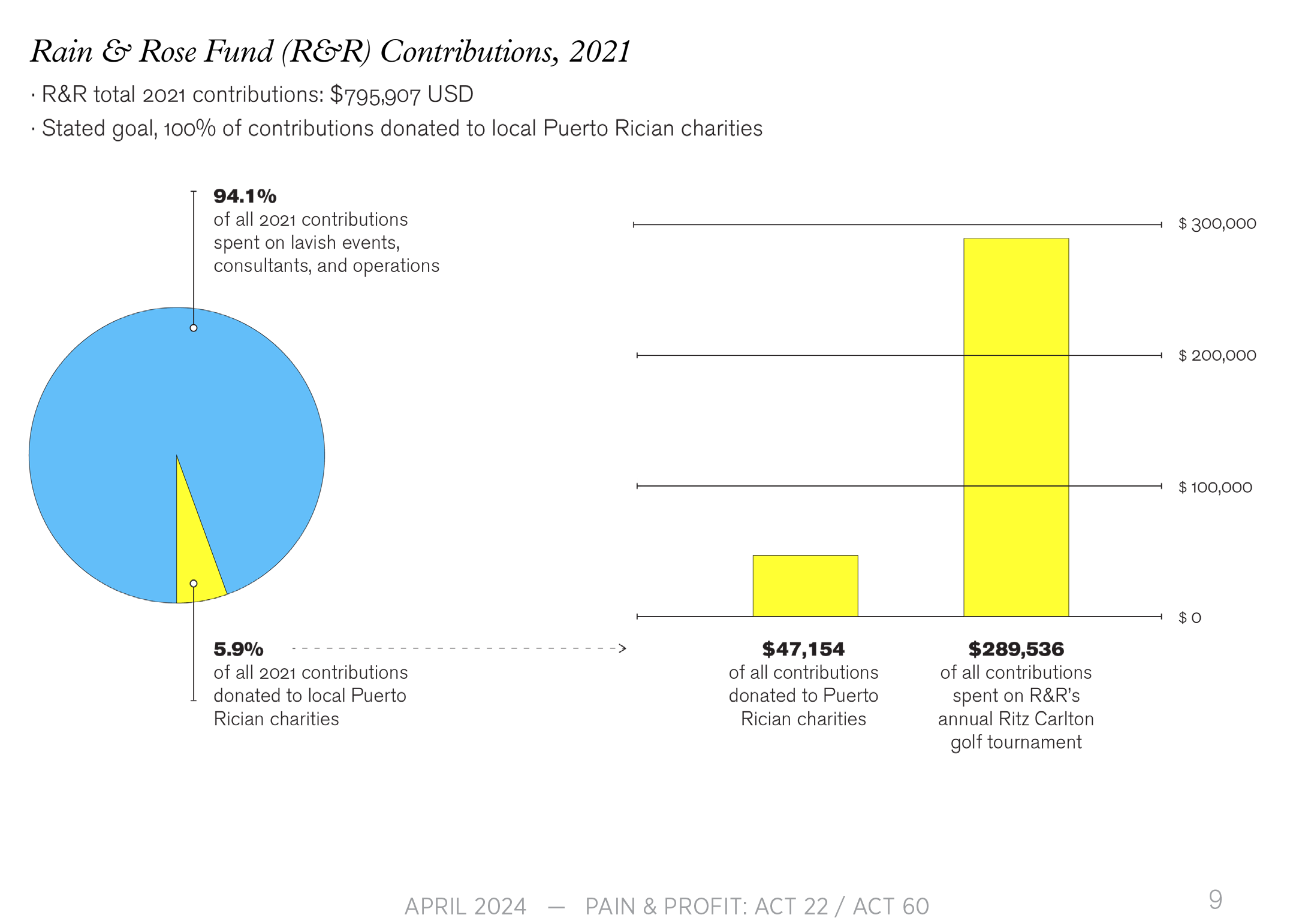

This report explores an essential but often overlooked aspect of the program: how these wealthy individuals adopt questionable charitable giving practices to maintain their Puerto Rico tax breaks. Act 22 beneficiaries must donate $10,000 to local charities yearly to retain their lucrative tax exemption. Our investigation reveals that the people taking advantage of these tax breaks appear to be creating loopholes and founding their own tax-exempt charities to meet the charitable giving requirement on paper.

This investigation profiles two tax-exempt organizations founded and led by Act 22 beneficiaries. First, the Rain & Rose Fund: This organization hosts lavish parties, including an annual golf event at the Ritz Carlton Dorado Beach, for wealthy investors to attend. Download to learn more >>